NCM Remains Firm After Lower Production Guidance

Shares of NCM have reached a six-week high of $20.92 even though the mining giant has cut its full year gold output forecast.

The lower production guidance is mainly on the back of a tailing dam collapse which halted operations at its Cadia mine in NSW. Cadia is NCM’s biggest and lowest-cost mine.

NCM produced 575,791 ounces of gold in the three months to March 31, down 6% from the previous quarter.

The miner now expects full year gold output to be between 2.25 and 2.35 million ounces, down from its previous estimate of between 2.4 and 2.7 million ounces.

We believe that NCM has more upside potential as the price of Gold remains stable above $1300.00 and the AUD/USD has just dropped 3% over the last 10 days.

Technically, the next resistance area is near the chart gap at $21.15. Above that level will point to the March high of $22.30.

NCM is part of our ASX Top 50 Model Portfolio.

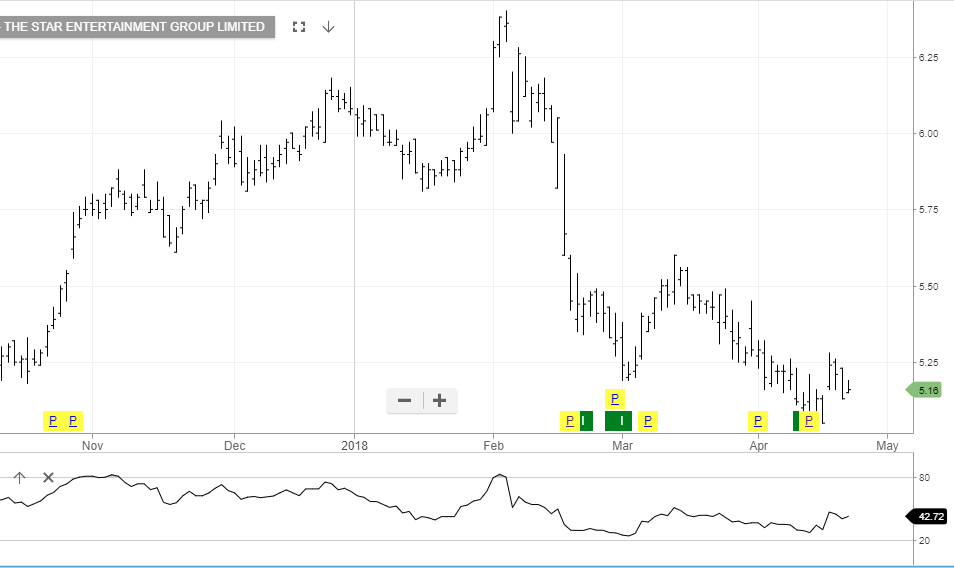

Buy Crown Resorts

Buy Crown Resorts

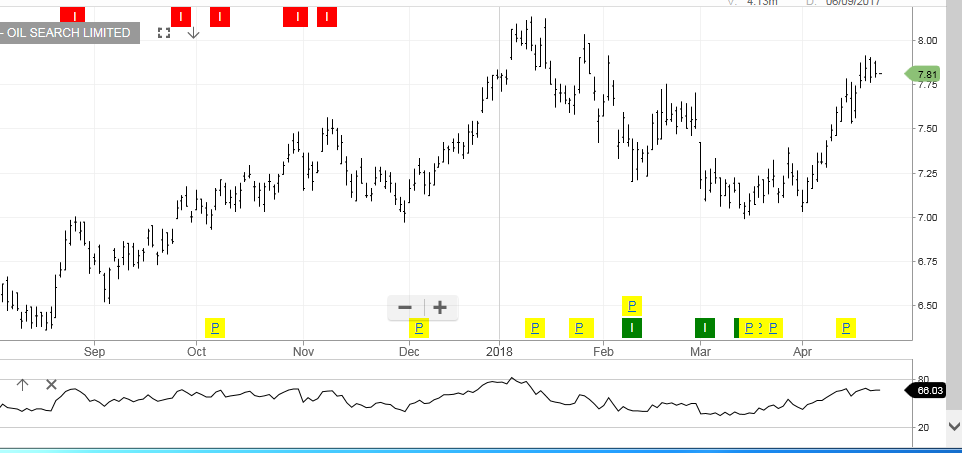

WTI Crude Oil

WTI Crude Oil Oil Search

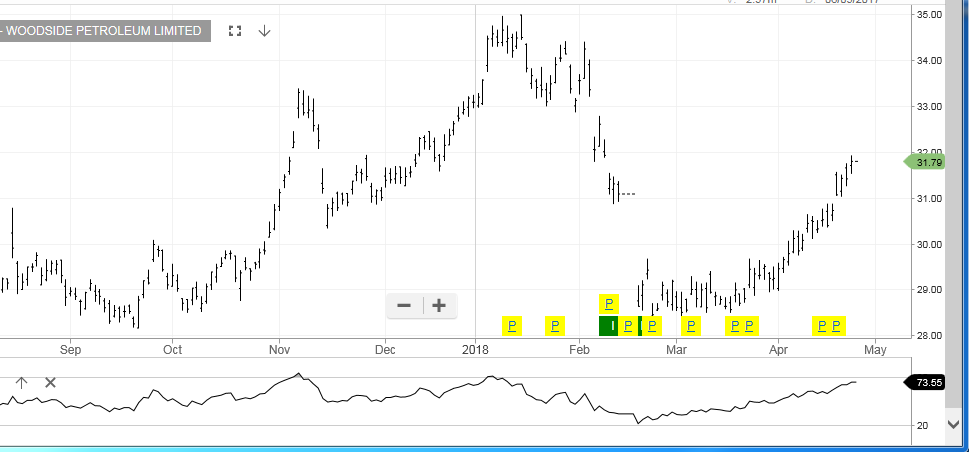

Oil Search Woodside Petroleum

Woodside Petroleum Santos

Santos