Despite a 2% fall in earnings for the first half of 2016, Maquarie Group announced an interim dividend of $1.90 per share, up from $1.60 per share in the corresponding period last year and above market estimates for a $1.73 per share dividend.

The investment bank also reaffirmed its guidance for the full year, with expectations of matching the the record $2.06 billion profit it posted in fiscal 2016. For the six months to September 30, the bank recorded earnings of $1.05 billion, down 1.9% from the same period last year but materially better than the forecasts of a drop to $994.5 million.

Macquarie’s tier 1 capital ratio was seen at 10.4% versus 10.7% when it last reported in May, while assets under management rose 3% to $493.1 billion. The modest decline in earnings was driven by an 18% drop in net interest and trading income and a 21% slump in fee and commissions down to $2.2 billion.

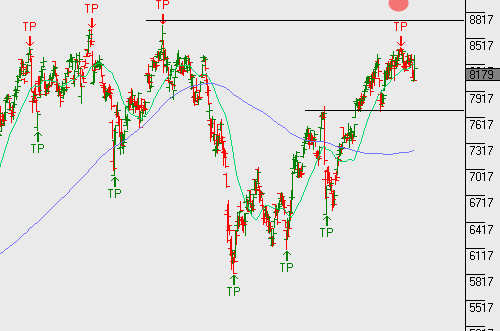

As long as the group meets its own forward forecasts that FY 17 will be broadly in line with FY 16 results, the share price valuation will remain reasonable at 12.5X forward earnings for a 5.5% dividend yield.

With around 60% of its total expected income to be earned overseas in H1 17, the company could get a bit of a tailwind if the Australian Dollar continues to track lower versus the US Dollar over the next six months.