US Gross Domestic Product (GDP) for the forth quarter of 2016 came in at 1.9%, reinforcing the stagnation in the US economy.

The December quarter GDP is the fifth out of the past six quarters where GDP has come in under 2%. This may help to explain why US companies are struggling to grow top line revenue.

We’re about two thirds through the reporting season for S&P500 companies, so far earnings appear to be growing at around 6%, which is 50% below the markets bullish expectations for 2017.

Looking ahead, we remain cautious of both the March GDP reading and in particular, the S&P500 March quarter earnings, (reported in April).

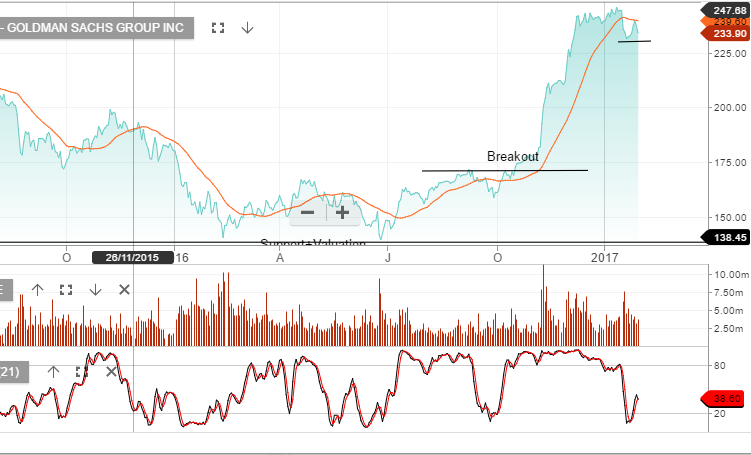

An area of concern when we get to the March numbers will be the US financials. The large jump in earnings among leading US trading firms in the December quarter from bond trading, will unlikely be repeatable in the March numbers.

Bond volatility in the March quarter will probably be less than December, therefore, resulting in lower levels of trading income. Furthermore, we’re beginning to see signs that mortgage repricing is starting to negatively impact housing starts. This was evident in the December new home starts data, which showed a 10% fall.