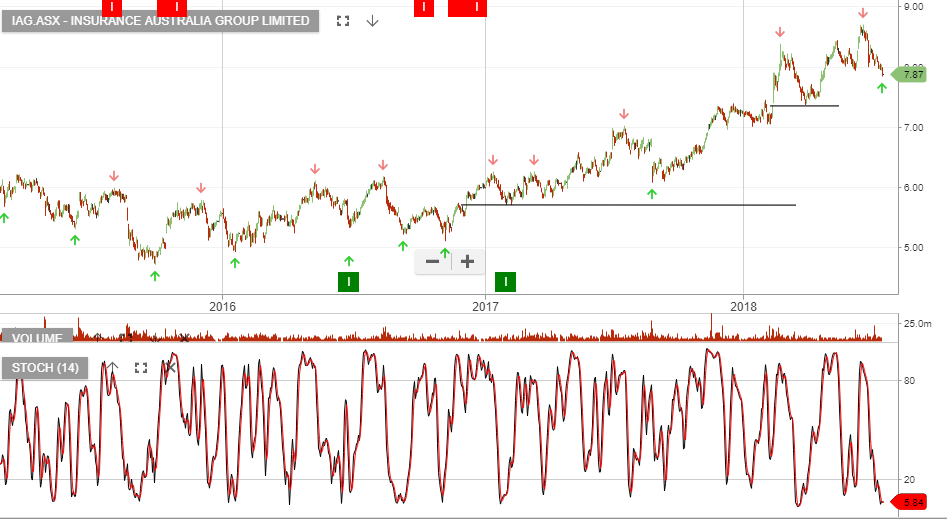

Although we don’t have a current Algo Engine buy signal in IAG, the stock is in the ASX 50 model portfolio from the original higher low pattern in 2017.

The recent share price retracement, from $8.70 back to yesterday’s low of $7.84, means we have the stock on our radar again.

Strong earnings growth, 5% fully franked dividend yield and an increase to the share buy back program should provide a floor under the share price.

We see IAG as a solid “buy/write” opportunity delivering 10 – 12% annualised cash flow.

IAG