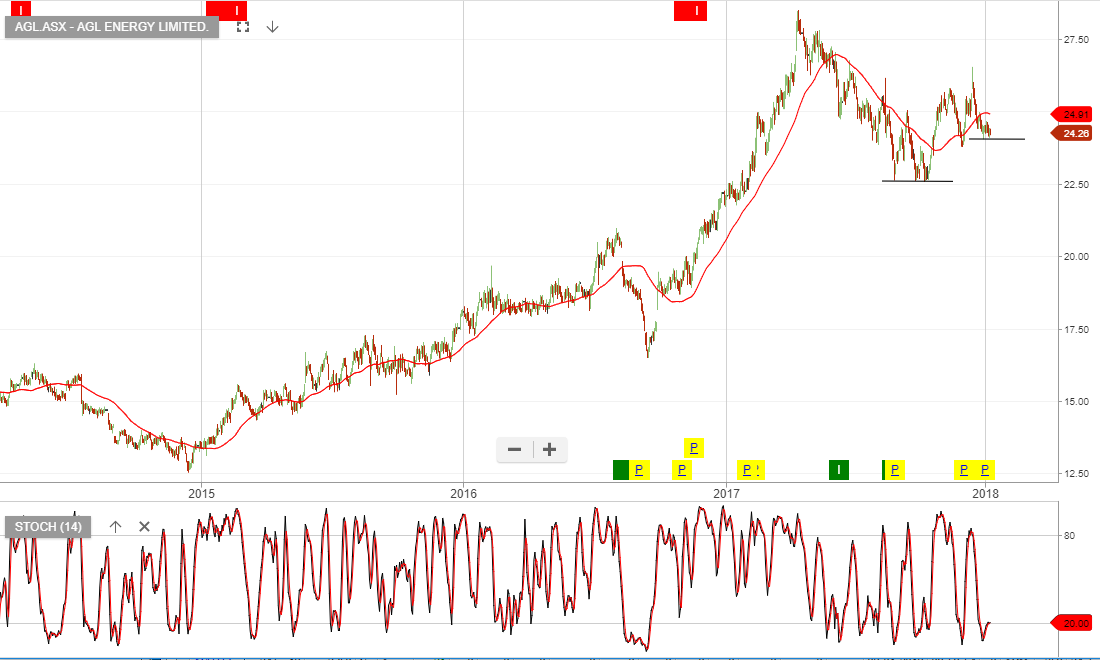

ALGO Update: AGL Continues To Drift Lower

Our ALGO engine triggered a sell signal for AGL on May 2nd at $22.50.

At the time, we suggested selling $23.00 call options into September, so investors would receive increased cash flow as well as the 54 cent dividend on August 23rd.

Performance reports from both the Loy Yang A and Bayswater facilities have failed to generate strong buying interest and we remain neutral on the stock.

Daily charts suggest the next level of support for AGL is near $21.35.

AGL

AGL