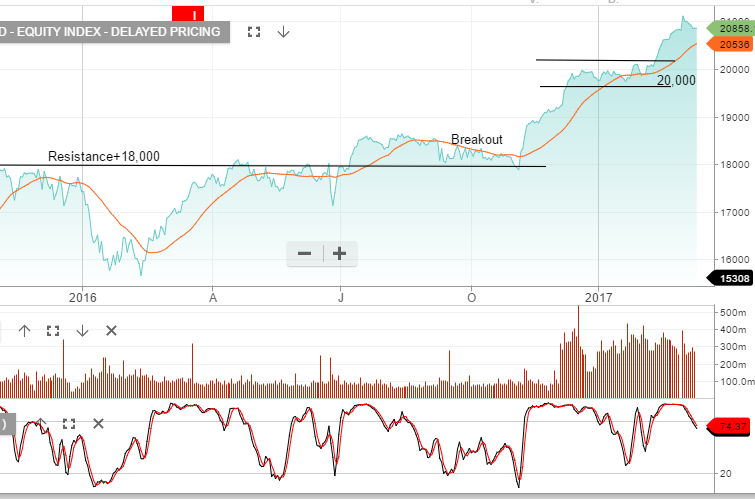

The Dow Jones had a minor retracement from the 1 March high of 21,169 to close the week out at 20,902. Wednesday in the US will see the Fed Reserve hand down their decision on US rates, with the market now pricing in a 92% chance of a .25% increase.

Interestingly, defensive names such as consumer staples have been some of the best performing stocks, (on a relative basis), when compared to other market sectors over the past month. In many cases, we’re now seeing PE ratios extend to 22x earnings and yields compressing down to 2.2%.

Dow leaders such as Boeing & Goldman Sachs are selling off after their terrific rally and GE, which has under performed lately, showed strength in Friday’s session.

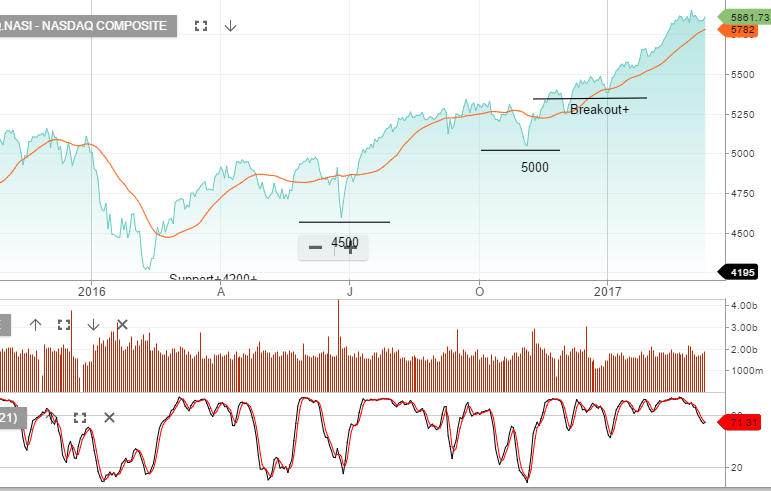

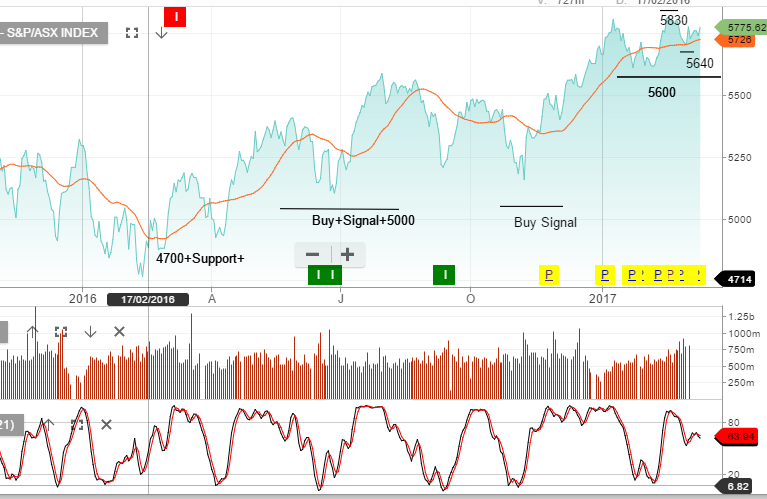

Due to stretched equity valuations, we’re most likely to see further consolidation in the major indices.