Silverlake Resources – Buy the Dip

ASX:SLR} has rallied 70% since we identified the Algo Engine buy signal back in September last year.

ASX:SLR} has rallied 70% since we identified the Algo Engine buy signal back in September last year.

BlueScope Steel is under Algo Engine buy conditions and we see the current selloff as a buying opportunity.

BSL reported net profit fell 70% to $186 million 2H19 from $624 million on the same time last year. Revenue dropped 8% to $5.8bn from $6.4bn.

EBIT fell 64% $302 million from the year-earlier $850 million.

The company indicated EBIT in the 1H20, had renewed caution because of the uncertain impact from coronavirus on its businesses and customers.

Value is likely to emerge near the $12.50 price level. We add this to our watchlist

Medibank Private is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

We highlight the price support on the MPL chart, as the price action nears the $2.94 gap created back in May last year.

MPL goes ex-div $0.057 on the 5th of March.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

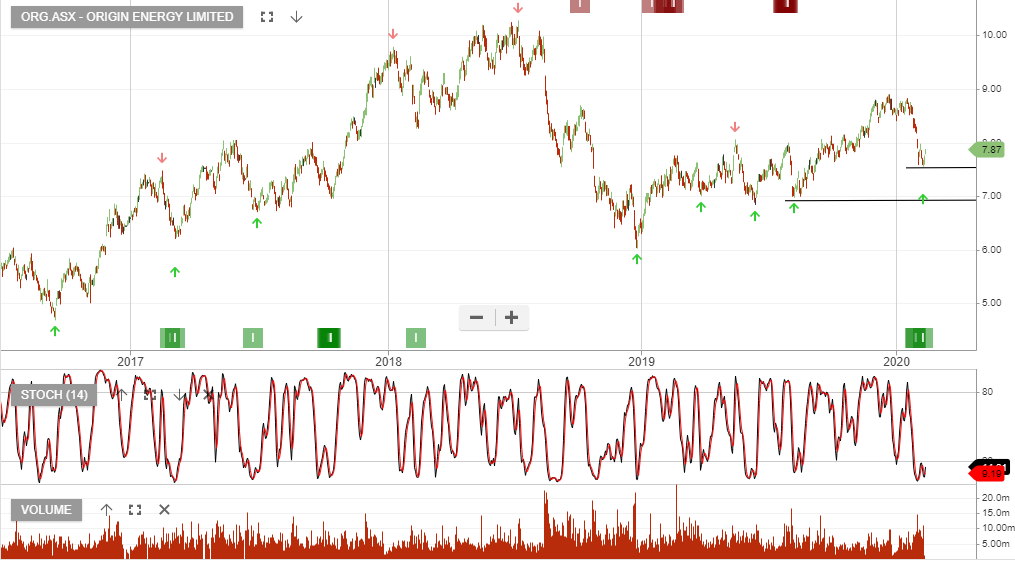

Origin Energy is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

Buy ORG at $7.80.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Insurance Australia Group looks oversold at $6.60. The insurers are out of favour and have been dumped from portfolios.

IAG is a preferred value recovery play within the sector.

Accumulate IAG within the $6.50 – $6.75 range.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

{ASX:AQG) is under Algo Engine buy conditions.

The share price has found support at $6.15 and is likely to make a new high, exceeding the $8.44 level set back in December.

Or start a free thirty day trial for our full service, which includes our ASX Research.