53.12% Return On Iluka Resources

Our ALGO engine triggered a sell signal for Iluka Resources into yesterday’s ASX close at $10.14.

ILU was added to our ASX model portfolio on February 7th, 2017 at $7.07

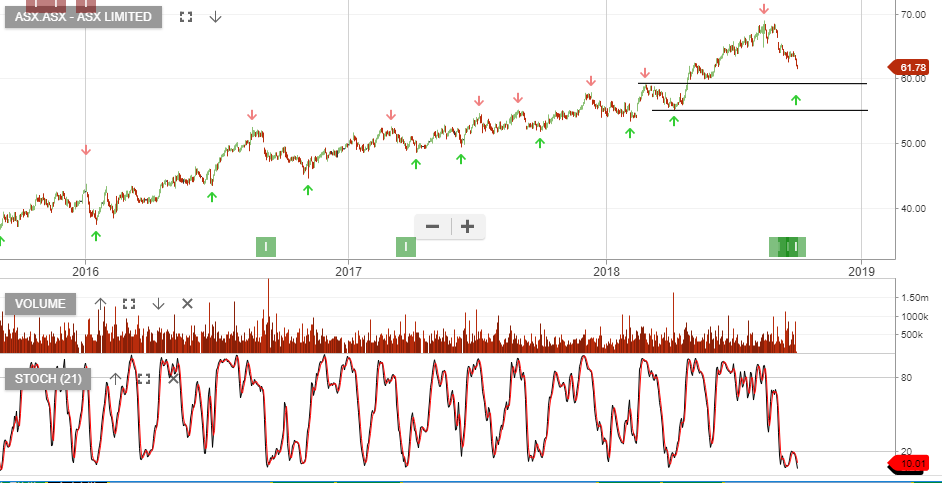

As illustrated in the chart below, ILU remained in the model, with several additional buy signals, as the stock maintained a pattern of “higher lows” over the 603 day holding period.

Further, investors who held ILU through the duration of the buy signal would have picked up 53.12% on their investment.

This 53.12% return is broken down into a 47.17% gain on the share price combined with 41 cents of dividends per share.

We will keep LIU on the radar and update subscribers and clients with future ALGO signals on the stock.

Iluka Resources

Iluka Resources