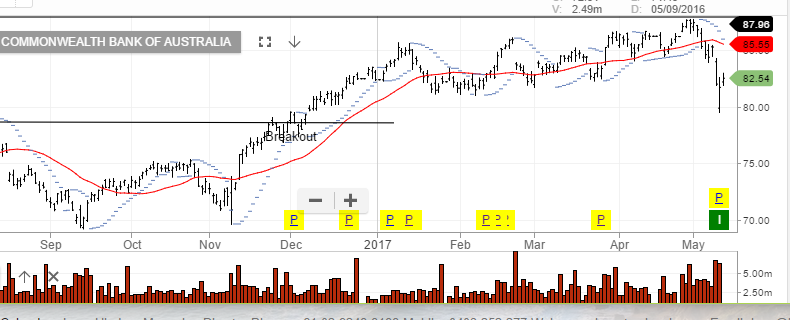

CBA Offloads Its Insurance Arm

Shares of CBA opened higher in early trade on the news that the bank has sold its troubled insurance business to the Chinese owned AIA Group for $3.8 billion.

The sale of Comminsure Life was largely considered a fire sale considering several problems involving denying payments to policyholders and pressuring medical assessors to reject client’s claims.

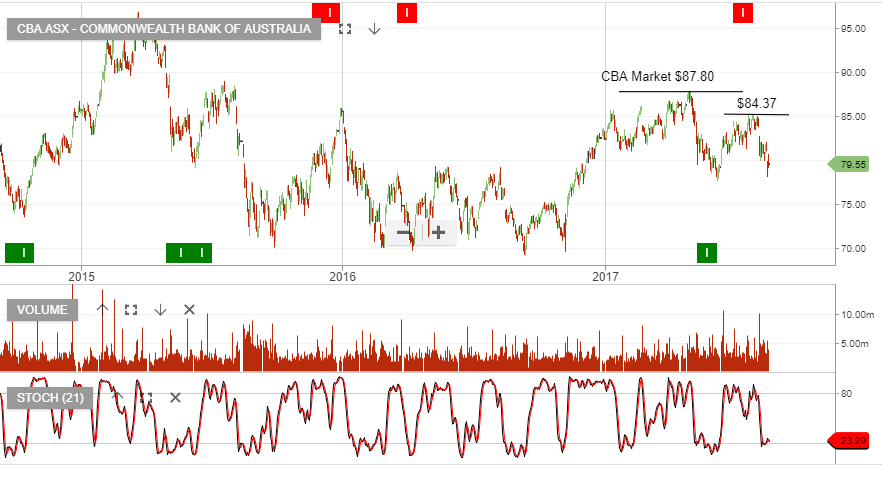

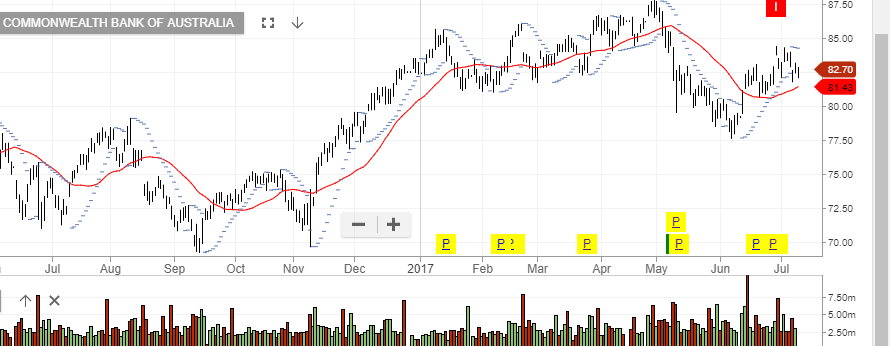

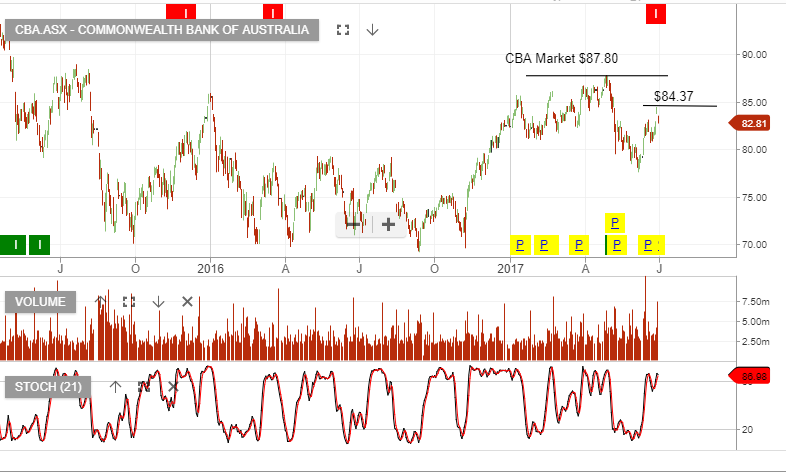

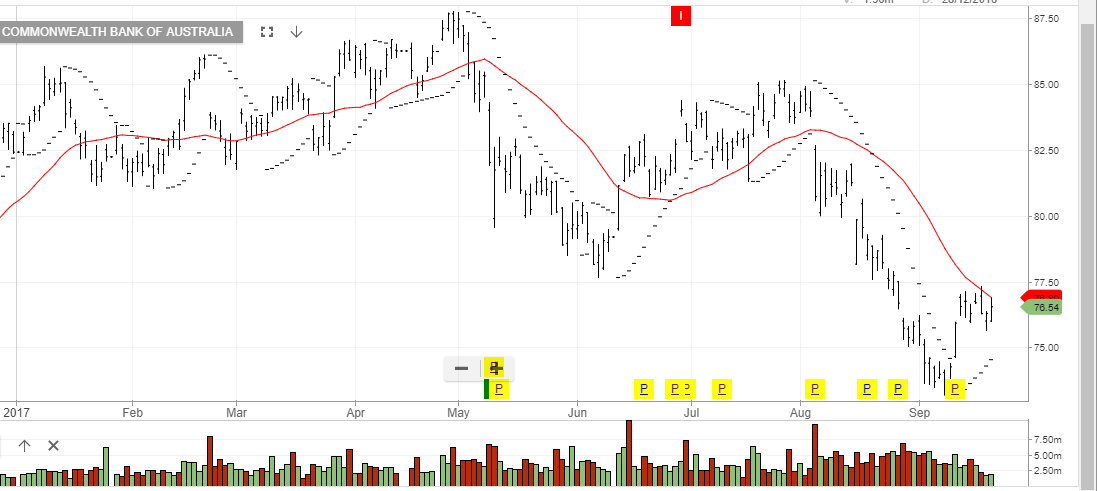

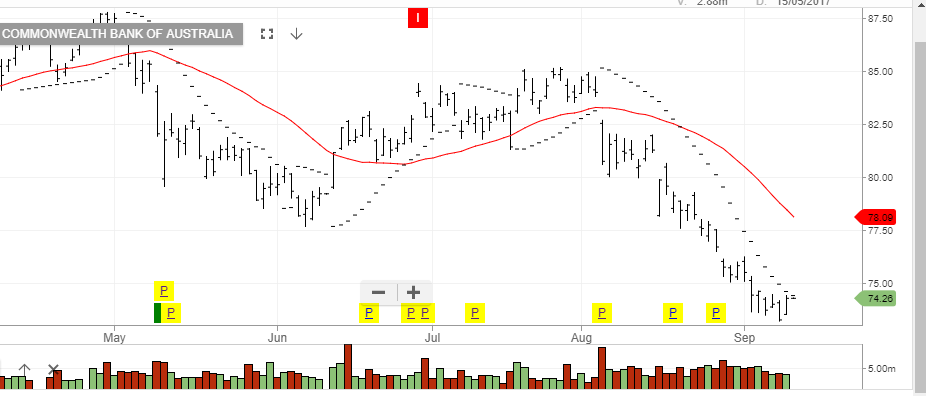

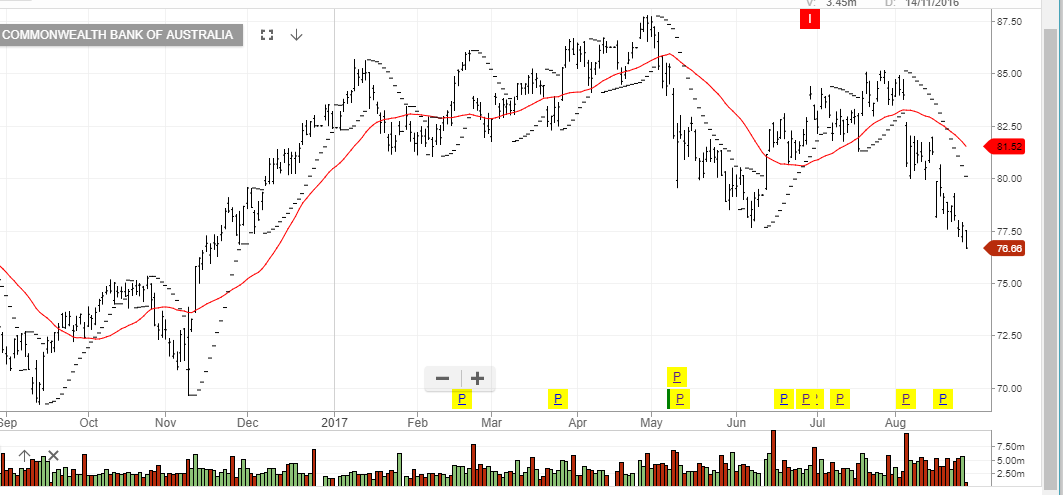

Our ALGO engine gave a sell signal in CBA on July 4th at $84.00. We consider this bounce in price as corrective and still see scope for CBA shares to return to the low $70.00 handle.

Commonwealth Bank

Commonwealth Bank

Commonwealth Bank Commonwealth Bank

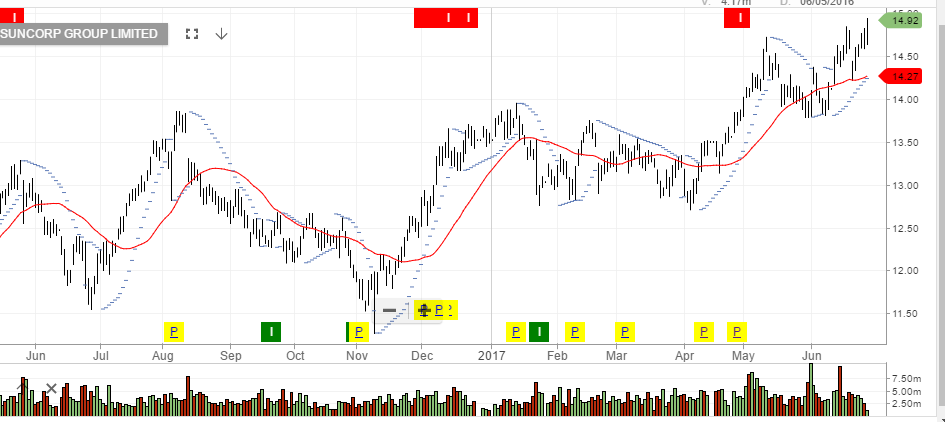

Commonwealth Bank