CYB – Long-term Value

Clydesdale & Yorkshire Bank, the UK spin-off from NAB, recently acquired Virgin Money. Their trading update for the December quarter was released overnight and there are some encouraging signs on increased cost synergy savings and improved margins in their loan books.

We see long-term value in CYB, despite the short-term volatility around the Virgin Money integration and Brexit impact.

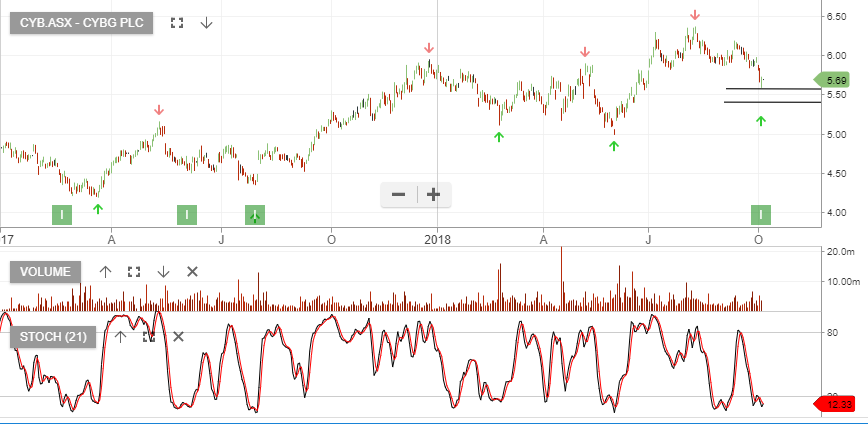

CYB

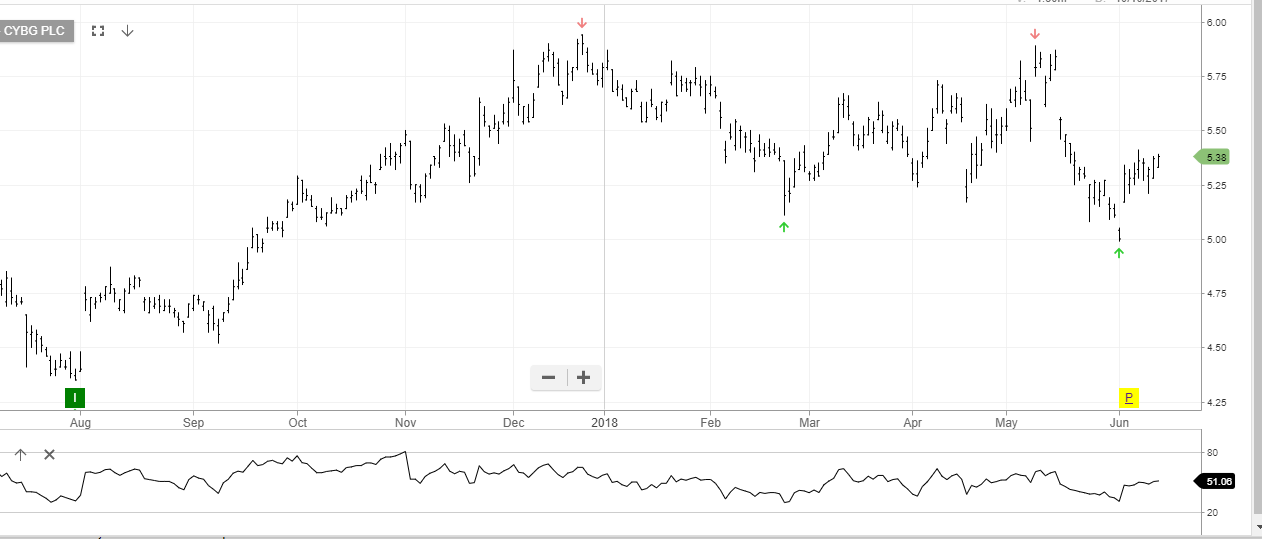

CYB