The Reserve Bank is expected to keep the official cash rate unchanged tomorrow, ahead of the federal government’s budget next week. Over the weekend, fresh concerns emerged that China’s economic recovery might not be as strong as expected, which may also be included in the RBA’s statement.

The consensus is that the 1.5 per cent benchmark interest rate will remain on hold, but some analysts believe it could be raised in the next few months with the domestic economy more resilient than expected.

However, renewed signs appeared yesterday that China’s economic growth trajectory could prove more volatile in 2017 than first thought after a surprising fall in manufacturing output.

It’s our base case that the RBA still maintains an easing-bias, and that the next move on rates will be lower. As such, we expect to see a protracted move lower in the AUD/USD, with a medium-term target near the January low of .7150.

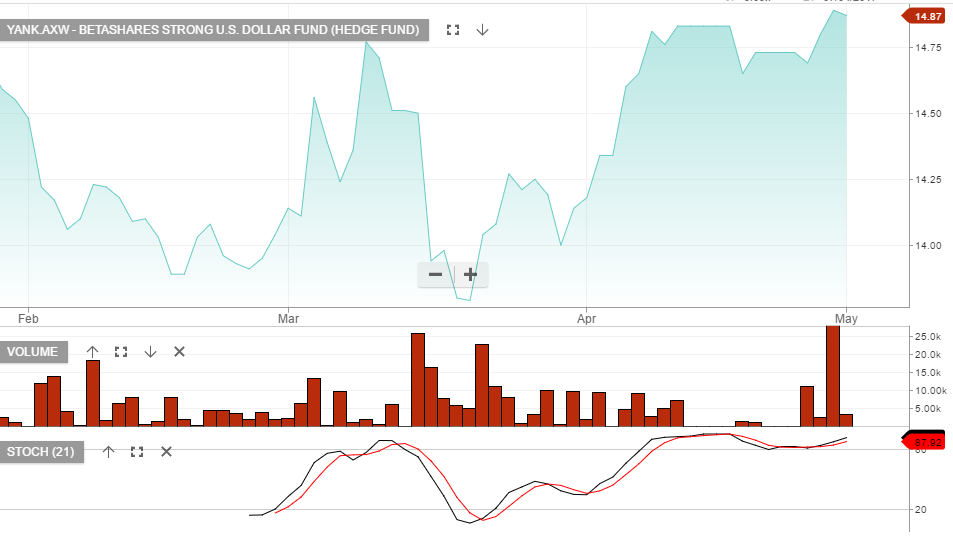

We have suggested that investors looking to profit from a lower AUD/USD can buy the BetaShare YANK ETF. This an an inverse ETF, with a 2.5% weighting, which gains value as the AUD/USD trades lower.