Major Banks Set To Report Earnings

The ANZ will announce its annual results on Thursday as the first of the major banks to report over the next three weeks. NAB will report next Thursday and WBC will report the following Thursday.

ANZ is expected to announce a full year cash profit of $6.89 billion and a DPS of 83 cents on revenue of $20.7 billion. Much of this gain is based on stronger owner-occupied home lending.

Analysts are expecting ANZ to be the first of the major banks to return capital to shareholders given its pro-forma position outlined by APRA last month.

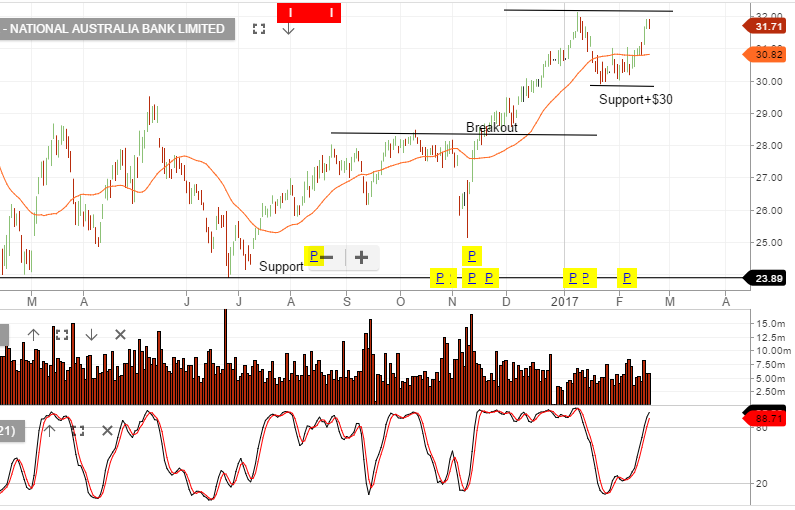

At this point, the NAB’s profit forecast is expected to be $6.6 billion with a DPS of 99 cents.

MQG will report their half-yearly results this Friday. The numbers on the street are reflecting a profit of $1.1 billion with a DPS of $2.10 per share.

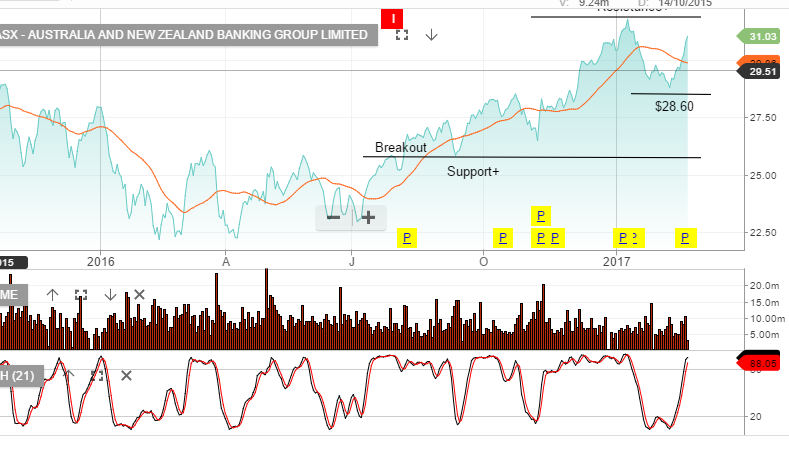

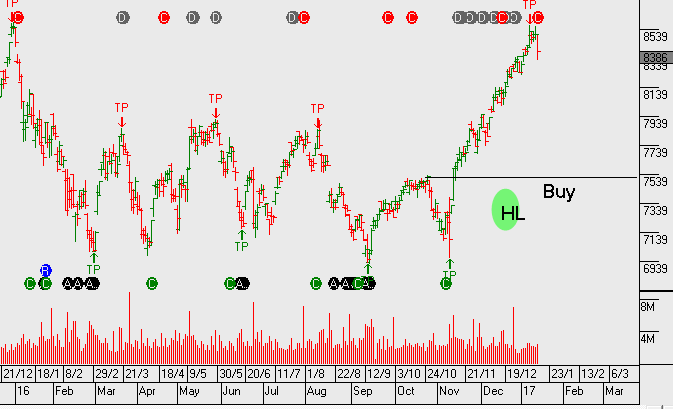

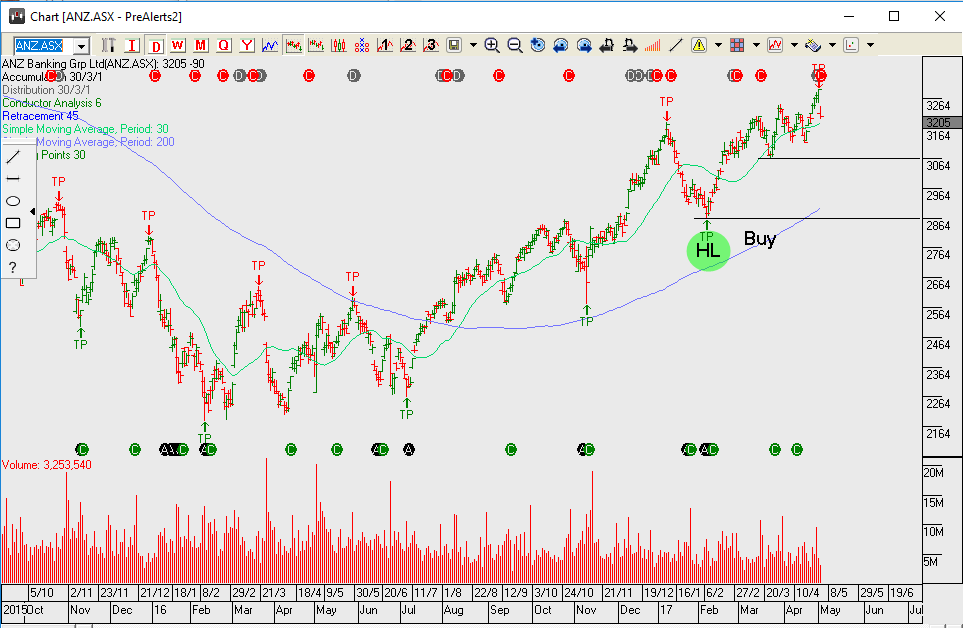

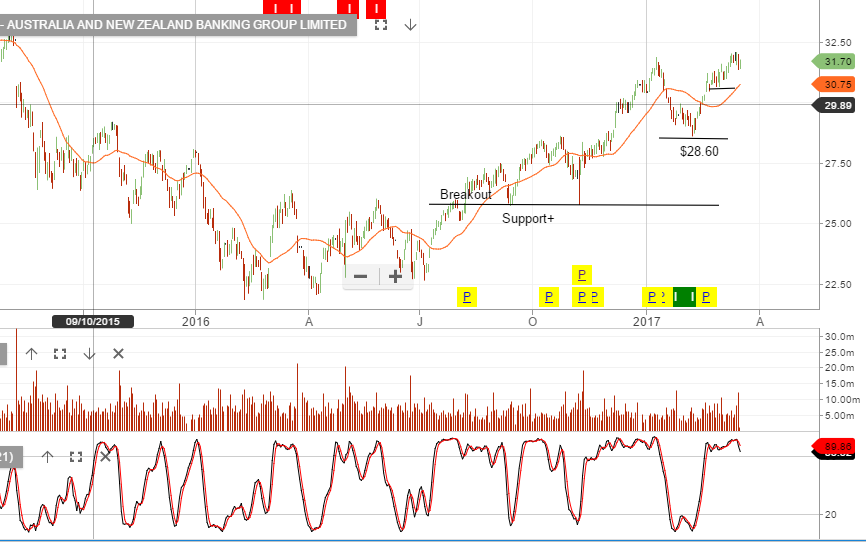

ANZ

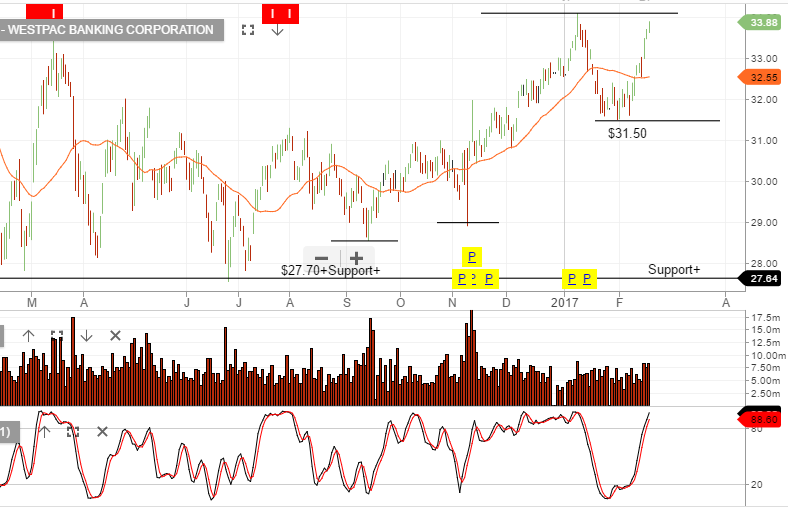

NAB

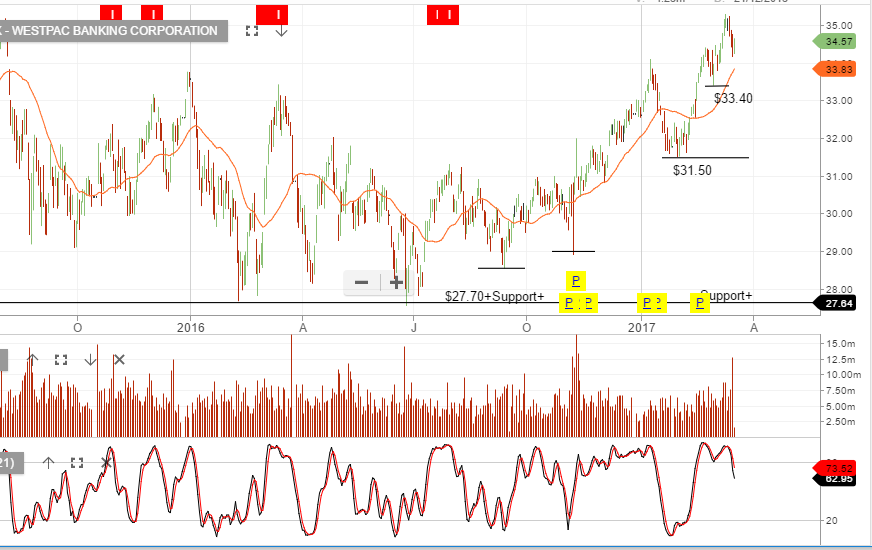

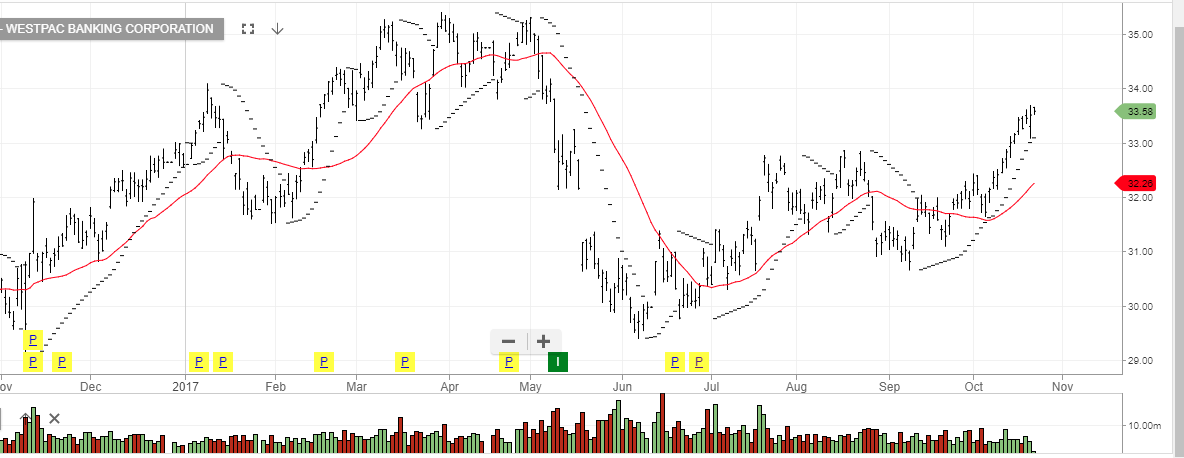

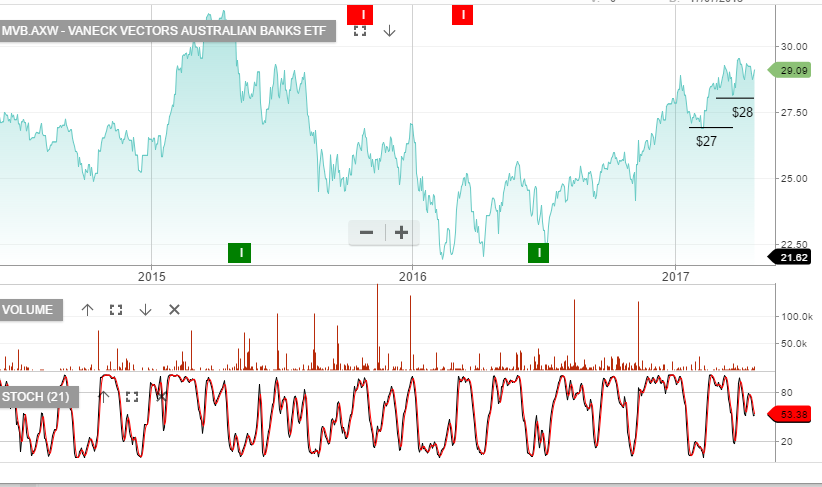

Westpac

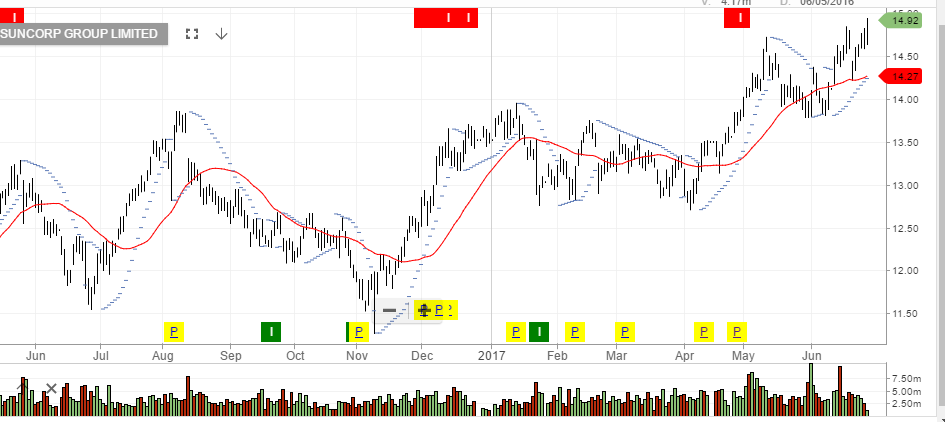

MQG

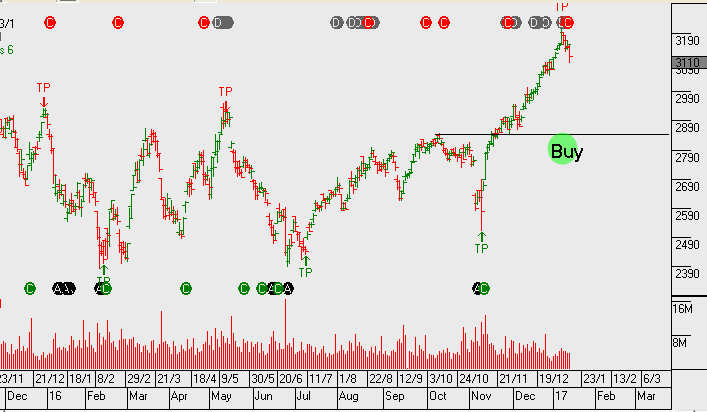

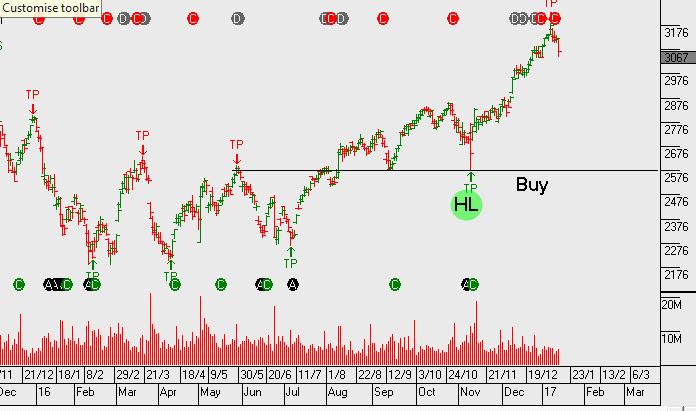

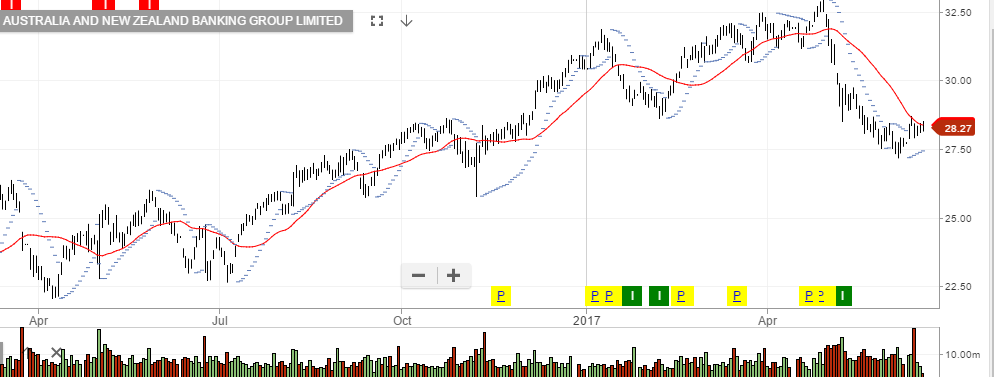

ANZ

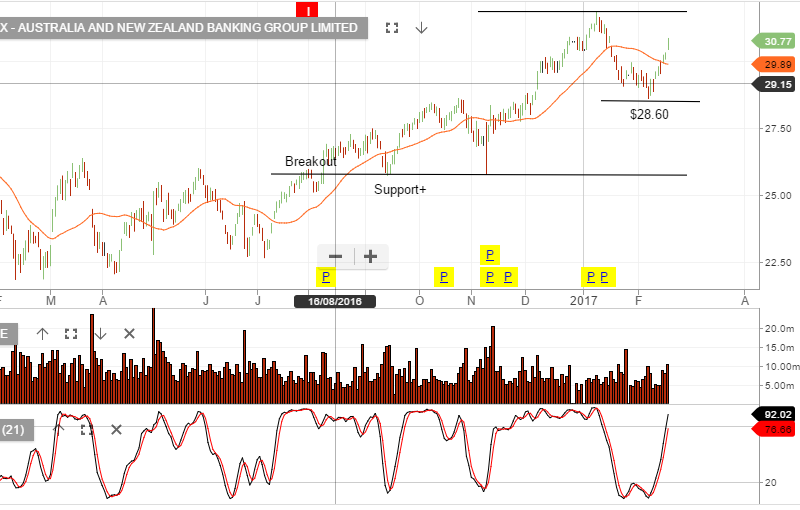

ANZ

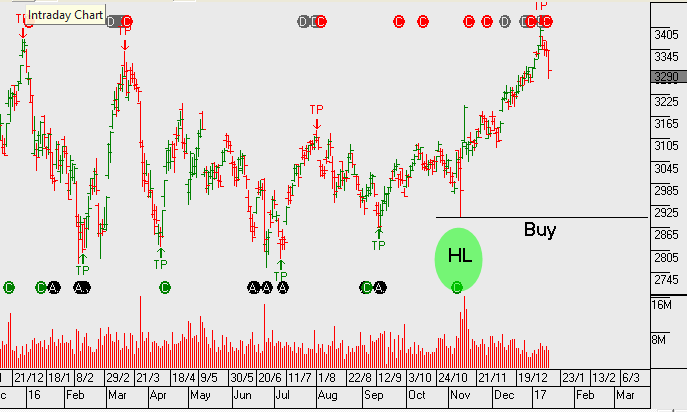

Chart – ANZ

Chart – ANZ