Flight Center: +6%

Flight Centre Travel Group is up 6% after being added on the 28/8.

Flight Centre Travel Group is up 6% after being added on the 28/8.

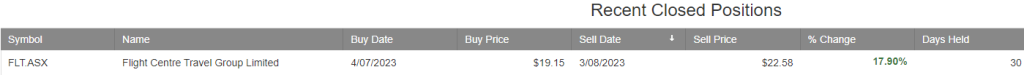

Flight Centre Travel Group was added to the ASX Trade Table at $19.15 and was closed yesterday for a 17.9% gain, after a 30-day holding period.

The ASX200 Trade Table shows a total YTD return of 31.6%. To access and review the new Trade Table technology in real-time, create a free trial now.

Flight Centre Travel Group is under Algo Engine buy conditions and is a current holding in the ASX 100 model.

It is, however, in negative returns. We hold 38 stocks in the ASX100 model, with only two names showing negative returns. AGL down 1.15% and FLT down 17%. Otherwise, all holdings are performing positively.

So, can FLT recover from here? Flight Centre is on track to deliver within the FY19 guidance range of $335-360mn in earnings before tax. This places the stock on 18x earnings and 3.8% yield.

We see technical support at sub $40 and are sellers into the high $40 price range.

Flight Centre Travel Group downgraded FY19 underlying earnings by 15% to $345m due to softer trading conditions in the Australian leisure market. The company also cited higher operating costs across the business.

Based on the downgrade we now have the stock trading 19x FY20 earnings and 3.5% yield.

Buying interest in FLT is likely to increase near $35 – $36 range.

Flight Centre Travel Group is under Algo Engine buy conditions and is a current holding in the ASX 100 model portfolio.

After going ex-div on the 21st March for $0.60 and paying a special div of $1.49, FLT now looks to be finding buying support at $40.00.

Flight Centre Travel Group delivered 1H19 PBT of $140 million, at the low end of the 1H19 guidance range.

A positive of yesterday’s result was the announcement of a $150m capital return , declared through a $1.49 special dividend.

We see support for FLT at $42.50 and we’re inclined to take profit at $48.

Since posting an all-time high of $70.50 on August 20th, shares of FLT have dropped over 30% to the current level of $47.00 in early trade today.

Much of the negative sentiment has been focused on the potential loss of market share from other online booking agencies.

However, recent data shows that the investment that FLT made in its in-house online service is starting to pay dividends.

Over the last several months, online flight and hotel bookings have risen to over 20% from just over 5% earlier in the year.

At current levels, FLT is trading at 16X earnings and a 3.7% yield.

Technically, the stock is forming a “rounded bottom” pattern relative to the November 2nd low at $44.20.

We see the first level of resistance at $52.50 with a longer-term target near $57.15.  Flight Centre

Flight Centre

Flight Center is under ALGO Engine buy signal and with the share price retracing from $70 back down to $45.50, we now believe buying demand will increase.

Flight Centre

At Flight Centre’s AGM yesterday, management provided a weaker than expected trading update.

The update suggested trading conditions were softer than expected driven by weak Australian leisure business.

FY19 underlying profit before tax was guided to be within $390-420m which equates to around 5%.

Whilst the update was below consensus, we believe the stock is close to support and will find buying interest near the current $48 – $49 level.

Flight Centre

After getting some bad press about excessive pricing, shares of Flight Centre have slid over 25% lower during the last 6 weeks and reached an 8-month low of $50.25 last Thursday.

Our ALGO engine triggered a buy signal last week and the internal momentum indicators are reflecting an oversold reading.

At the current price, FLT shares are trading at just under 16X forward earnings and the company has announced they will retain their $3.20 FY2019 annual dividend.

As such, we see good investor value in the stock with an initial upside target of $65.15.

Flight Centre

Or start a free thirty day trial for our full service, which includes our ASX Research.