Aristocrat

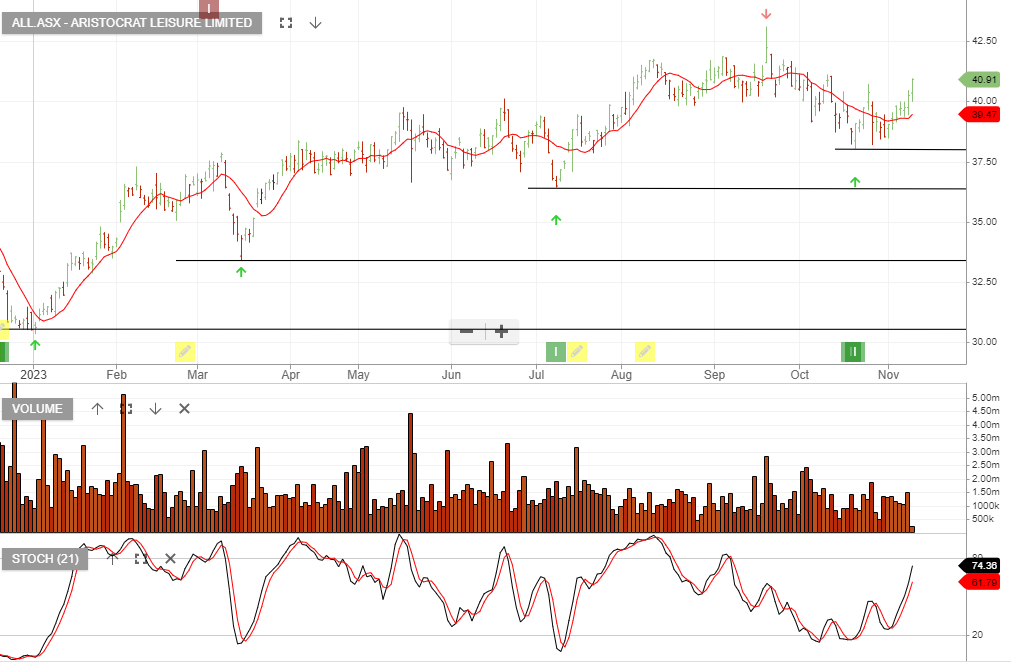

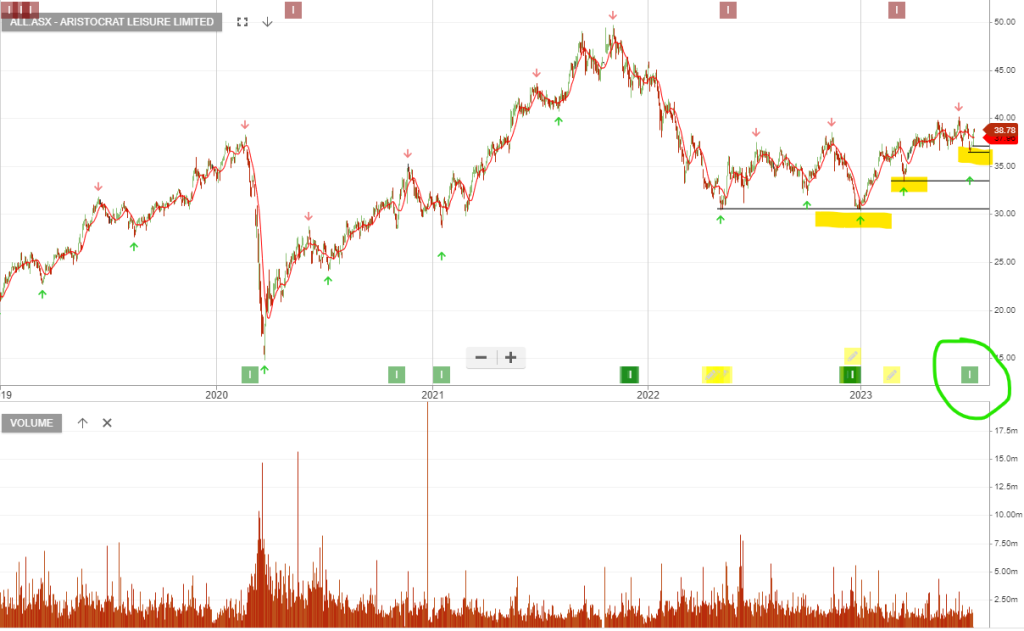

Aristocrat Leisure is nearing support; look to buy on the cross above the 10-day average.

Aristocrat Leisure: Positive Momentum

Aristocrat Leisure continues to build positive momentum following the switch to Algo Engine buy conditions in July.

Aristocrat Leisure

Aristocrat Leisure is up 7.7% in 27 days.

Aristocrat Leisure

Aristocrat Leisure has recently been added to the ASX 100 portfolio following the switch to Algo Engine buy conditions.

ALL is also an open trade in the ASX100 Trade Table.

Aristocrat Leisure

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Aristocrat Leisure

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Aristocrat Leisure

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Aristocrat Leisure

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Aristocrat Leisure

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Send our ASX Research to your Inbox

Or start a free thirty day trial for our full service, which includes our ASX Research.