By the end of the NY trading session on Friday, it turned out to be a great day for the US Dollar. The USD posted gains against all the G-7 currency pairs after FED Chair Janet Yellen’s speech at the Jackson Hole Global Economic Forum. In fact, the EUR/USD, AUD/USD and USD/JPY all posted key reversal price patterns for the week.

Interestingly, though, it wasn’t Ms Yellen’s words which sparked the rally in the Greenback, derailed the early rally in the SP 500 and sent gold to a one month low at 1314.00. But rather, the later clarification of her comments by FED Vice-Chair Stanley Fischer which brought higher US rates back into play.

Ms Yellen’s comment that ” a case for an increase in the federal funds rate has strengthen in recent months” was followed by a sharp rally in Gold and US equities, and a moderate drop in the USD. However, later in the NY session, Mr Fischer was far more explicit when he said Ms Yellen’s comments were consistent with a possible rate hike in September and that two rate hikes this year is still possible.

Throughout last week, there were consistently hawkish statements from US policymakers who all seem to agree that US inflation is on the rise, wages are growing at a consistent pace and the jobs market is close to full employment. Mr Fischer made it clear that this week’s Non-Farm Payroll data would be a crucial component to the FOMC’s decision to further normalize rates on September 21st.

Since the monthly employment figures are among the most significant reports in the monthly data cycle, this may or may not be the case. However, the market took the bait on Mr Fischer’s comments and ramped up the odds of a September rate hike to 42% from 32% the previous day…..which is the highest probability in over a month. On balance, many economists are forecasting the US economy to accelerate into the end of the year as the Atlanta FED GDP tracker is at 3.4%, and the NY FED tracker at 2.8%.

With the US Payroll data scheduled on Friday, it’s unlikely that financial markets will trade sideways throughout the week. Other market moving data points this week include Australian building approvals on Tuesday, Eurozone PMIs on Wednesday and UK manufacturing PMIs on Thursday.

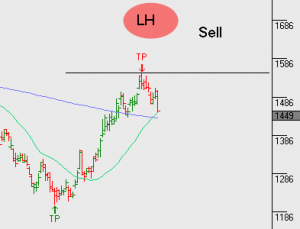

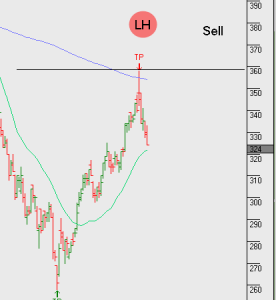

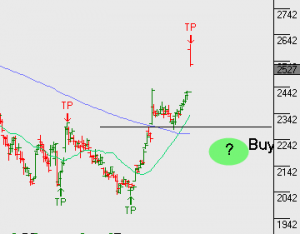

As a general trading strategy, it’s our base case that the market reaction on Friday illustrates a further widening of the Central Bank divergence theme in which US monetary policy continues to have a tightening bias, while other central banks are increasing fiscal and monetary stimulus. As such, we suggest maintaining a bullish market posture on the US Dollar.