Bendigo Bank

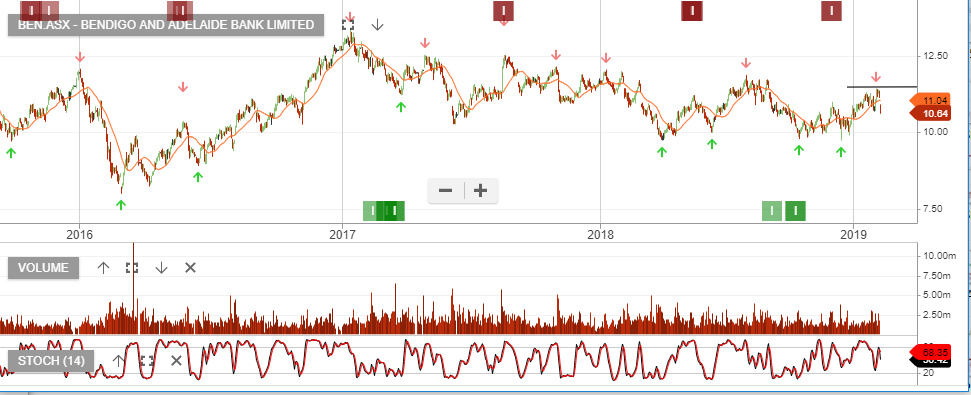

Bendigo and Adelaide Bank is under Algo Engine sell conditions.

Bendigo and Adelaide Bank is under Algo Engine sell conditions.

Bendigo and Adelaide Bank is under Algo Engine sell conditions.

The bank reported a 2% rise in cash earnings to $220m alongside a first-half dividend of $0.23 (24% lower than the previous corresponding period).

Smaller bad debt charges are helping bank results globally.

Bendigo and Adelaide Bank remains under Algo Engine sell conditions. The company reports their FY19 earnings on Monday 12th August and we expect a soft result, along with a cautious outlook.

Bendigo Bank and Computershare have been our two “high conviction” short trades. We’ve now covered Computershare but retain our short BEN positioning.

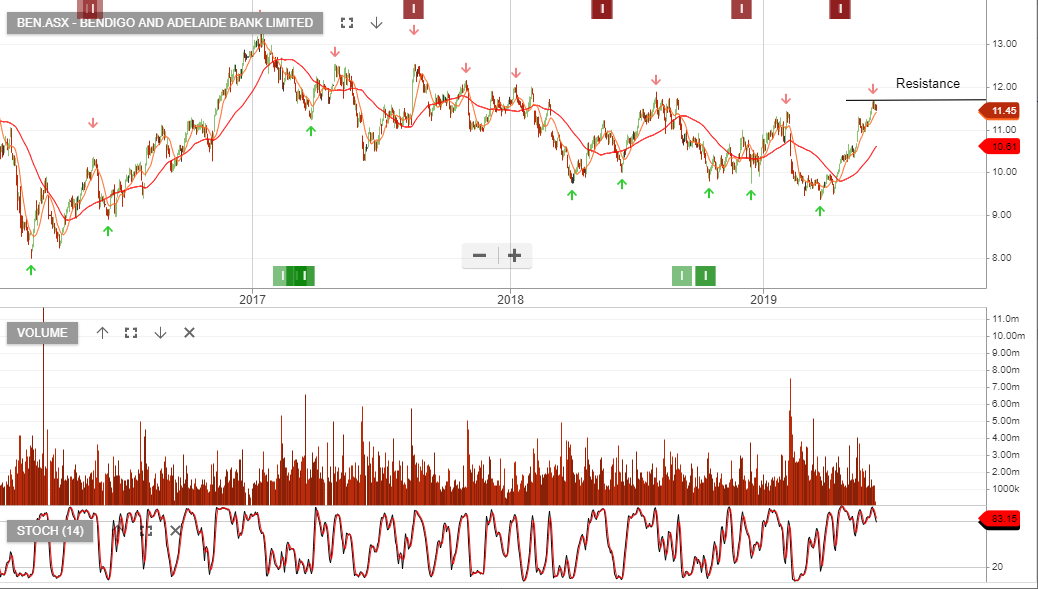

Bendigo and Adelaide Bank is under Algo Engine sell conditions and we see resistance building at $11.75.

Bendigo is likely to show softer revenue driven by lower net interest margins and continued competitive pressures.

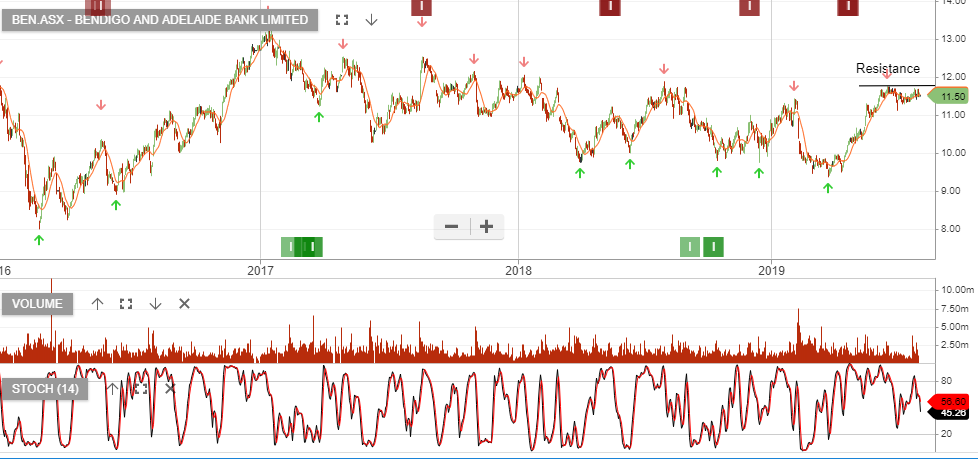

Bendigo and Adelaide Bank is now under Algo Engine sell conditions and we see resistance building near the $11.50 price range.

Bendigo and Adelaide Bank is under Algo Engine sell conditions and is now approaching overbought levels and we expect to see the short-term indicators turn negative.

The chart below illustrates where we anticipate selling pressure to build.

Bendigo reported earnings slightly below market consensus.

1H19 cash profit came in at $220m, however, we continue to see challenging conditions for the regional banks.

BEN and BOQ both display lower high formations and are under Algo Engine sell signals.

Amcor reports on Monday, we expect the earnings result to support the current share price rally. AMC has been a high conviction call, expressed on the blog and in the “Opportunities in Review webinar”.

Bendigo Bank, (BEN) reports on Monday, we’re cautious of this name and see the money being made on the short side.

Origin Energy (ORG) reports next Friday, we feel the LNG related income will surprise on the upside.

For more detail on the earnings season, register for Monday’s Opportunities in Review webinar.

All four major banks, and the regional names, are now displaying Algo Engine sell signals. Currently we have no bank long holdings within our model portfolio.

Within the financial sector our preference remains for ASX and IAG. Both offer a fully franked dividend yield, and when combined with a covered call, we’re generating 10 – 12% annualized cash flow.

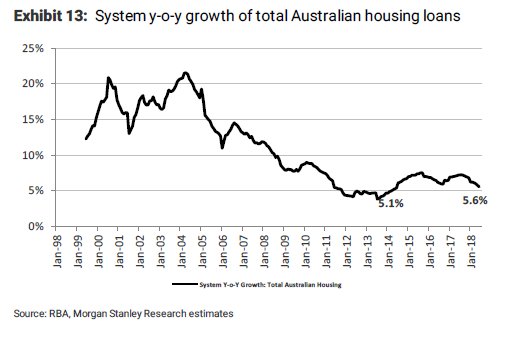

Our concern about the low ROE for the domestic banks is driven by weak housing loan growth and the rising cost of funds. These conditions keep us cautious on the banks, especially when combined with the present group of ALGO sell signals.

Our Algo Engine has flagged the “lower high” formation in Bendigo Bank and with the stock facing earnings headwinds, we feel this an appropriate short trade to consider

Sell within the $11.00 – $11 .30 range.

Bendigo

Or start a free thirty day trial for our full service, which includes our ASX Research.