Expect More Debt Stress From Italy

One of the first lessons that we learned working on a dealing desk is that instability in sovereign bond markets can create sudden turmoil across a wide range of financial products.

The reason for this is because the aggregate amount of global bonds outstanding dwarfs the value of all the shares of stock in the world, combined.

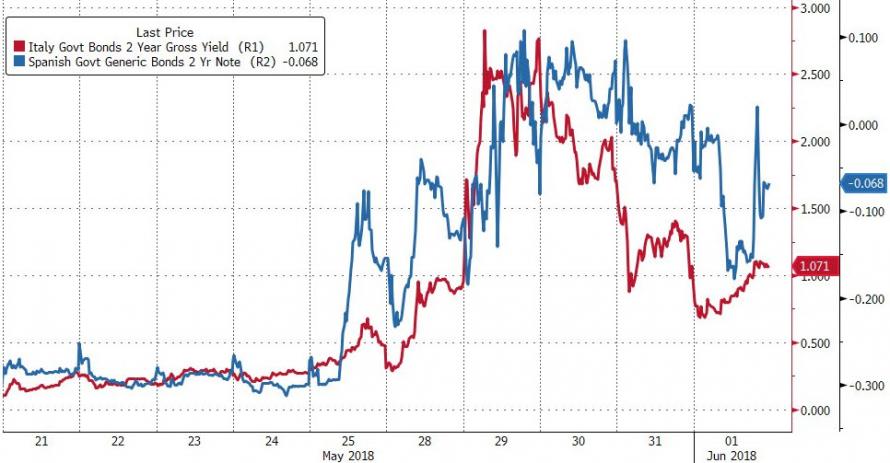

Last Tuesday, global financial markets were spun into a frenzy as Italian sovereign bond yields exploded to the upside.

The catalyst for the move was President Mattarella’s rejection of the new government’s candidate for Finance minister, Paolo Savona.

Mr Savona is an outspoken critic of the EU and the Euro currency

As a result, Italian 2-yr bond yields rose from .68% to 2.42% in one day. That’s a rise of 250% in just 24 hours!!

Looking past the political aspect of this week’s events, Italy is well on its way to becoming the next financial basket-case in Europe.

Regardless of who governs Italy, the country will need to re-finance over 350 billion worth of debt maturities and close to 300 billion worth of non-performing loans over the next five years.

We consider the ongoing debt stress in Italy as a potential source of contagion for global equity markets, including the ASX 200 Index.

Italian Sovereign Yields

Italian Sovereign Yields

BetaShare ETF BBOZ

BetaShare ETF BBOZ