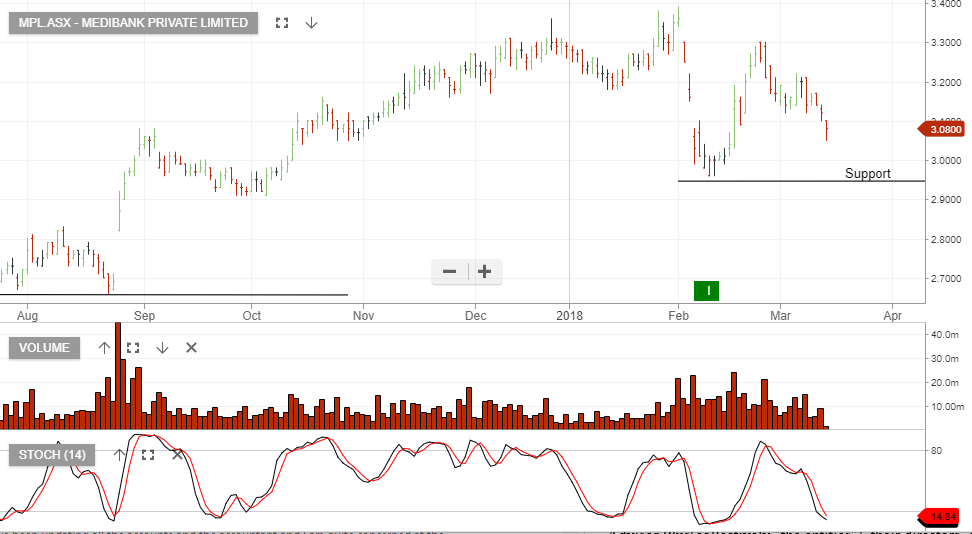

Buy Medibank Private – Support $2.80

We suggest accumulating Medibank near the $2.85 support level.

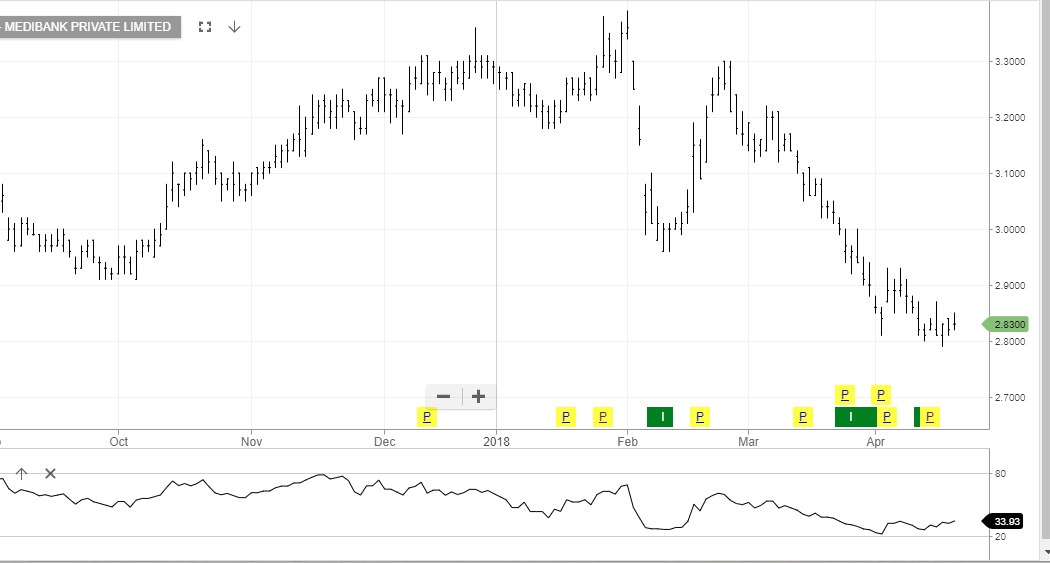

Medibank is a current holding in the ASX 50 model portfolio from may 30th at $2.73.

Following the correction from the January high of $3.30, the stock now trades on a forward yield of 4.5%.

We expect a rally from the current $2.85 level back towards $3.00. We will then add a covered call option, which will help further enhance the annualised cash flow.

Medibank Private

Medi-Bank Private

Medi-Bank Private