GPT

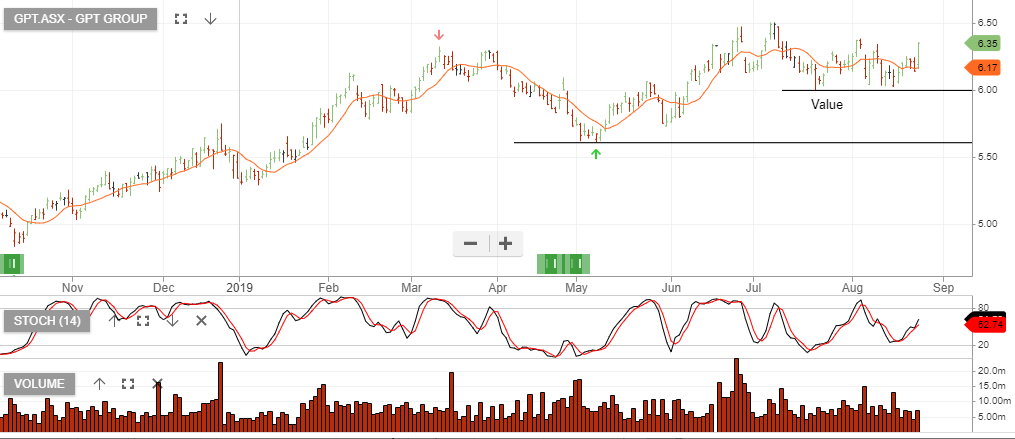

GPT is under Algo Engine buy conditions.

GPT – Algo Buy

GPT is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

GPT – Algo Buy

GPT has switched to Algo Engine buy conditions and has now been added to our ASX 100 model portfolio.

GPT – FY19 Earnings

GPT has increased earnings by 2.6% growth, which is in line with the recently lowered guidance.

The FY20 outlook is for similar underlying growth of around 2%.

Office and logistics are clearly the stand-out performers, whilst retail exposure remains a potential drag.

With GPT trading on a 4.5% yield and low levels of growth over the next 1 to 3 years, we consider the stock full value.

GPT – Algo Buy Signal

GPT is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

We see value in buying GPT at $5.75 and waiting for a rally back to $6.00 before selling out-of-the-money call options.

For more information on the derivative strategy, please call our office on 1300 614 002.

GPT – High Conviction Buy

GPT remains a high conviction buy. The share price has rallied 5% over the past week and we now recommend selling covered call options to enhance the income return.

GPT goes ex div $0.13 on the 28th of December.

GPT Strategy – Generates 10% cash flow

GPT reported 1H19 earnings which showed growth at 2% based on the same time last year.

Full-year guidance remains at +2.5% and DPS growth of +4.0%.

We consider GPT an attractive buy-write strategy where a combination of the dividend and the call option premium is generating 10% cash flow.

For more detail on the buy-write, please call our office on 1300 614 002.

GPT – High Conviction “BUY”

GPT is a high conviction buy opportunity which we’ve been highlighting on the blog.

Buying support has been steadily building from the recent $6.10 low and we’re now seeing the short-term indicators trending higher.

GPT Group – Buy & Add Call Options

GPT is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio. The share price is up 30% since being added back in October 2018.

The recent price retracement from $6.50 to $6.10 is temporary weakness following the rights issue this month. We suggest investors take advantage of the pullback in the share price and begin accumulating.

GPT goes ex-div $0.1285 on the 28th December 2019.

Send our ASX Research to your Inbox

Or start a free thirty day trial for our full service, which includes our ASX Research.