Prices of West Texas Intermediate (WTI) Crude Oil moved higher in New York trade, extending the recent rebound to a sixth straight session after a decline in US crude production eased concerns about deepening oversupply.

WTI futures settled up 19 cents at $44.93 per barrel after hitting a two-week high of $45.45 earlier in the day.

Supply disruptions in the Gulf of Mexico from Hurricane Cindy, as well as, increased demand for gasoline in front of the long July 4th weekend have also supported the move higher in Crude.

On June 23, we posted a report suggesting Crude Oil prices had become technically oversold and a reversion higher was likely. We are still looking for a extension of the move higher into the $46.50 area.

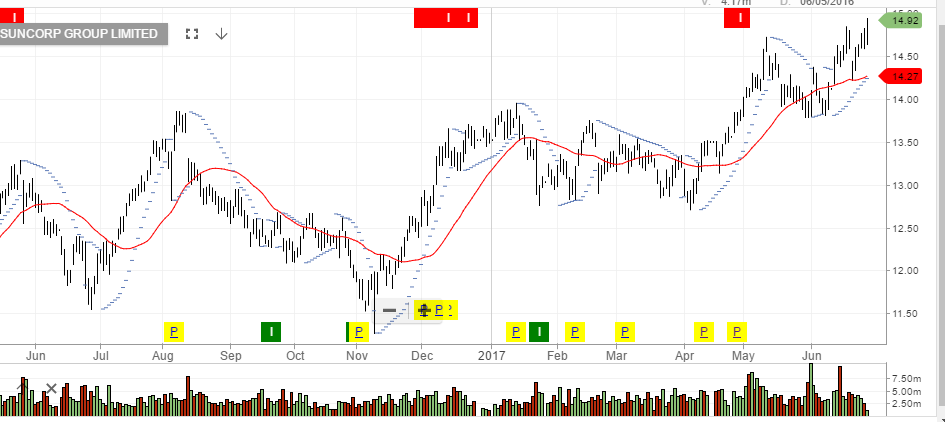

Investors looking to profit from higher Crude Oil prices can look to buy the BetaShare ETF with the symbol: OOO.

We started adding OOO to client portfolios in the $12.30 area.

We calculate that when WTI trades back to $46.50, the price of OOO will be near the $14.60 level, which is a reasonable area to take profits.

BetaShare ETF: OOO