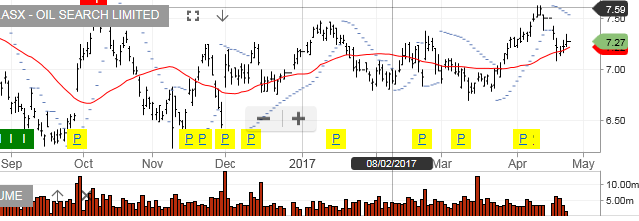

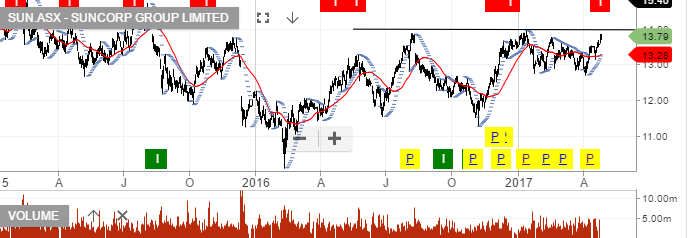

Take Profits In Suncorp

The ALGO engine gave us a buy signal on Suncorp on January 23rd at $12.92. Yesterday, the ALGO engine generated a sell signal at $13.77.

We suggest that investors who took advantage of the buy signal use this recent price increase to take profits or write covered calls above $14.00.

Technically, the $14.00 level has proved stiff resistance dating back to January of 2015.

Furthermore, the ALGO engine has generated exceptional signals for capturing the medium-term trading ranges for Suncorp.

Suncorp