Long SGR.ASX

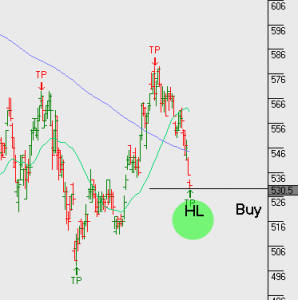

Long SGR

I recommend accumulating SGR at $5.40 and holding for a rally back towards the $6.20 range.

Long SGR

I recommend accumulating SGR at $5.40 and holding for a rally back towards the $6.20 range.

Long AMC (update)

Reminder that I recommended buying AMC in the $14.25 to $15.00 range. It’s now trading $14.30 and you should begin accumulating today.

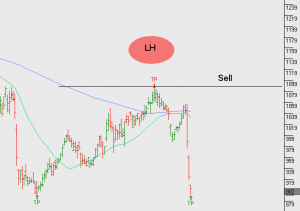

Short CPU (time to take profit)

On 27th of May 2016 I recommended going short CPU, the stock has now sold off over 15% in 4 weeks. It’s time to take profit.

Buy back short exposure at or near $9.00

US Macro

The widespread reaction to the United Kingdom’s decision to leave the European Union (EU) has dramatically changed the technical conditions across the Foreign Exchange market. While the “Brexit” was clearly a political event, it has acutely altered the market’s “group psychology”; which is the cornerstone of technical analysis.

For example, the GBP/USD traded from a new yearly high, at just above 1.5000, to its lowest level in 30 years in less than 8 hours; the widest trading range in the history of the pair. From a technical perspective, it’s reasonable to believe that stop levels and option positioning were all wiped out on Friday. In this sense, if price support is where buyers are enticed, and price resistance is where sellers offer supply, then technical levels of the GBP will have to be rebuilt over time.

As a result of the breakdown of many technical components, volatility looks to be the name of the game for the short to mid-term. Fears that the UK’s exit will inspire other nations to do the same are not unwarranted, and FX investors should be cognizant that Brexit is not an uniquely European problem. All global financial markets have been propped up by central bank policy makers; especially from the ECB, FED and the BoJ.

As such, the FX market may show a blithe response to most of the economic releases on this week’s schedule. However, now that the FED FUNDS futures market has entirely priced out any rate normalization for 2016, Tuesday’s US GDP report could get a rate adjustment back on the radar. The final reading for Q2 GDP is forecast to print at 1%, which is twice as strong as the last GDP data. In addition, US Consumer Confidence is due early Wednesday morning and is expected to show a sharp rebound to 93.1%.

Short XTL (update)

I suggested shorting the XTL on 2nd June 2016 and now I believe that Central Banks will have no choice but to embark on a more aggressive stance. BoJ, BoE and ECB will be looking to reduce volatility, inject liquidity, depreciate ¥ and avoid excessive US$ appreciation. The Fed will work hard to reduce the degree of monetary policy divergence.

This means we are getting ready to close out the XTL short and bank the profit.

| ||

Short AZJ.ASX

Time to look at AZJ on the short side. $4.80 range is the target I’ve been waiting for, the stock has pushed higher against a backdrop of selling in the broader equity market but with no revenue growth, 100% payout ratio on the dividend, I think AZJ is susceptible to a pullback into the July/Aug earnings result. Target pullback to $4.40 – $4.50

US Macro

In less than a week, citizens of the UK will make their biggest decision in more than a generation when they go the polls to vote on whether to stay in the European Union (EU), or to leave it. It’s conceivable that the political and economic future of the entire 28 member EU could be reshaped by the June 23rd referendum.

Those in favor of leaving the EU, known as the “Brexit” option, say EU elitist rules restrict UK companies and leaving would boost the UK economy. They also say that leaving the EU would give Britons control of their borders and limit immigration. Those campaigning to stay (including the PM David Cameron) paint a very grim picture of life outside the EU.

The result of the vote could have acute and far reaching consequences not just for the British and EU economies, but also for global FX markets and G-7 stock markets in particular. At this point, the polls suggest that UK voters are spilt down the middle without an outright majority on either side. Further, it seems the only clear consensus is that a win for the Brexit camp would reshape the future of the UK and EU for decades to come……….the problem is that nobody knows exactly how.

Long TLS. ASX

Income buyers will start to look at TLS ahead of the August dividend. Buyers are redescent at the moment due to macro issues with Brexit but now is the time to start looking at long exposure in TLS on this exhaustion in the pullback to $5.25 – $5.30.

AUD/USD

Since the start of 2016, significant turns in the direction of the AUD/USD have worked as a good leading indicator to trend changes in the other G-7 currency pairs and the USD, in general.

Some foreign exchange commentators pin this forward looking correlation to the fact that over the last six months the AUD/USD trend has been acutely sensitive to Central Bank policy expectations and price swings of commodity metals and minerals……..Which have also driven the USD versus the other G-7 pairs.

Recall that the AUD/USD bottomed out at around the .6850 level in Mid-January over a month before the EUR/USD turned higher from the 1.0820 level in early March. More recently, the Aussie peaked out at .7835 on April 21st while the broader turn in the Major pairs didn’t reach the highs until May 3rd. Further, over the last two weeks, the AUD/USD bottomed on May 24th while the others didn’t turn until May 30th.

This is significant because the AUD/USD rejected the .7500 level during yesterday’s Asian session and posted a key reversal lower during the NY session with the close below .7430. And while the RBA held on rates on Tuesday, the price of copper extended its recent slide to 4-month lows just above $2.00 per pound.

Whether or not AUD maintains its role as a leading indicator for price action will be determined over the next few sessions. We still prefer the short side of the pair.

Or start a free thirty day trial for our full service, which includes our ASX Research.