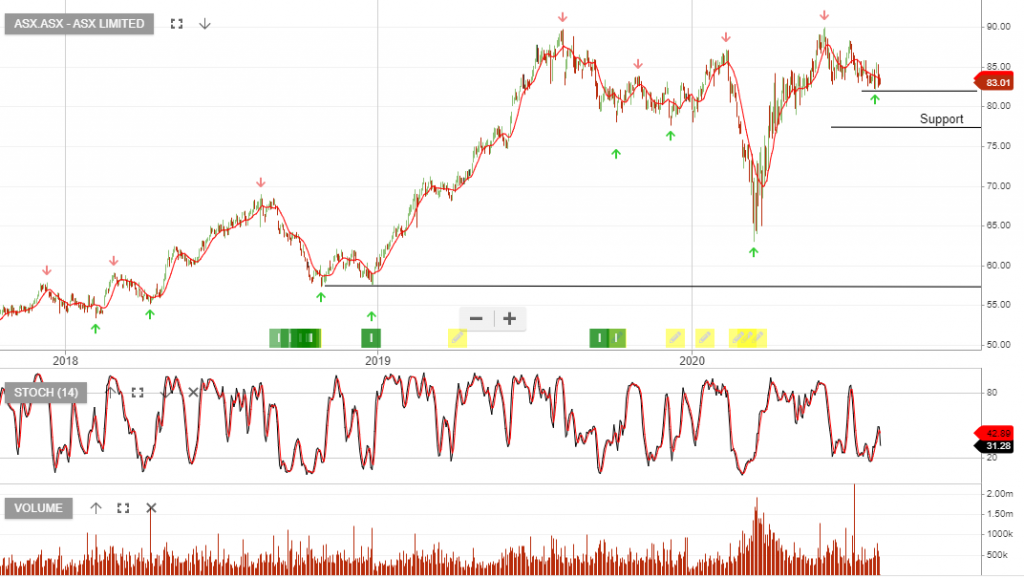

ASX – Buy

ASX is under Algo Engine buy conditions and is now likely to find buying support.

ASX is under Algo Engine buy conditions and is now likely to find buying support.

ASX is under Algo Engine buy conditions and is now likely to find buying support.

ASX is under Algo Engine buy conditions and is now likely to find buying support.

ASX is under Algo Engine buy conditions and is now likely to find buying support.

ASX is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

ASX is now under Algo Engine buy conditions and we highlight the expected buying support range of $77 – $82.

ASX is under Algo Engine buy conditions.

August cash equity volumes and average daily futures contract volumes were well down on the same time last year, -13% and -19% respectively.

FY21 earnings are likely to be flat at best and with the stock on a forward yield of 2.8%, we see it as “fully valued”. Owning the stock and selling an at the money covered call option is generating 8% cash flow.

We see value in buying ASX on any market weakness.

ASX is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

July trading volumes show cash market: 32.5m, (lower than the 12-month average of 38.4m) and total value traded in July rose to $140.5bn, (July 2019’s $126.8bn).

Derivatives total of 8.6m contracts, down 22% on a year ago and much lower than the past 12-month average.

Volumes are expected to remain below the elevated levels of the past few months.

ASX is a quality business and we look to add to the position at lower price levels.

ASX is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

Accumulate within the $64 – $68 price range.

NOTE: It was reported on mainstream media that NYSE volume is up over 50% in March, (based on the same time last year).

It seems reasonable to assume that the ASX will be benefiting from a similar pick up in order flows, across both equities and derivatives.

ASX is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

We recommend investors buy ASX and we reaffirm our “high conviction” rating.

Or start a free thirty day trial for our full service, which includes our ASX Research.