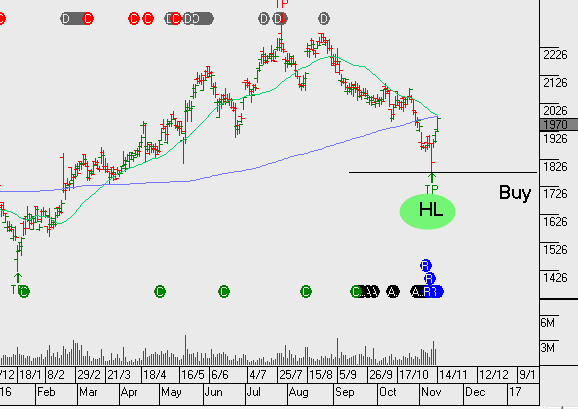

Computershare – Earnings Result 16th Aug

Computershare reports earnings on the 16th August.

At 20x forward earnings and 2.6% dividend yield, we feel CPU will likely disappoint and deliver earnings below market expectations.

Any bounce in CPU from these levels will provide an opportunity to consider building new short exposure.

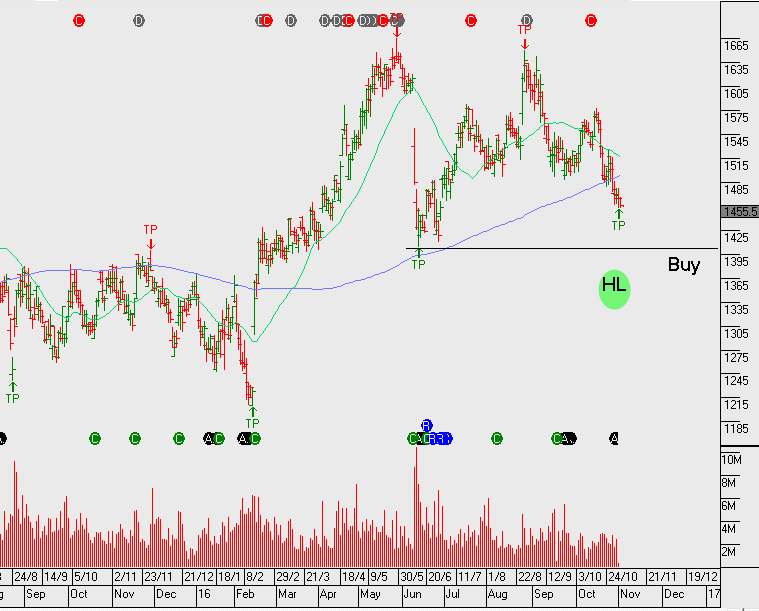

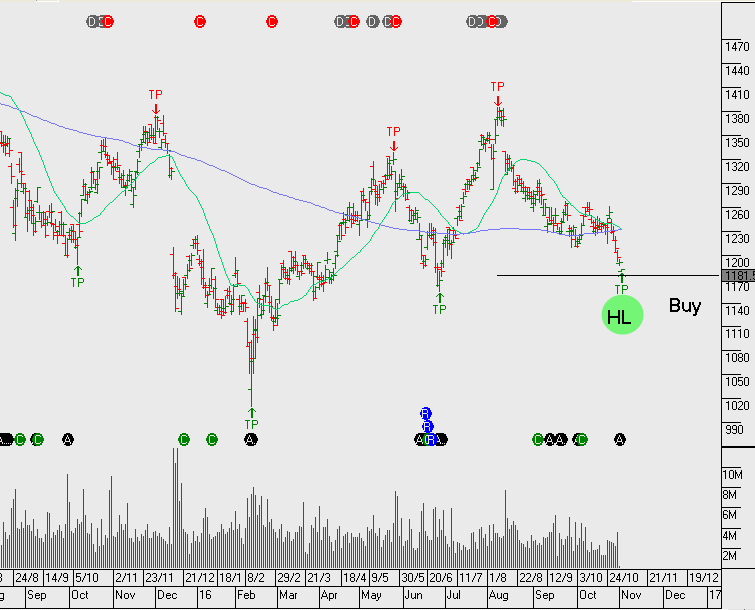

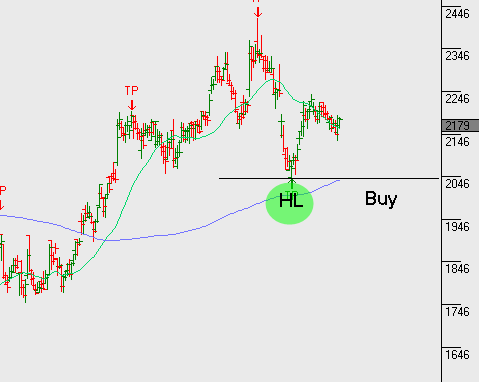

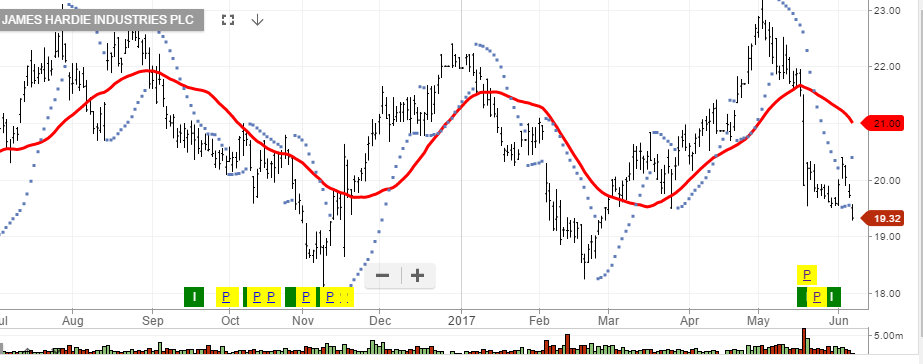

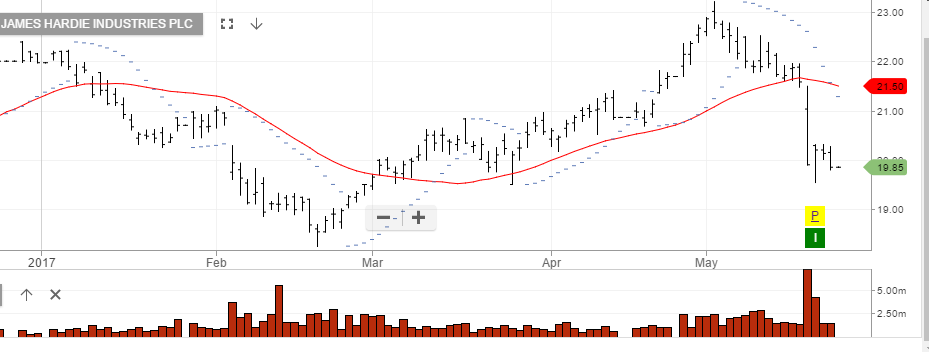

James Hardie trades at 26x forward earnings with a 2.7% forward yield.

Again, we consider this name expensive and likely to disappoint investors when JHX report earnings on the 8th August.

A rally back towards $21.00 will provide an opportunity to reset short exposure.

James Hardie

James Hardie James Hardie

James Hardie