Aristocrat Leisure – Algo Buy

Aristocrat Leisure is under Algo Engine buy conditions.

Aristocrat Leisure is under Algo Engine buy conditions.

Aristocrat Leisure is under Algo Engine buy conditions.

Aristocrat Leisure is under Algo Engine buy conditions.

Aristocrat Leisure is under Algo Engine buy conditions.

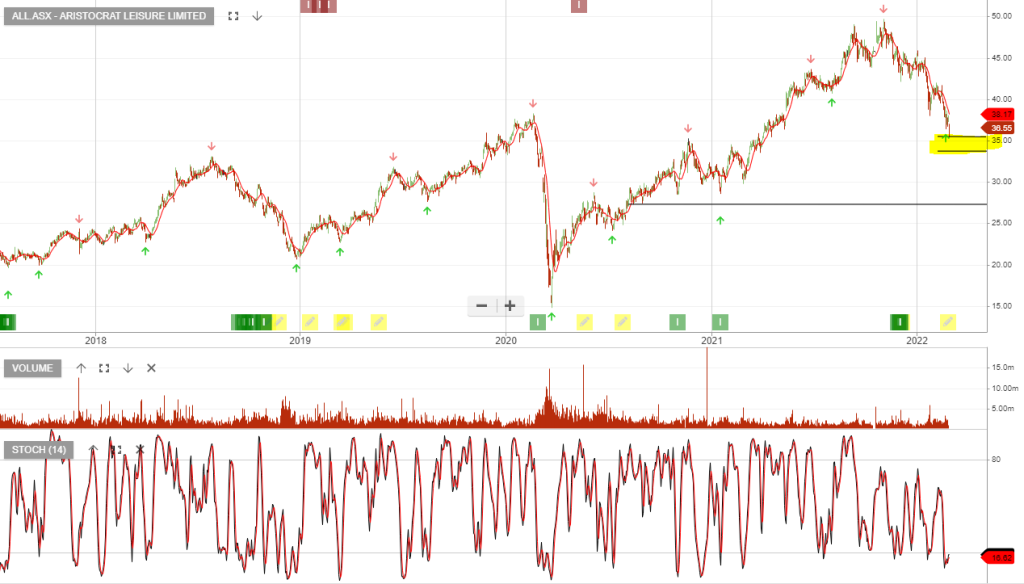

Aristocrat Leisure is among the best-performing stocks in our ASX model portfolio. After being added in November last year, the stock is up 53.7%.

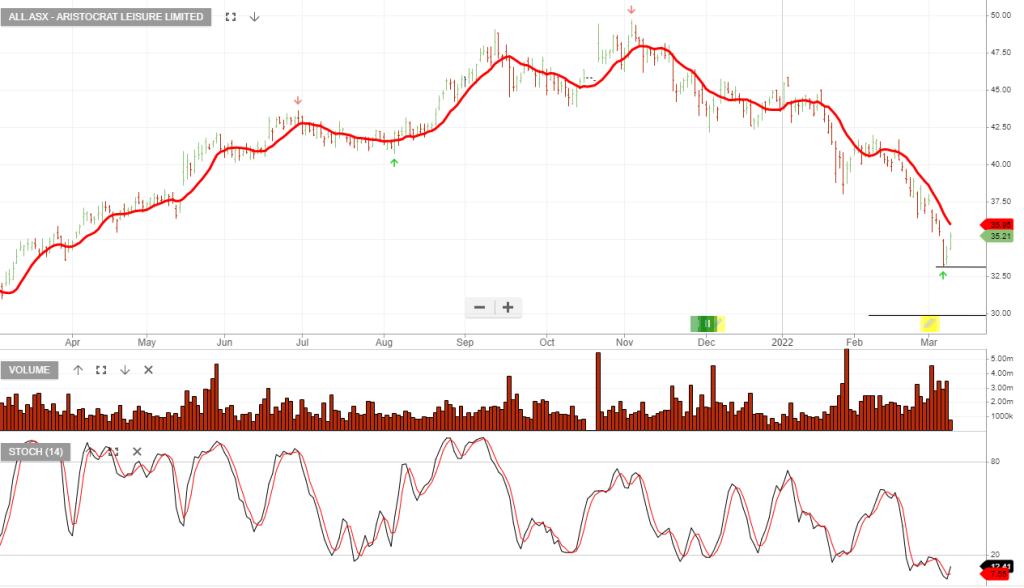

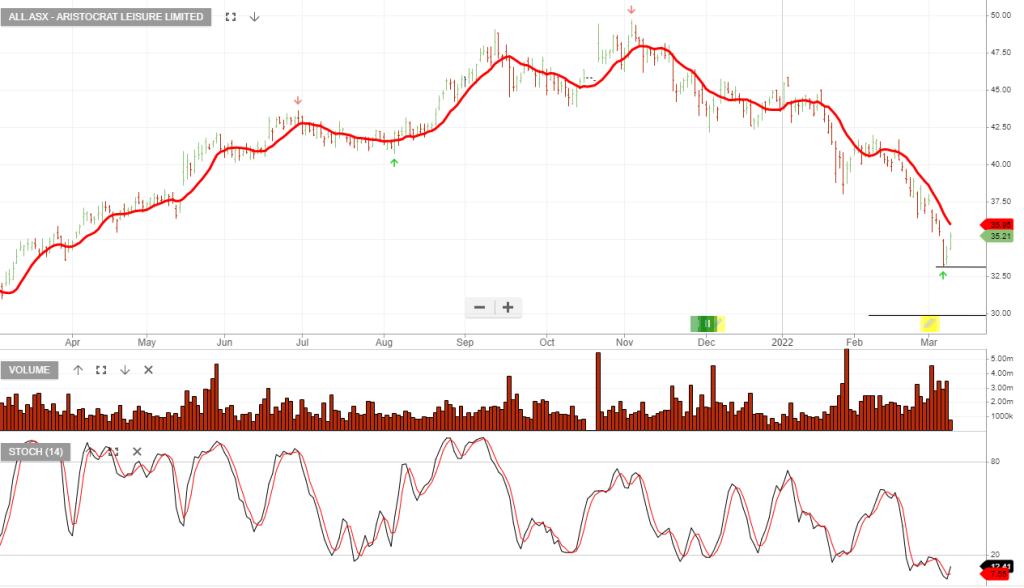

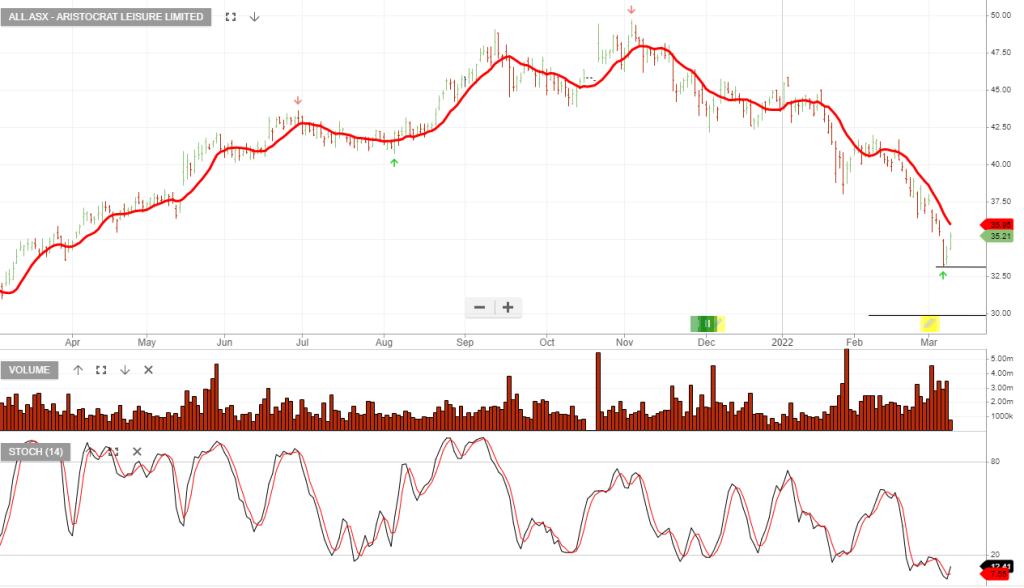

The recent pullback from $50 to $42 has generated another Algo Engine buy signal. We see buying support building above the recent $42 pivot low.

Aristocrat Leisure is under Algo Engine sell conditions and we see increasing selling pressure due to a weak earnings outlook.

Risks remain elevated coming into the next earnings release.

Aristocrat Leisure has now switched to Algo Engine sell conditions and has been removed from our ASX 100 model portfolio.

Aristocrat delivered 1H20 net profit, (NPATA), of A$368mn which was down 13% on the same time last year. Growth in digital earnings was not enough to offset weak revenue in the Americas.

We’re not willing to look at shorting ALL as we see a normalization of the business conditions by 2022, we’ll revisit this name should we see a “buy on the dip” opportunity later this year.

Aristocrat Leisure reported a strong 1H19 result with the North American division the standout. The result also benefited from a lower AUD/USD exchange rate. Normalised profit after tax $422 + 16% in reported terms and +7.7% in constant currency. Up from $361m the same time last year.

In FY20 we forecast revenue to grow by 8% and EPS growth at a similar level. Based on this, we have ALL on a forward dividend yield of 2.2%.

Risks to the business include increased regulation, competition and slowing

customer demand. We look to buy ALL on the next Algo Engine buy signal.

The company goes ex-dividend $0.22 on the 29th of May.

Aristocrat Leisure was highlighted on the blog as a “counter trend” buying opportunity last week at $23. The stock is now trading at $25 and we suggest locking in gains.

Aristocrat Leisure is under Algo sell conditions following the lower high formation at $26. This is a favourite amongst local fund managers, with analyst price targets as high as $40.

The recent selloff has seen the PE fall from 30x back to a 17x PE. With the share price at $23, buying interest is now building and we may see a counter trend rally extend through to $24.50.

Or start a free thirty day trial for our full service, which includes our ASX Research.