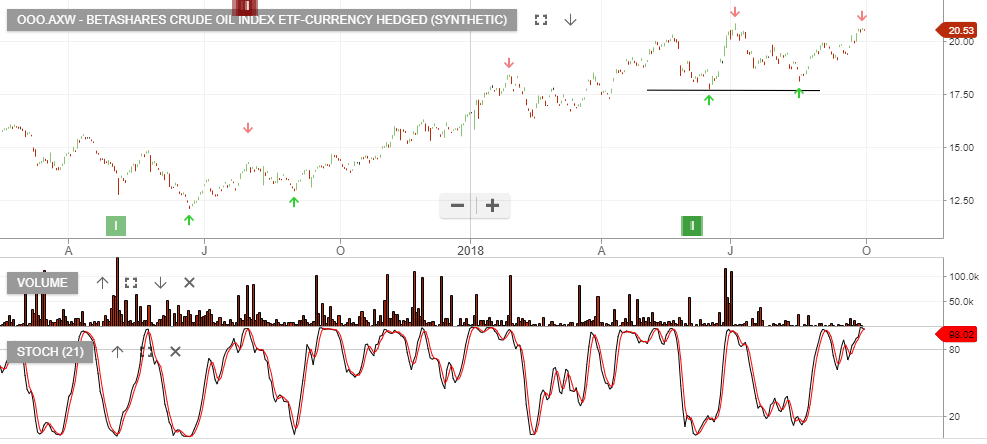

US Sanctions On Iran Tighten Supply

Oil prices continue to rise as U.S. sanctions on Tehran squeezed Iranian crude exports, tightening supply even as other key exporters increased production.

Recent signals in OSH and STO continue to push higher. Also, the OOO ETF, (Oil ETF), is now up almost 20% from the recent Algo Engine buy signal.

Oil ETF OOO

Aristocrat Leisure

Aristocrat Leisure