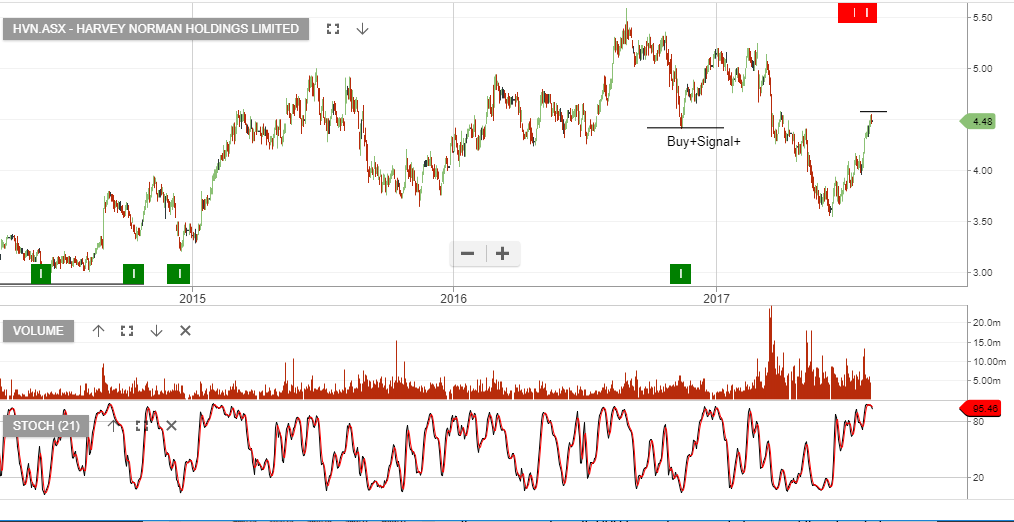

The technical pattern for Harvey Norman started to break-down early this year when the price action traded through the $4.50 support level.

Since then, HVN made a low in June at $3.55 and has now had a counter-trend rally back to $4.50.

Our Algo Engine is now flagging the “lower high” structure and we’ve added HVN to the short trade list with a stop loss above the $4.75 area.

Short term traders may prefer to use the momentum indicators to compliment the entry and stop loss rule.

HVN reports on the the 31st August. The market is looking for NPAT to increase to $377m, (from $337m last year), and DPS up 1 cent to $0.18.

Overly optimistic property revaluations, along with weak consumer trends, concern us and support our bearish view.