Building Stocks Approach Key Resistence Levels

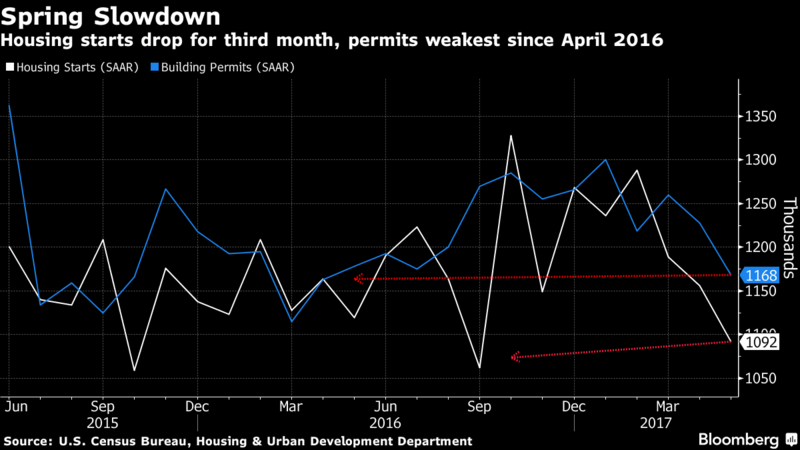

Reports about the health of the Aussie housing market vary depending on who is writing them; the RBA is suggesting the market is softening as household debt increases, while real estate agents look to foreign buyers to support higher prices.

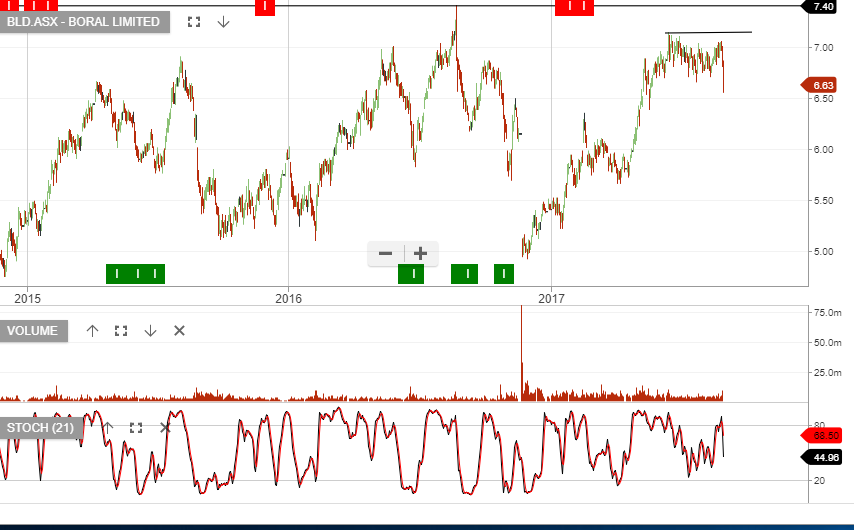

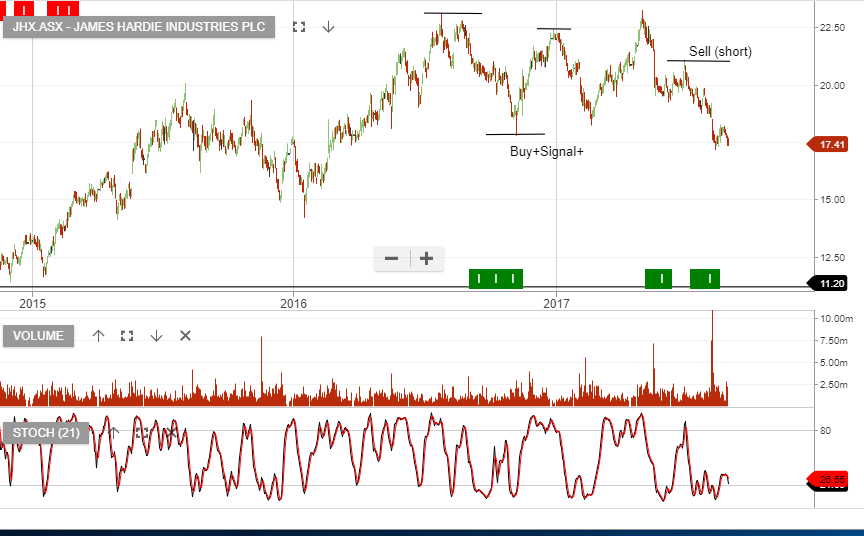

Within this mix we have seen building stocks rally hard and are now beginning to look overbought.

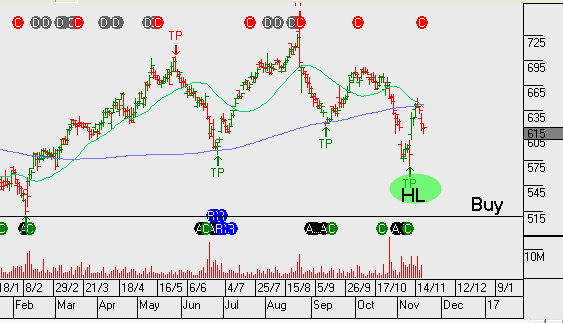

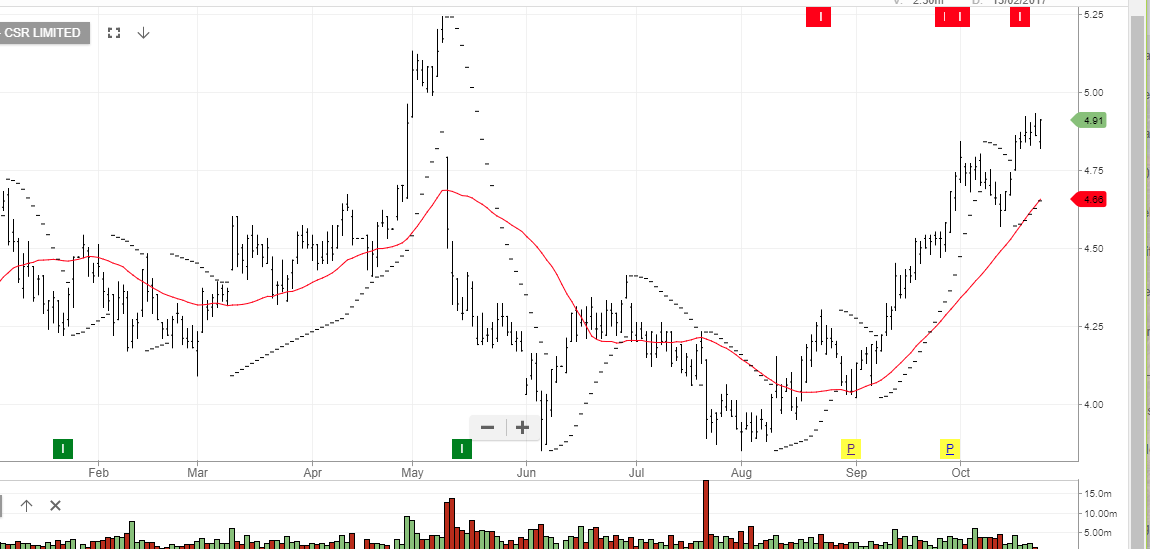

Of the three major companies, CSR, JHX and BLD, our ALGO engine has triggered a sell signal on both CSR and JHX.

The internal momentum indicators on all three of these names are in extreme valuation ranges and and near their 52-week highs.

We believe it’s reasonable to expect a pullback from current levels and look for downside targets of $17.75 in JHX, $4.30 in CSR and $6.50 in BLD.

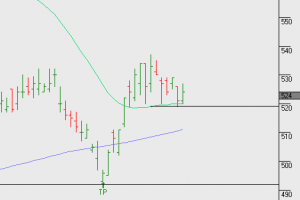

James Hardie

CSR

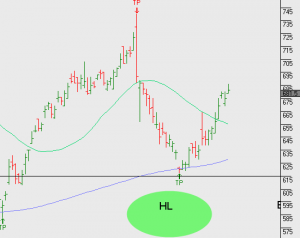

Boral