Brambles

Brambles

Brambles is now on our watchlist following the correction from $15 down to $12.85

Brambles up 25.4%

Brambles is among the best-performing stocks in our ASX top 20 model, after increasing 25.4% since being added on 3/10/22.

BXB delivered 3Q23 YTD sales growth (constant currency) of 15%.

Brambles

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Brambles – Algo Buy

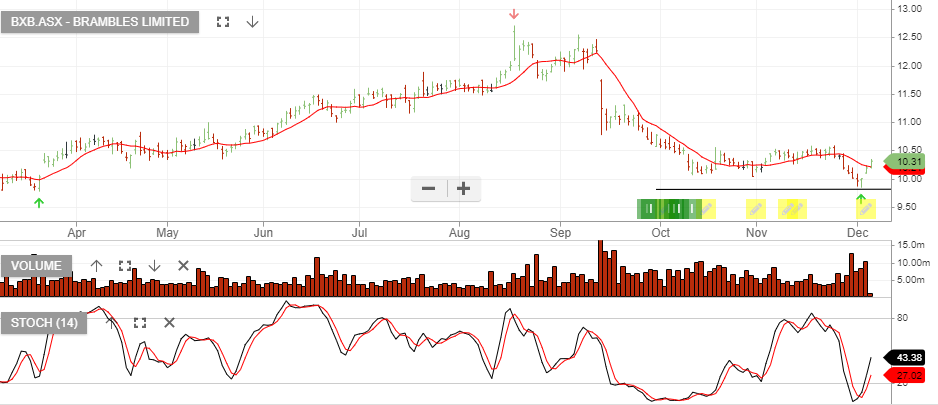

24/11 update: Brambles continues to find buying support.

14/11: BXB will likely form a higher low above the recent $10.88 pivot low. Watch the stochastic for a turn higher.

14/10 Update: BXB has built a series of higher low formations and has recently shifted to Algo Engine buy conditions.

Brambles – Algo Buy

14/11: BXB will likely form a higher low above the recent $10.88 pivot low. Watch the stochastic for a turn higher.

14/10 Update: BXB has built a series of higher low formations and has recently shifted to Algo Engine buy conditions.

Brambles – Algo Buy

14/11: BXB will likely form a higher low above the recent $10.88 pivot low. Watch the stochastic for a turn higher.

14/10 Update: BXB has built a series of higher low formations and has recently shifted to Algo Engine buy conditions.

Brambles – Algo Buy

14/11: BXB will likely form a higher low above the recent $10.88 pivot low. Watch the stochastic for a turn higher.

14/10 Update: BXB has built a series of higher low formations and has recently shifted to Algo Engine buy conditions.

Brambles – Algo Buy

14/10 Update: BXB has built a series of higher low formations and has recently shifted to Algo Engine buy conditions.

Brambles is under Algo Engine buy conditions and has now been added into our ASX model portfolio.

6/12 update: Buy BXB and hold above the recent pivot low or for short-term traders, hold whilst the price action remains above the 10-day average.

Send our ASX Research to your Inbox

Or start a free thirty day trial for our full service, which includes our ASX Research.