There were no bright spots in yesterday’s US Payroll report.

The 156,000 growth in jobs disappointed and is well below the recent averages. The back two months were revised lower by a total of 41,000 jobs.

The unemployment rate ticked up to 4.4% even though the participation rate was unchanged at 62.9%. Weekly average earnings fell from .2% to .1%.

This was enough to lift US Stock Indexes higher into the weekend.

The NASDAQ had it’s best week since December 2016, finishing 2.75% higher, and the S&P 500 rose 1.5% for its best weekly performance in 4 months.

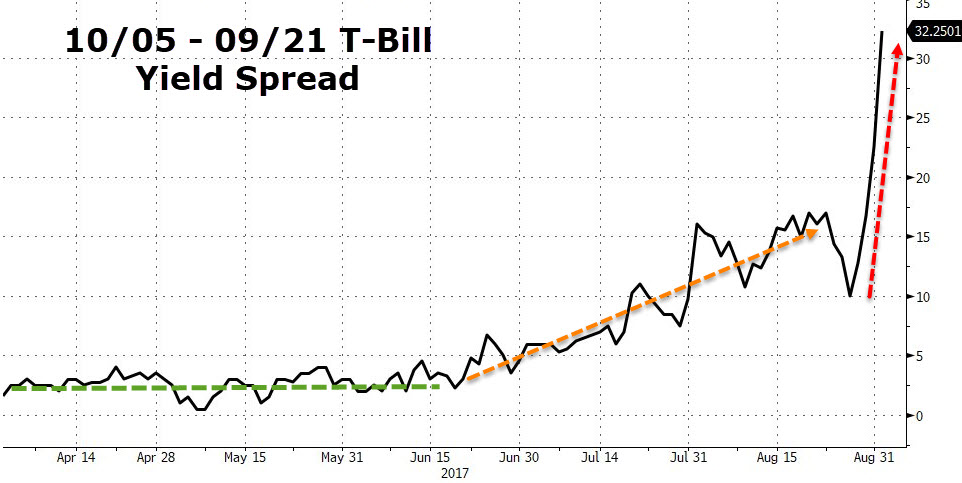

However, as illustrated in the chart below, the shortest end of the Treasury curve remains troubled as the debt ceiling panic continues to build.

And while the US 10-yr yields rose modestly to 2.16% after the payroll data, the T-Bill yield dislocation has extended out to 32 .25 basis points.

This indicates that the market remains extremely nervous about a debt ceiling crisis over the next month, which is not bullish for US equities.

September 21st versus October 5th T-Bill yield spread

September 21st versus October 5th T-Bill yield spread