James Hardie

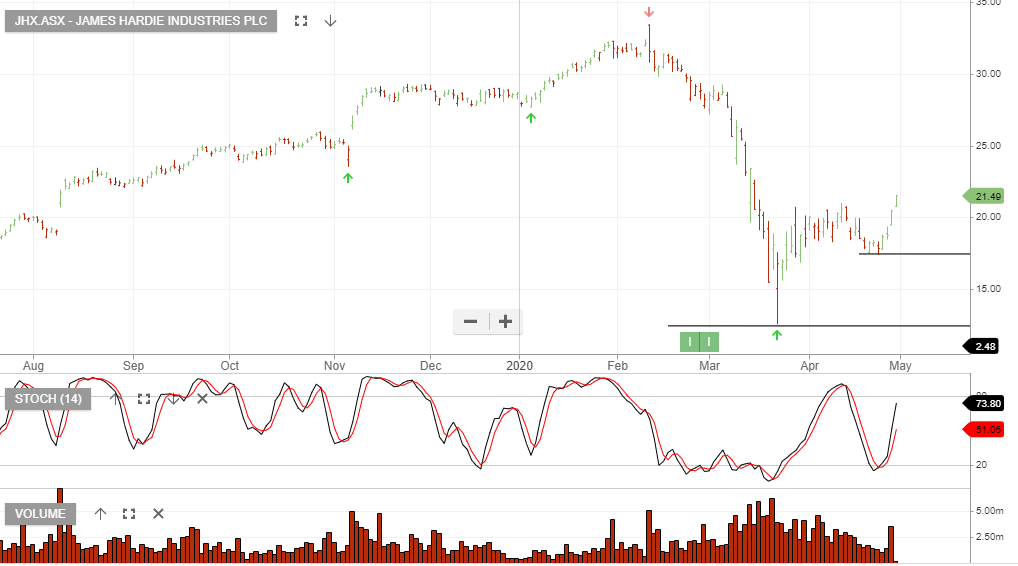

James Hardie Industries is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

JHX will report FY20 earnings tomorrow and previous guidance of $350m to $355m was provided on the 5th May.

The weak demand environment ahead for new residential construction will likely weigh on earnings. The fall in the share price from $33 to $21 allows for these headwinds and a discounted valuation argument builds for both JHX and BLD.

Note: James Hardie has suspended the payment of dividends.