Technical Update For CCL

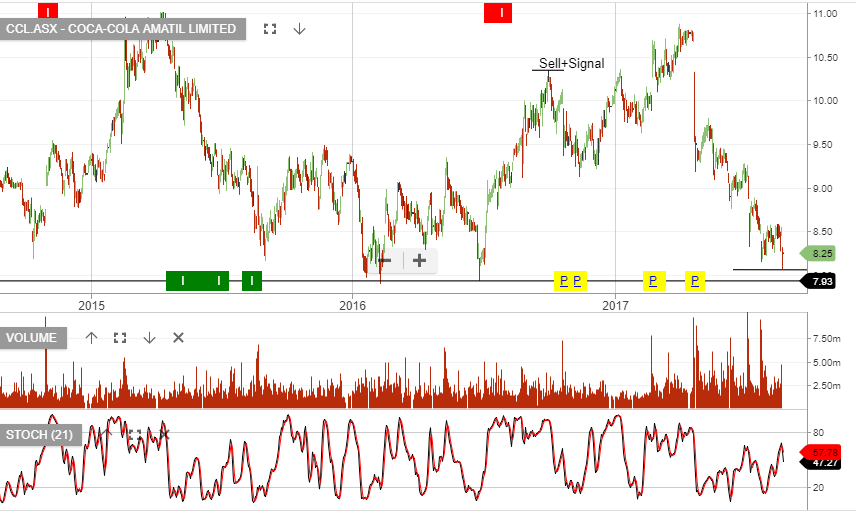

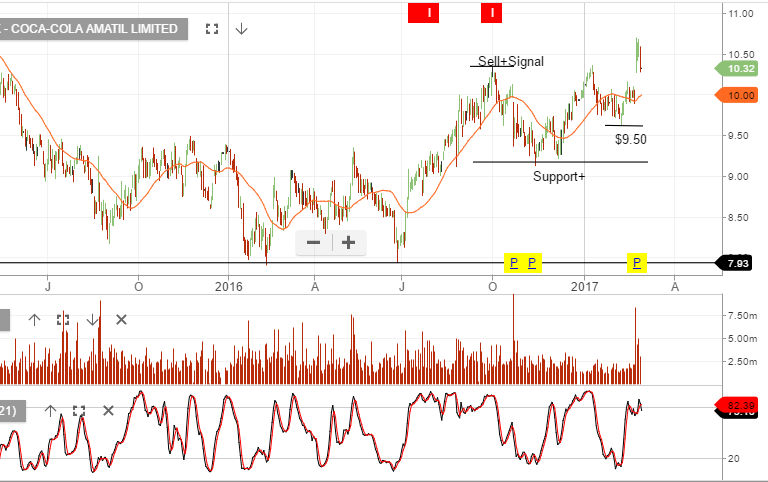

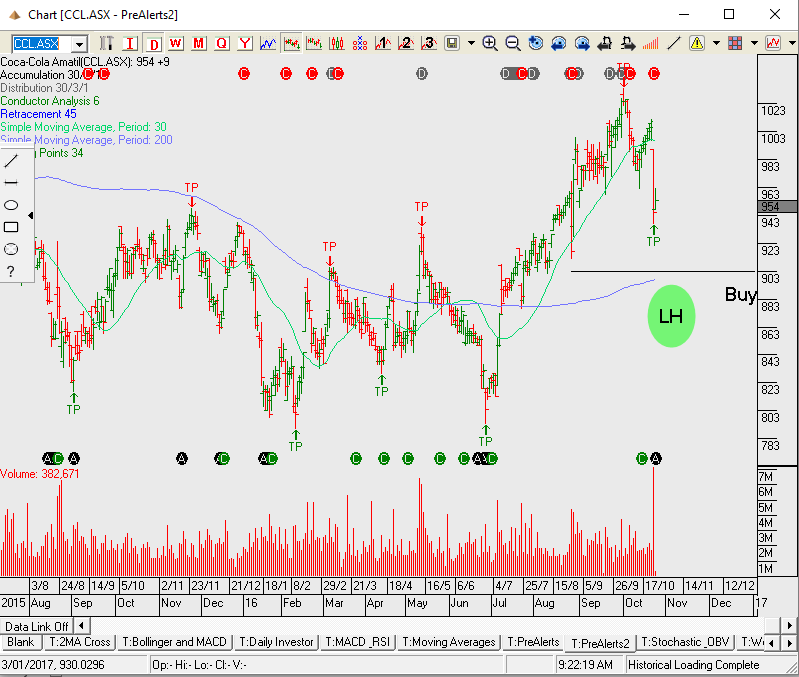

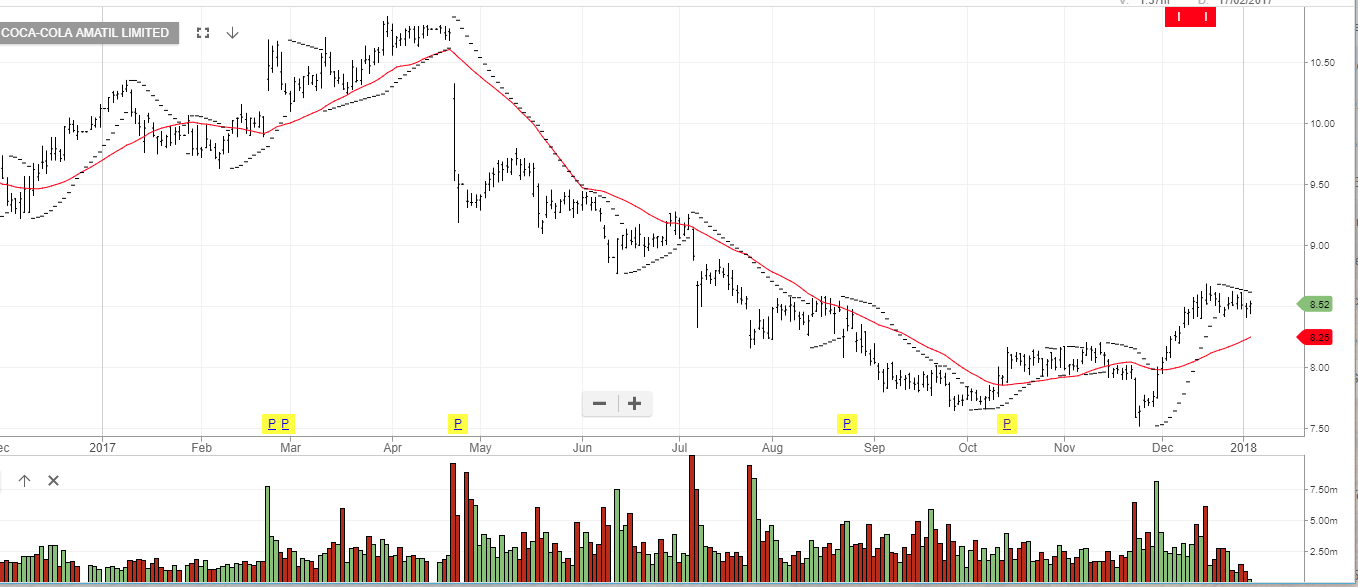

Since posting an intra-day low of $7.52 on November 24th, shares of CCL have been carving out an ascending flag formation.

This is a bullish continuation pattern and is bounded by support at $8.05 and resistance at $8.65. A break of the $8.65 level would point to a measured move targeting the June highs near $9.40.

CCL is due to report earnings next Wednesday, the 21st.

In late November, the company advised that profits for the 12 months to December were expected to be $13 million higher than the consensus of $405 million.

CCL is scheduled to pay a 25 cent dividend on February 27th. At the current price, that pencils out to an annual yield of 5.5%.

Technically, an ASX close above $8.45 would suggest range extension to the $8.65 level.

Coca Cola Amatil

Coca-Cola Amatil

Coca-Cola Amatil