Asia 50 & China Large-Cap ETFs

We recommend investors add the IAA, (Asia top 50 ETF), and IZZ, (China Large-Cap ETF) to their portfolios.

We’re now looking at oversold levels on both of these ETF’s and value is beginning to emerge.

We recommend investors add the IAA, (Asia top 50 ETF), and IZZ, (China Large-Cap ETF) to their portfolios.

We’re now looking at oversold levels on both of these ETF’s and value is beginning to emerge.

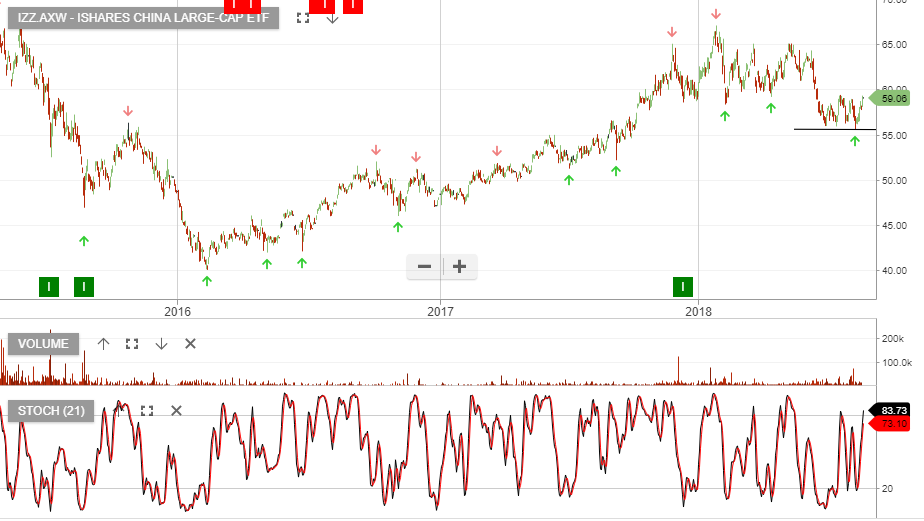

The IZZ iShares ETF provides broad exposure to China Large-Cap stocks.

Recent price action has found medium-term support at $55 and stop losses should be consider on a break back below this level.

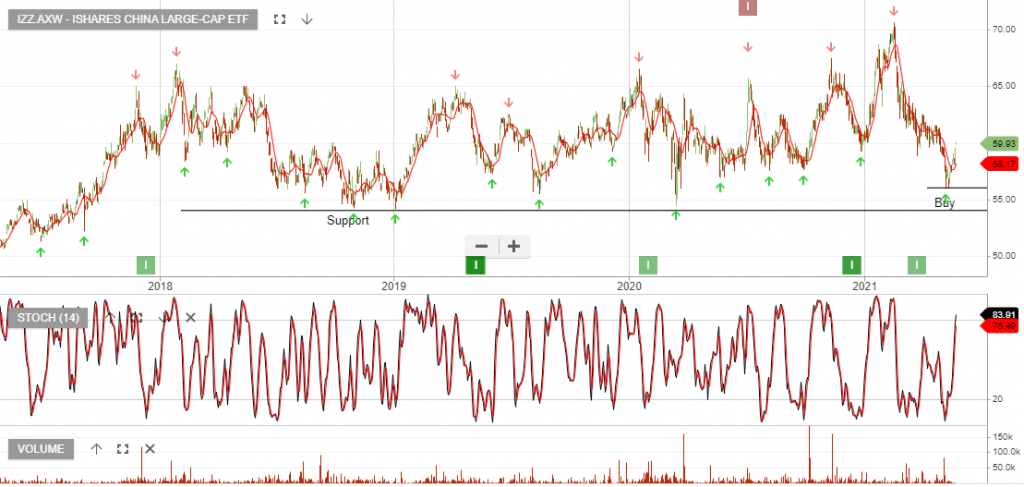

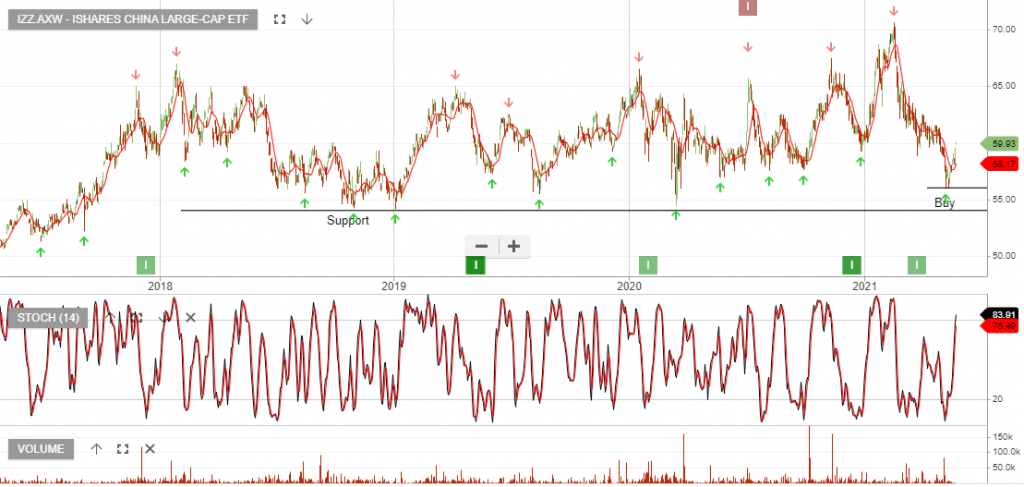

IZZ China ETF

We recommend investors add the IAA, (Asia top 50 ETF), and IZZ, (China Large-Cap ETF) to their watch lists.

There is a high probability that we’re now looking at oversold levels on both of these ETF’s and value is beginning to emerge.

IZZ China ETF

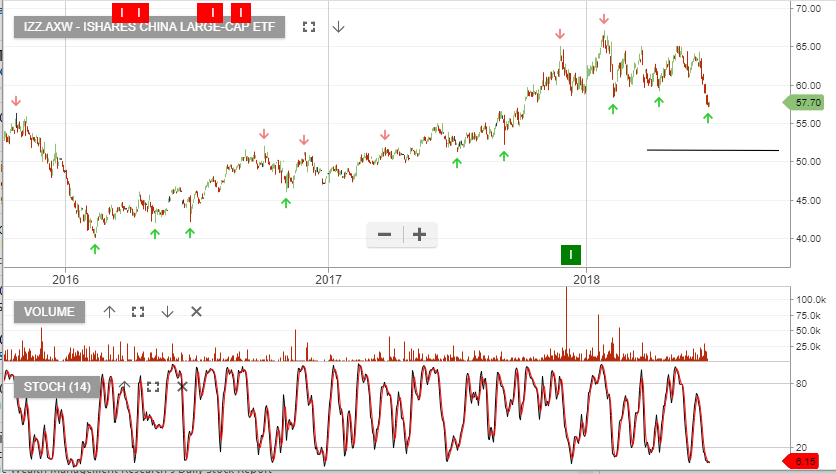

We’ve taken a contrarian view on the China stock market sell-off and started buying the IZZ China ETF a few weeks back.

Upside target is now in the $62 – $64 range

IZZ China ETF

During times of conflict, there’s a saying in the market: “you should buy when the cannons are firing and sell when the champagne corks are popping”.

More specifically, the current trade war between the US and China is likely to be resolved and the 20% correction in Chinese equity indexes may be looking overdone.

The IZZ iShares ETF provides exposure to large cap Chinese stocks. We see a buy side opportunity at $57.00

In the second half of 2018, value in oversold Asian markets will likely produce a good long-term entry level.

Our preferred ETFs are the IZZ China Large-Cap and the IAA, iShares Asia top 50.

Chinese indices are now down between 10 – 20% this year.

iShares Asia 50

We highlight the higher low structure in IZZ – iShares China Large-Cap ETF.

Our Algo Engine has flagged the higher low formation in the iShares ETF, IZZ China Large Cap.

IZZ has retraced from $65 last month to a low of $58.61 in Thursday’s session. Following stronger data out of China on Friday, the ETF had a strong close to the week.

Consider buying with a stop-loss below $57.40

Or start a free thirty day trial for our full service, which includes our ASX Research.