Boral – US Investor Day

Boral (BLD.ASX) remains on our preferred watch list. The recent management briefing in San Antonio, Texas reaffirms what we see as positive industry trends in construction material prices and domestic strength in infrastructure spending.

FY17 NPAT forecast profit of $295m on EPS $0.41 and DPS of $0.27 places the stock on a forward yield of 4%. Underlying growth should remain in the range of 7%+ over FY17 and FY18.

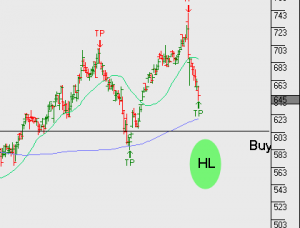

On the above basis, the recent pullback in BLD warrants the stock staying on our preferred watch list, with a potential entry point at or near the current higher low formation.