The biggest monetary event of the US calendar is set to take place at Jackson Hole, Wyoming over the next two days. From an interest rate policy perspective, the main event will be the speech from Federal Reserve Chief Janet Yellen, who could use her speech to indicate a more or less aggressive policy position from the FED going into the end of the year.

Considering the recent upbeat reports on the US labor market, inflation, wages and household spending, Ms Yellen may use the opportunity to signal the FOMC’s growing optimism in the general outlook for US economic activity.

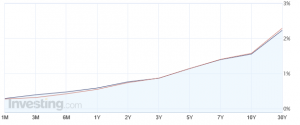

With the US Treasury Yield Curve flattening over the last month, the impact of Ms Yellen’s comments will likely have an asymmetrical impact US Credit markets as a hawkish tone will steepen the curve more than dovish comments will push yields lower.