Energy & Materials Set to Benefit

Energy and Material stocks are set to benefit from US President Donald Trump and Chinese President Xi Jinping agreeing to temporarily halt the imposition of new tariffs, as they work towards negotiating a more permanent agreement.

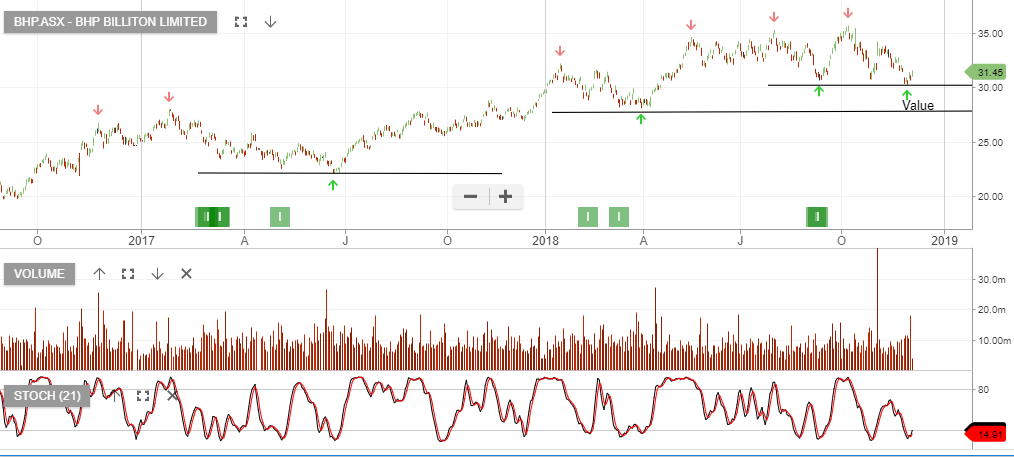

BHP, WPL, S32, STO and OSH are our preferred holdings.