XJO (ASX200) – Selling Pressure

S&P/ASX is now trading below the 10 day moving average. Investors should continue to watch the price action and monitor any pick up in selling pressure.

S&P/ASX is now trading below the 10 day moving average. Investors should continue to watch the price action and monitor any pick up in selling pressure.

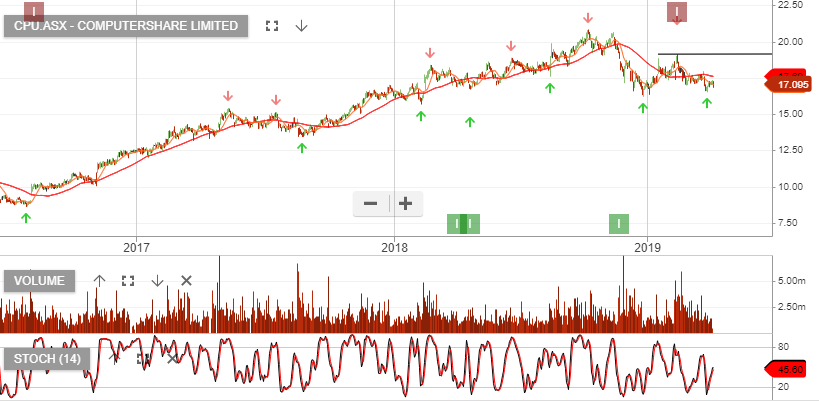

Computershare is under Algo Engine sell conditions and we continue to see downside risks to earnings and consensus valuations. Bond yields are well below the input levels used by analysts 6 months back, when forming the forecast valuations.

With the stock trading 20x earnings on a 2.3% yield, we see little reason to own this one.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Boral has been highlighted on the blog as a “high conviction” recovery play. The stock price has now rallied from $4.40 to $5.00.

Looking through any short term market weakness, we see a second half 2019 price target of $5.50 as achievable.

Macquarie Group reported FY19 earnings today and group revenue was up 19% to $6.25bn and NPAT was up 17% $2.99bn.

MQG is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

We forecast FY20 earnings to increase by 6%, placing the stock on a forward yield of 4.8%.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Coles Group is under Algo Engine sell conditions following the lower high at $12.70.

The group announced their 3Q19 sales growth which came in ahead of market expectations. Food and liquor sales grew at 3.3% in 3Q19, however, management indicated that they expect to see the growth moderate back to 2%, or in line with historical growth rates.

A review of the valuation forecasts show FY20 revenue of $40bn, EBIT $1.34bn, on EPS of $0.68 and DPS of $0.55, placing COL on a forward yield of 4.8%.

We see limited downside risk for the share price and we consider selling at-the -money-call options as an alternative to selling the underlying stock.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

A number of REITs announced their 3Q19 operational updates yesterday.

Dexus forecast 5% underlying earnings growth. reaffirmed its FY19 guidance for 5% growth.

Mirvac indicated their FY19 guidance will be in the 3 – 4% growth range with DPS growth at 5%.

Across the sector it is likely residential and retail remain the weak spots, whilst office and industrial will continue to provide strong growth. Softening of the retail sector was evident in GPT’s March quarter business update.

Despite GPT’s exposure to retail, the office exposure along with the groups strategy to expand the footprint in logistics, makes the stock one of our preferred opportunities within the REIT sector.

Or start a free thirty day trial for our full service, which includes our ASX Research.