Algo Short Signal – Flight Centre

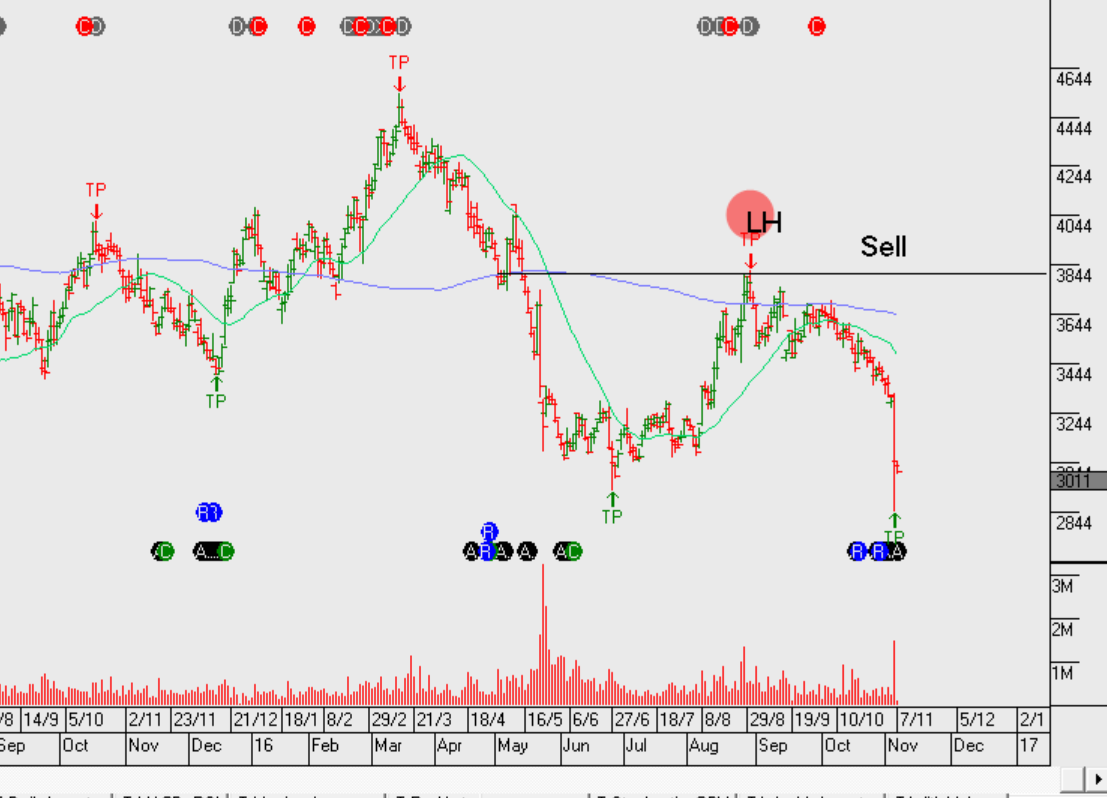

Our Algo Engine is flagging the lower high structure in FLT.

Our Algo Engine is flagging the lower high structure in FLT.

The ALGO engine triggered a sell signal for Flight Centre (FLT) yesterday at $30.95.

After posting a high of $31.20 on February 15th, FLT fell to $28.00 over the following two weeks. We see the possibility of a similar price pattern emerging.

The ALGO engine has done a good job of picking the ranges on FLT.

As such, we will wait until the short-term momentum indicators confirm the direction before taking action on the trade.

Flight Centre

We’ve been on the short side of Flight Centre for most of 2016.

The share price rebounded from their early November low of $29.50 to close last week at just under $33.00. However, structural headwinds, recent earnings shortfalls, and overly optimistic guidance suggest clear skies are not ahead for the firm.

On November 4th, Flight Centre indicated that 1H 2017 profits before tax (PBT) would decline 18 to 28%. The company maintained an FY17 earnings guidance of $320m – $350m. We believe this is overly optimistic and unlikely to be achieved given international flight price deflation.

Gradual ongoing selling pressure in FLT could see a low around $28 in early to mid 2017.

On the 7th of September in the weekly video market review we looked at 4 short signals, CPU, QAN, ORI and FLT.

All four short trades have performed very well, although a question mark remains over ORI following the markets positive response to Friday’s earnings update.

Flight Centre has now sold off over 20% from our algorithm short signal, which was triggered in late August. The rapid sell-off last week in FLT was caused by the company downgrading their earnings guidance. We take this as an opportunity to cover the short position.

Or start a free thirty day trial for our full service, which includes our ASX Research.