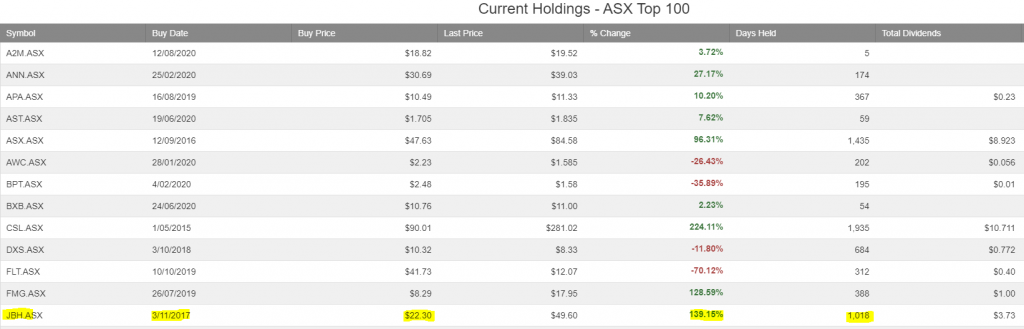

JB Hi-Fi: 1H22 Earnings

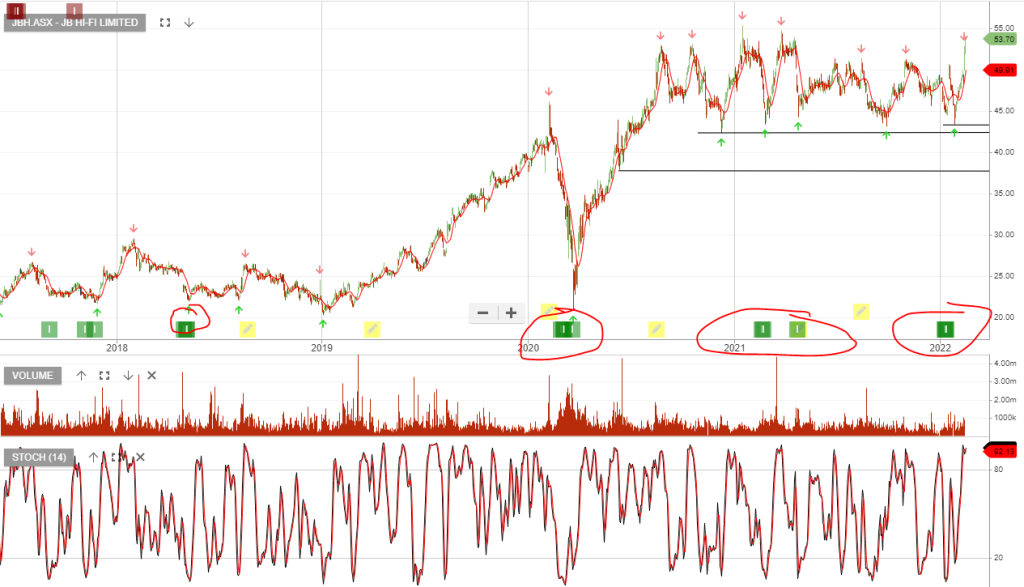

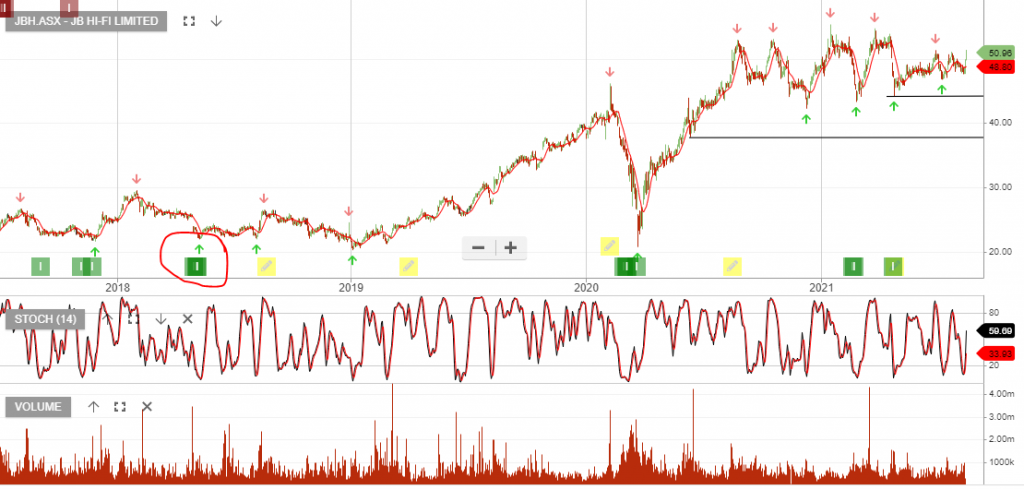

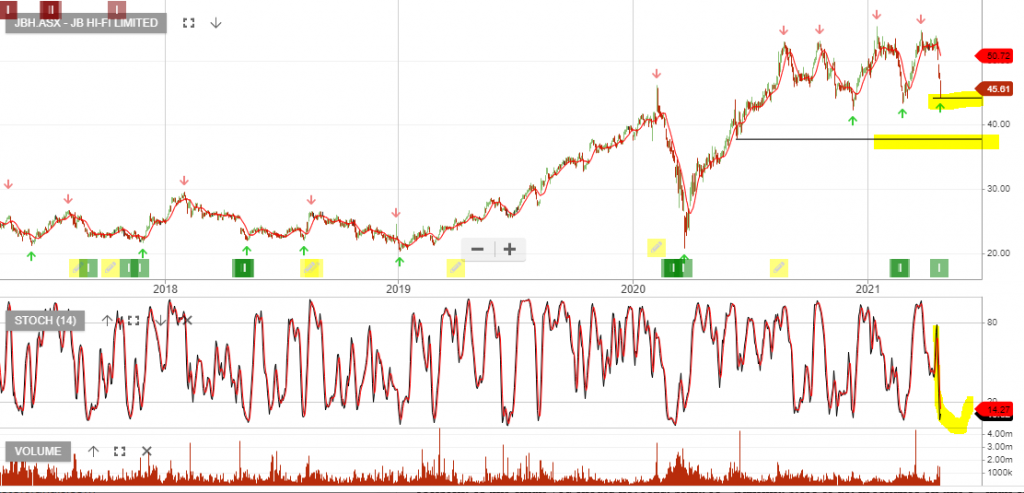

JB Hi-Fi is under Algo Engine buy conditions.

1H22 total sales fell 1.9% to $3.29bn but have increased 20% over a two-year period and net profit for the six months fell 9.4% to $288m.

JB Hi-Fi said it will return up to $250m of capital to shareholders via an off-market buyback,