The 1QFY17 production result for BHP was weaker than the market had expected. Weather related issues were mainly the cause.

BHP maintained FY17 shipping guidance for Iron Ore at 265-275mt. Petroleum volumes are anticipated to improve in the year ahead following recent issues with weak production from the Gulf of Mexico assets and lower shale volumes.

Forecast FY17 revenue to be in the range of $35b, EBIT of $7b, DPS of $0.50, which places the stock on a forward yield of 3%.

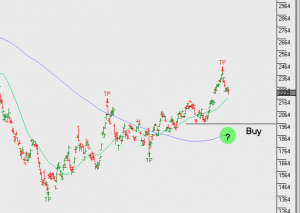

Many analysts have a bearish outlook for commodity prices in Fy18 and as a consequence, lower forecast EPS and DPS for the majors. Our view differs slightly and we think any pullback early next year will most likely create a solid “buy on the dip” opportunity for both BHP and RIO.

Our algorithm engines will track these and other major resource names for potential entry conditions.

BHP.ASX