GrainCorp Limited – MaltCo divestment

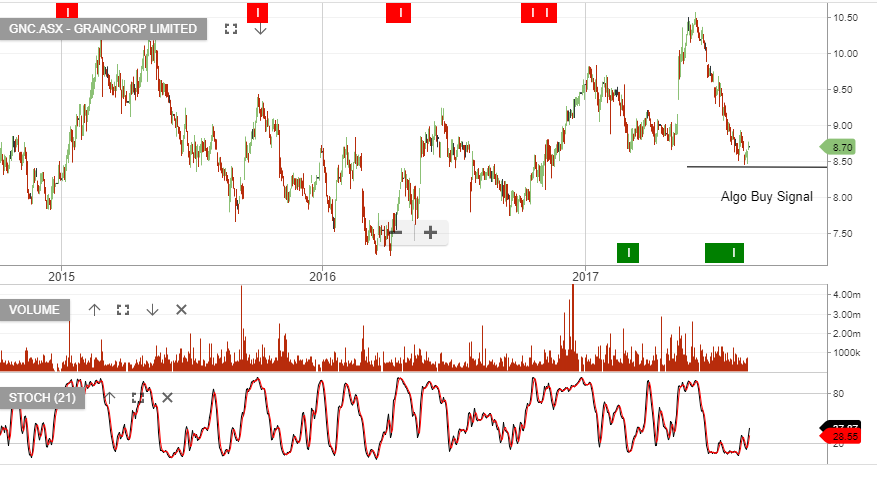

GrainCorp is a current holding in our ASX100 model portfolio.

We continue to follow the developments regarding the demerger or divestment of the MaltCo entity from the main Graincorp listed business. Either outcome is likely to unlock value for Graincorp shareholders.

GrainCorp’s proposed MaltCo would be the world’s fourth-largest independent maltster with assets in Australia, the United States, Canada and Britain. It made $170 million EBITDA in the 2018 financial year.

We see upside potential for the GNC share price supported by a share buy-back or capital return in early 2020.