Bank stocks are down globally on average 30 to 50% from their recent highs. Even large cap US banks have seen heavy selling caused by global growth concerns and the impact of the inverted yield curve pressuring margins.

JP Morgan, (listed on the NYSE), is arguably the best operated bank in the world with one of the strongest balance sheets. Nevertheless, it has endured a share price fall from $120 in September to $91 in late December.

JP Morgan – finding support at $91 and is now under Algo Engine buy conditions.

BANKS, is a Betashares ETF providing broad based exposure to the global banking sector. The trend is obvious with a 30% sell off in 2018.

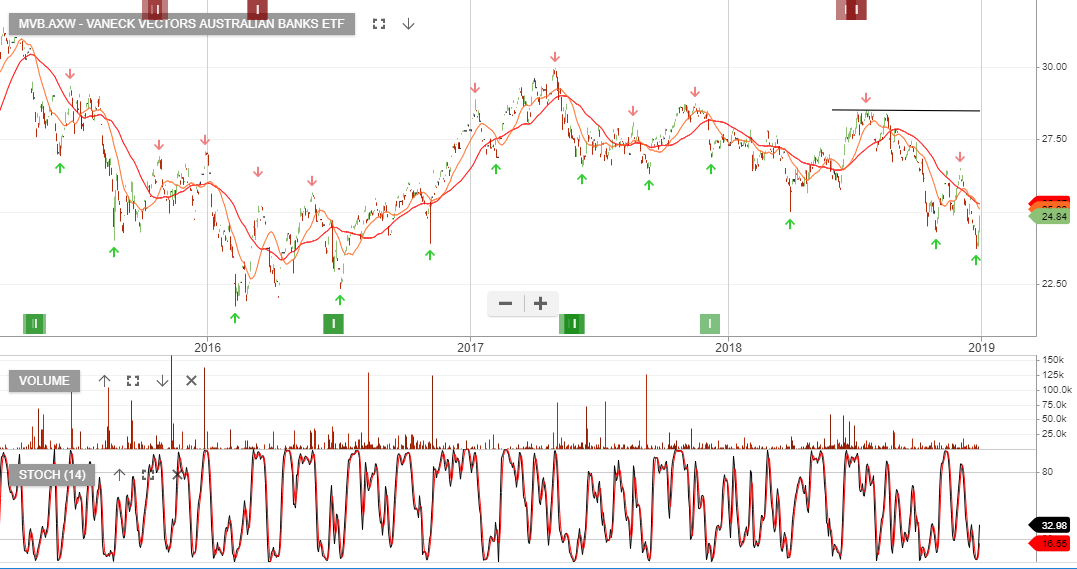

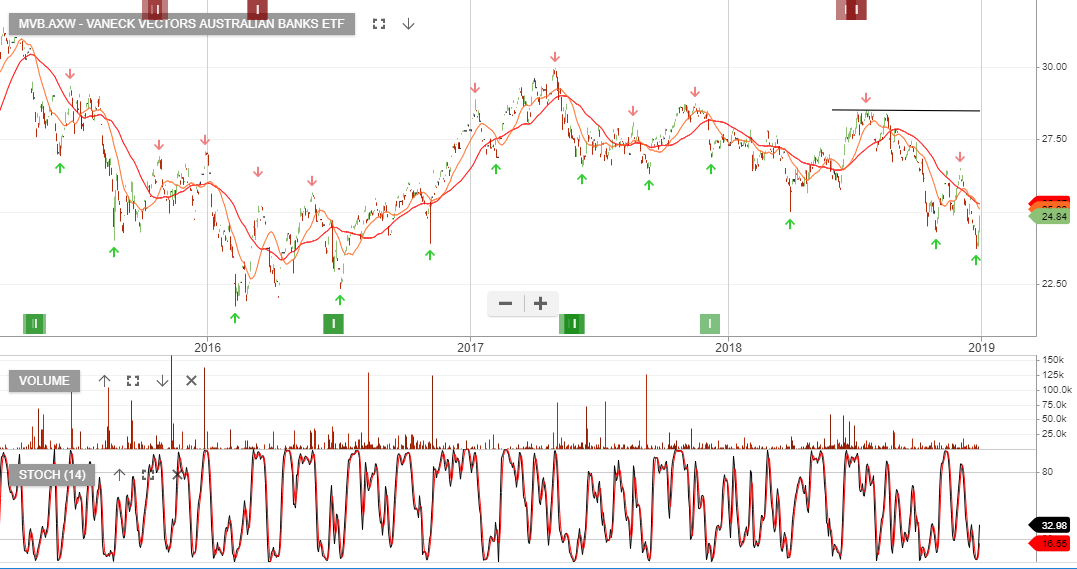

The MVB Market Vectors Australian Bank ETF shows that we’re still under Algo Engine sell conditions following the lower high formation in July.

The following bank names may see a bounce from oversold conditions, CBA, NAB and WBC.