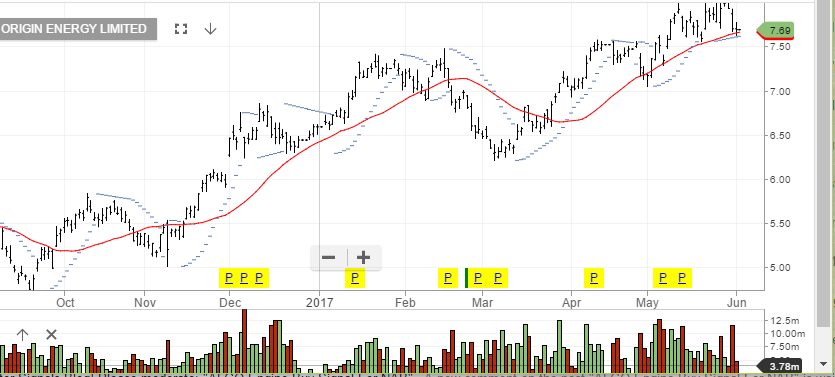

Buy The Pullback In Origin

Origin Energy has been trading in a broad range between $6.70 and $8.10 over the last four months.

We recently took profits for client portfolios at $8.00 and are currently looking for a retracement into the $7.50 area to re-enter long positions.

The recent weakness in crude oil has had a dampening effect on various energy names. However, we feel Origin’s natural gas assets will keep the share price fairly well bid over the medium to longer-term.

Origin

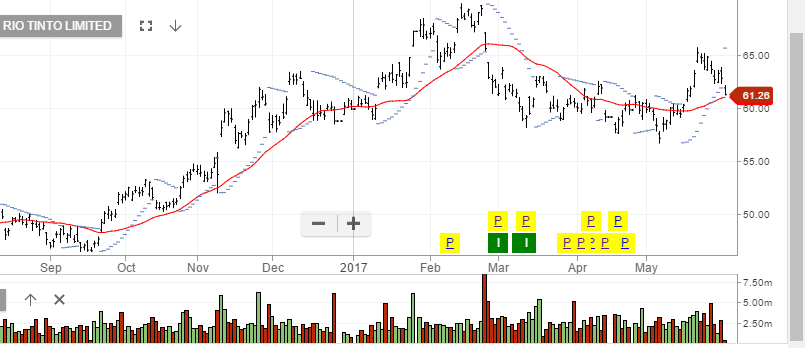

Rio Tinto

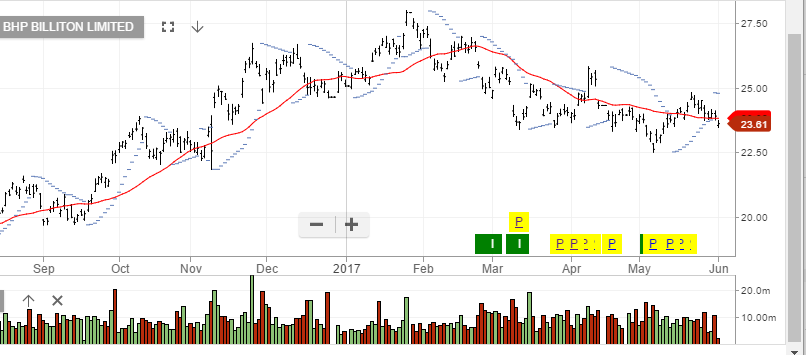

Rio Tinto BHP

BHP