Algo Update – BHP & WOW

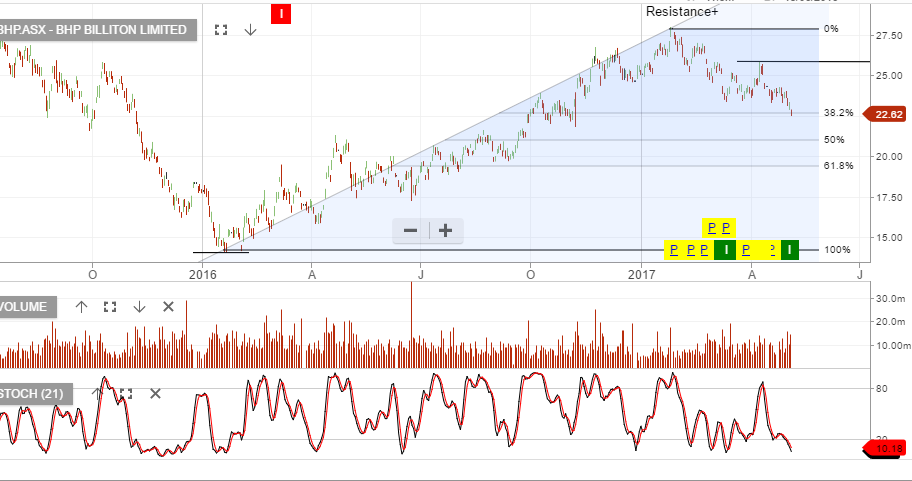

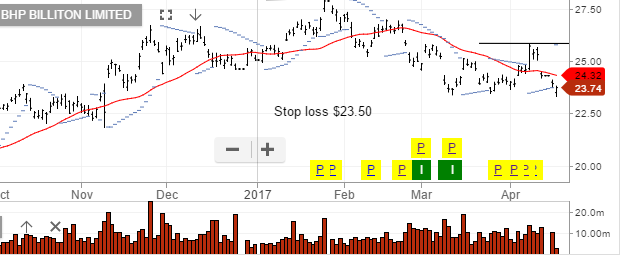

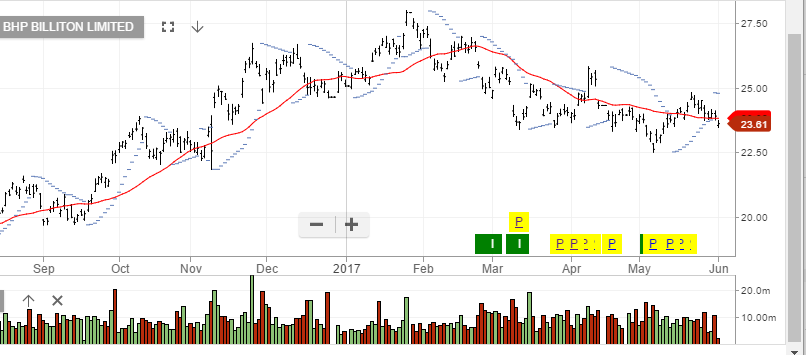

Recent Algo Engine buy signals in BHP and WOW continue to perform strongly.

An overnight rally in metal and oil prices will support BHP in today’s trading and investors may wish to consider selling covered calls into November, at or near the $26 strike price.

Woolworths reports earnings on the 23rd August and the market will be looking for underlying EPS growth of 8% to support the 22x earnings multiple.

With WOW now trading on forward yield of 3% and a relatively high multiple, we encourage investors to sell $28 Dec call options to boost the annual cash flow return.

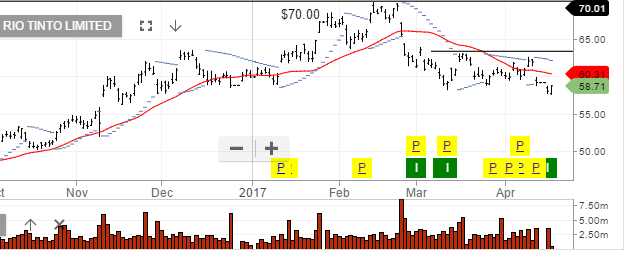

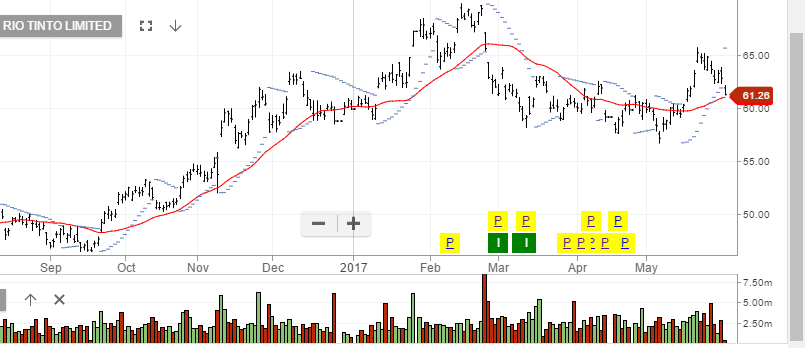

Rio Tinto

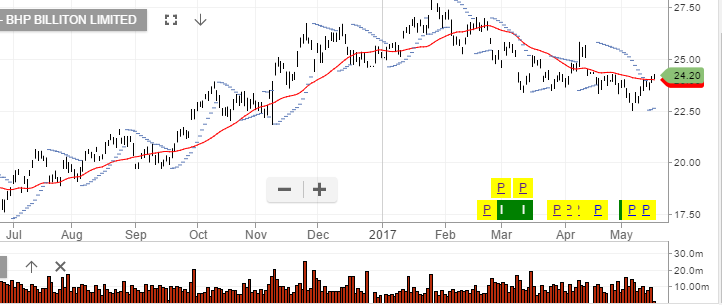

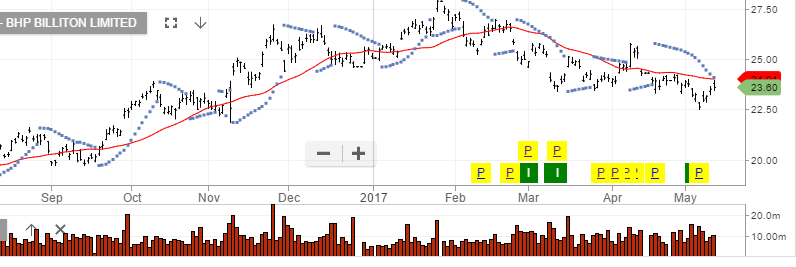

Rio Tinto BHP

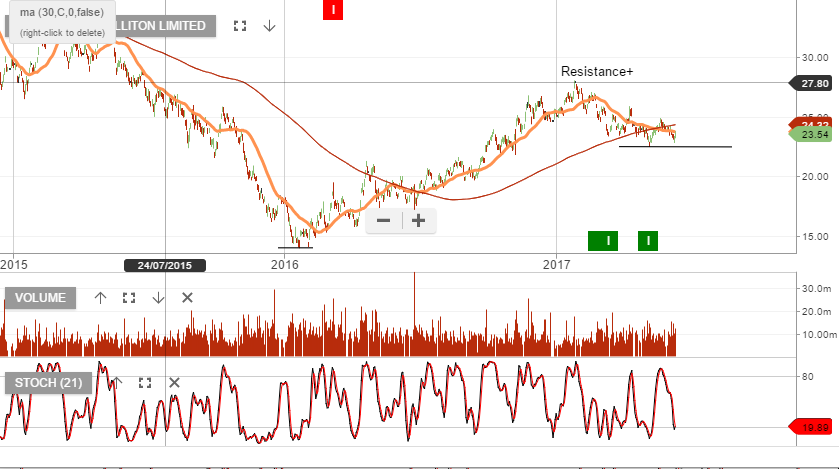

BHP