RIO – $3bn Share Buy-Back

RIO has confirmed that Yancoal remains the preferred bidder of Coal & Allied post a revised and improved offer from Yancoal yesterday.

We expect material free cash-flow (FCF) to be passed through to shareholders despite iron ore falling from its February peak. In FY18, RIO could return up to $3billion through share buy-backs.

We remain cautious on the outlook for spot iron ore prices. However, the low levels of debt, low cost of production and aggressive capital management undertaking by RIO will help to provide share price support.

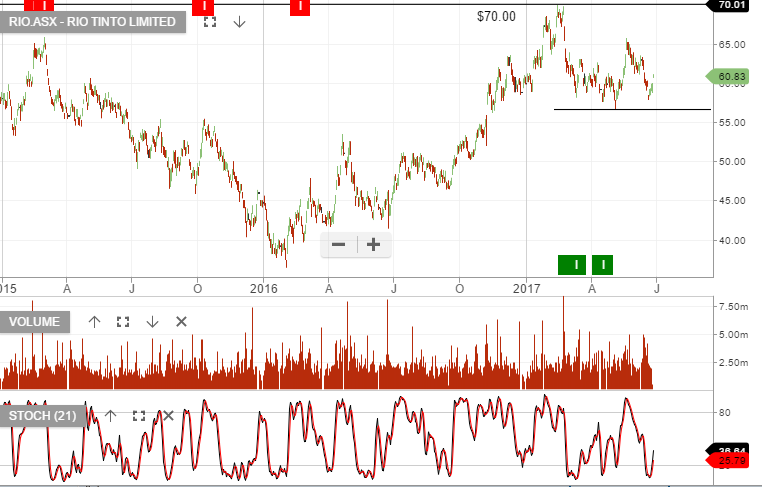

FMG, RIO & BHP will likely see a minor rally from the current oversold conditions, before turning lower.

Macquarie Group (MQG)

Macquarie Group (MQG)