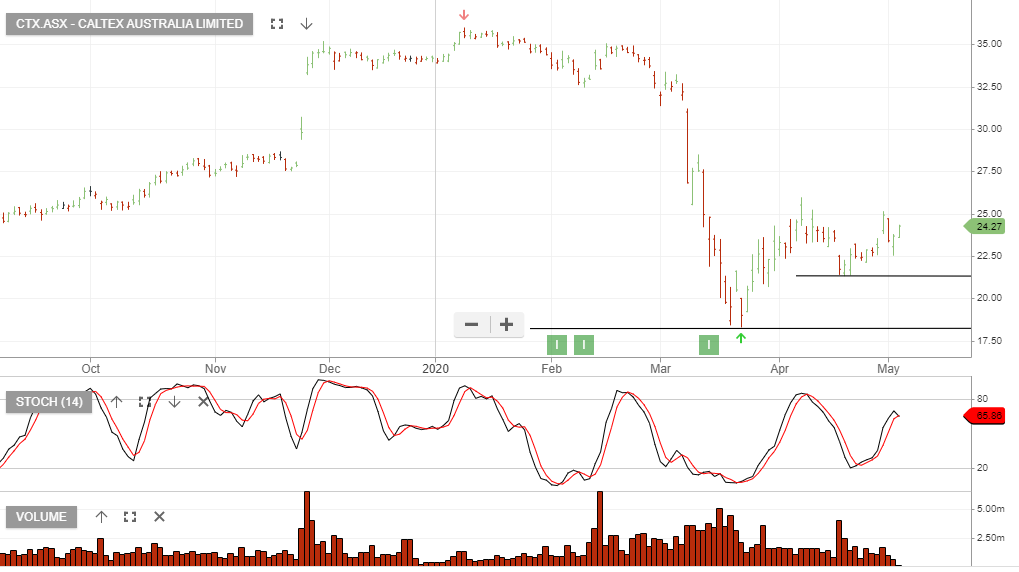

Caltex – Buy Signal

We expect investor sentiment to improve towards Caltex and consider the current price range as an opportunity to accumulate the stock.

Buy CTX at $24 and look for a move back to $26.50

We expect investor sentiment to improve towards Caltex and consider the current price range as an opportunity to accumulate the stock.

Buy CTX at $24 and look for a move back to $26.50

Caltex Australia is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

Buy CTX at $33.75 and sell the $34.50 April call for $0.55 credit.

CTX goes ex div $0.61 on the 1st March.

NOTE: Downside risks are somewhat mitigated by the fresh indicative bid of $35.25 per share.

Caltex Australia is under Algo Engine sell conditions and was removed from the model portfolio late last year at $28.50.

Fuel retail margin was A$35-45mn lower at end-February, (based on the same time last year), driven by diesel pricing and gasoline retail competition. The company will provide a Q1 trading update at its AGM on 9 May 2019.

In FY20 we assume $25.5b in revenue and 4% increase in EBIT to $1.07b which flows through to $1.25 in dividends, placing the stock on a 4.5% forward yield.

For investors who are not taking up the buy back offer, we recommend selling a covered call option to enhance the income return.

For more detail, please call our office on 1300 614 002.

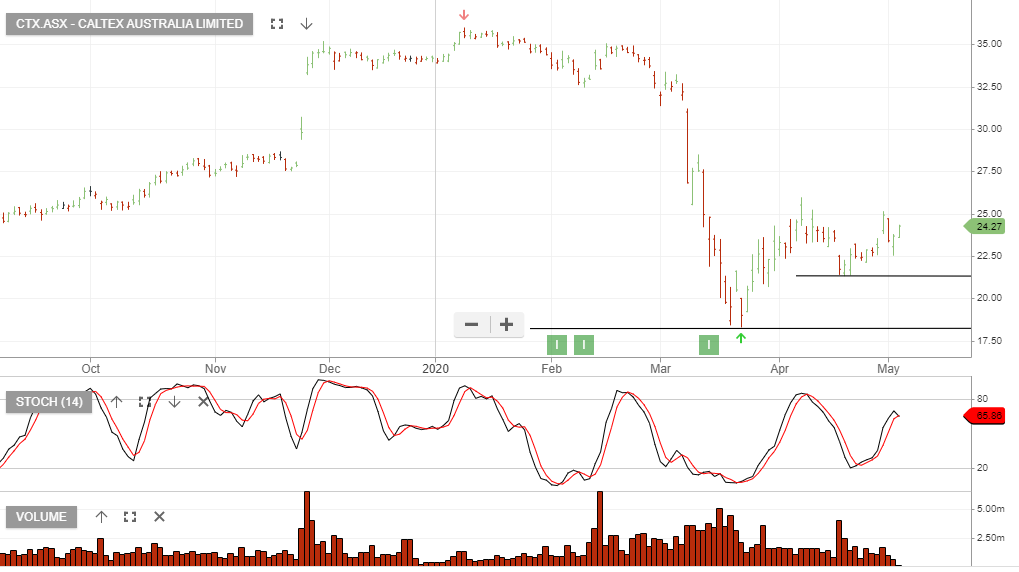

The XJO has formed a “lower high” pattern within the existing Algo Engine buy signal structure.

The market has rallied 6% from the recent buy signal but we’re now mindful of the recent break of the “higher low” structure, as circled on the chart below.

5941 is resistance for the XJO and whilst the market remains below this level, some caution is required.

Names that remain supported within today’s broad market sell off include, AGL, CTX, GPT, WES, SCG, TCL, HSO & WOW. We remain cautious on the banks and select resource names .

XJO

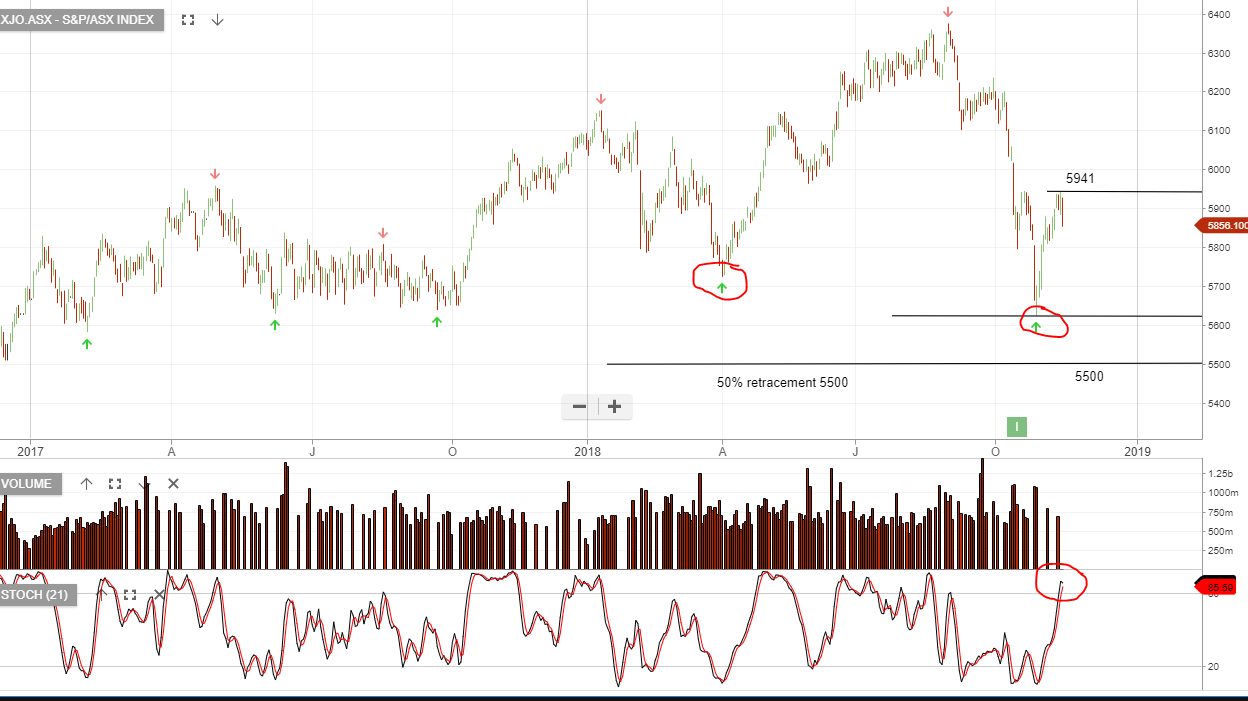

Shares of Caltex have dropped over 10% this week, posting a 3-month low of $30.10 this morning, as investors continue to sell the stock after a disappointing 1H 2018 result.

The worst part of the report was that the fuel division posted a $314 million profit, which is below the lower end of the company’s $315 to $335 million guidance.

In addition, corporate costs rose to $31 million compared to $21 million at the same time last year, which prompted a lowering of the interim dividend from 60 cents to 57 cents.

Our ALGO engine triggered a sell signal for CTX on June 26th at $32.68. We see scope for a key support area near the $29.00 area.

Caltex

Caltex

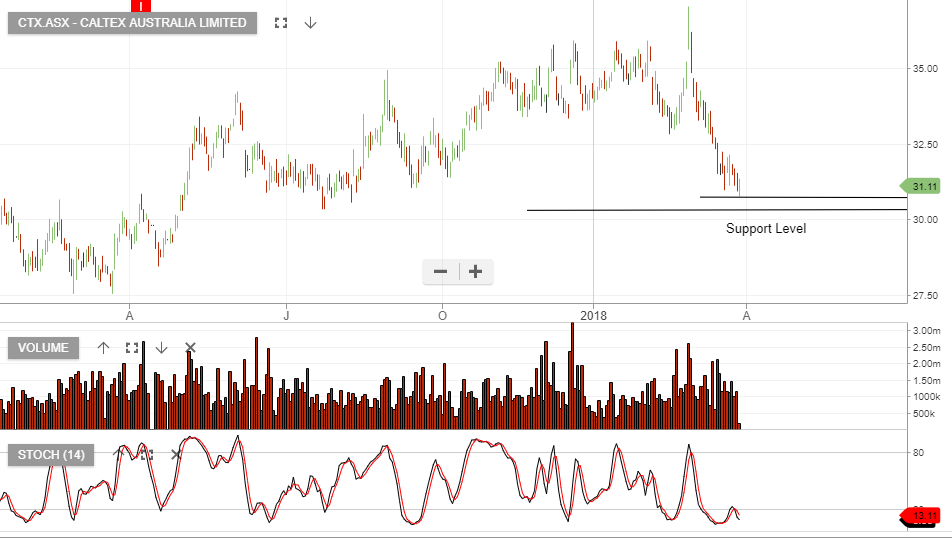

Our ALGO engine triggered a sell signal on CTX on June 21st just above $31.25.

A recent broker note has updated its rating on CTX to “outperform” and given the share price a 12-month target of $37.00.

The share price has come under pressure over the last few sessions as last week’s fuel supply extension with Woolworth’s was expected to result in an $80 million reduction in CTX’s EBIT.

We expect the share price to find support around the $30.50 area and will update on specific buy levels in a future posting.

Caltex

Our ALGO engine triggered a sell signal on CTX into yesterday’s ASX close at $31.15. The “lower high” structure is referenced to the high of $32.02 posted on April 20th.

Since announcing stronger profit guidance numbers on June 12th, shares of CTX have risen over 8%.

Internal momentum indicators are now approaching the overbought area near $32.00 and a near-term correction lower looks to be the most likely direction.

We see strong resistance in the $32.25 area and initial support at $30.40.

CalTex

Shares of Caltex have surged by over 3% in early trade as the company expects to book higher first half profits even with lower retail fuel margins.

This looks to be a positive result of the “shrink to grow” strategy put into place late last year and has lifted the return on assets to just under 14% at 7X EBITDA.

We don’t have a current ALGO signal on CTX, but we suggest keeping the stock on the radar for a signal soon.

The internal momentum indicators are pointing to the next area of resistance near $31.20, with support in the $29.80 area.

Caltex

We consider Caltex a buy at $31 and recommend selling covered call options to enhance the income.

Caltex goes ex-div $0.60 on the 11th of September.

Caltex has sold off $6.00 in the past 4 weeks. With the stock now trading 13x earnings and 4% dividend yield, we expect to see buying interest starting to build.

There is no current Algo Engine buy signal, therefore investors will be well advised to manage the trade by scaling into the purchase.

CTX

Or start a free thirty day trial for our full service, which includes our ASX Research.