Drop In Crude Oil Puts CTX back In The Buy Zone

WTI Crude Oil prices posted their largest one-day loss in six weeks, as the US Energy Information Administration reported a smaller than expected draw down on crude supplies.

The Spot crude price fell $1.97, or 3.8% to settle at a 4-week low of $52.90. The next level of support will be found at $52.50.

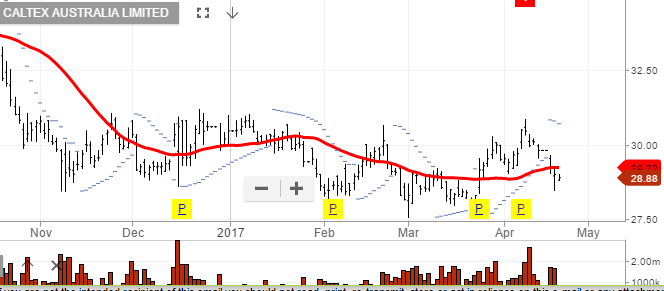

We expect the overnight fall to put shares of Caltex (CTX) back into the buy zone around the $28.80 level.

Regular readers will recall that we sold our long positions in CTX early last week in the $30.50 area.

The Daily chart pattern is showing a trading range of $28.30 to $30.50, we are looking to trade this range over the near-term.

Chart Caltex