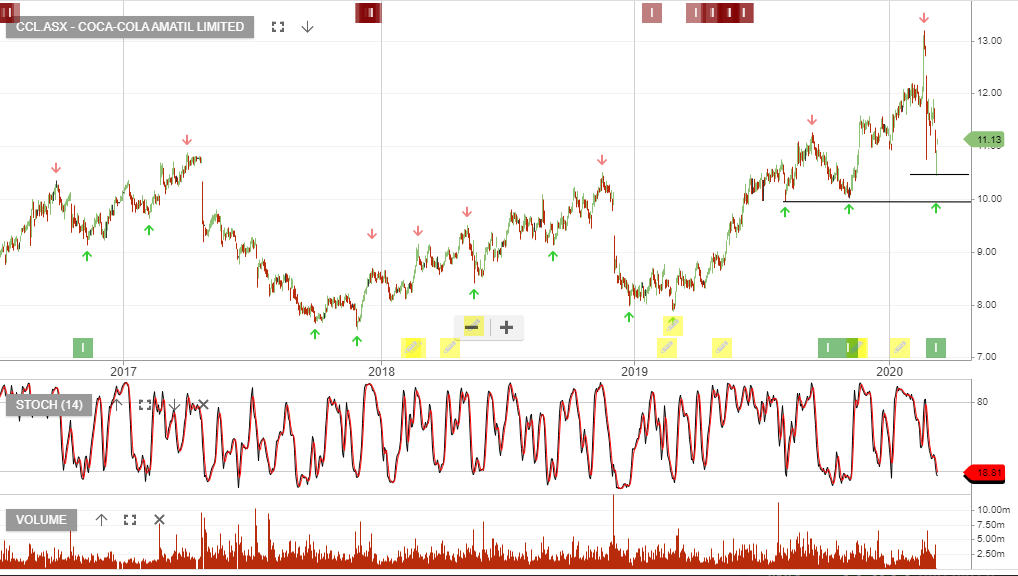

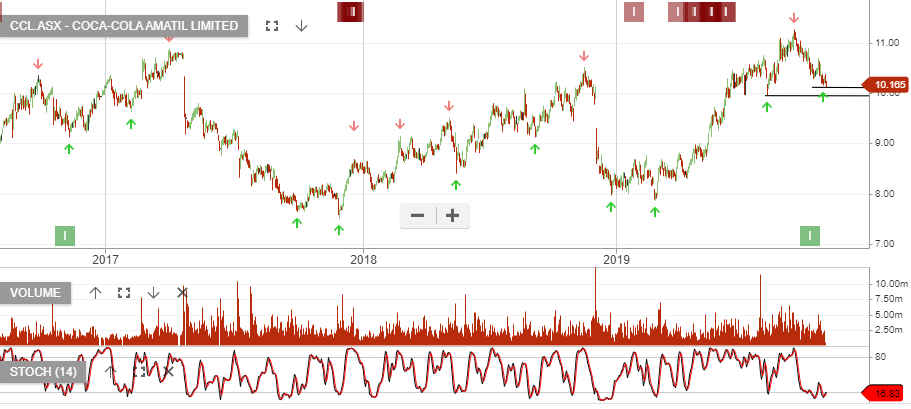

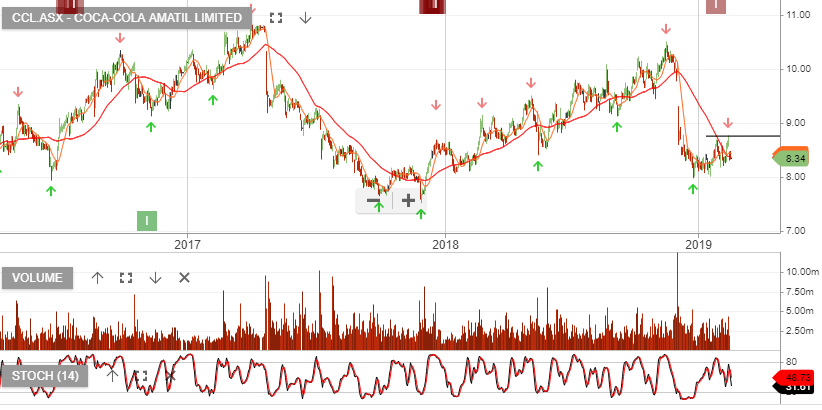

Coca-Cola Amatil is under Algo Engine sell conditions following the lower low and lower high price structure. The downtrend started back in 2013 when CCL traded as high as $15 and during investor capitulation in 2017, traded down to $7.50.

If we look at the valuation metrics on CCL and assume flat earnings per share growth over the next 12 months, we have CCL trading on a 5% dividend yield. We assume total revenue of $5bn producing EBITDA of $950mn.

The last positive volume growth period was after Coke Life was launched in 2015. Indonesian volumes appear to be rebounding with growth of 10%+ in the March quarter, compared to the same time last year.

Buying CCL and selling a covered call option is a consideration for investors looking to generate 10%+ cash flow from a low risk opportunity, on a moderate PE of 15.5x earnings.

CCL goes ex-div $0.21 on the 27th August. For more detail on the covered call strategy, please call our office on 1300 614 002.