Westpac – Sell

Westpac Banking is under Algo Engine sell conditions and we expect selling pressure to build with overhead resistance at $26.90

Westpac Banking is under Algo Engine sell conditions and we expect selling pressure to build with overhead resistance at $26.90

National Australia Bank is under Algo Engine sell conditions and we expect selling pressure to build with overhead resistance at $27.50

National Australia Bank is under Algo Engine sell conditions.

Revenue was down 3% and cash NPAT $1.65bn was ahead of market expectations given lower credit impairment charges.

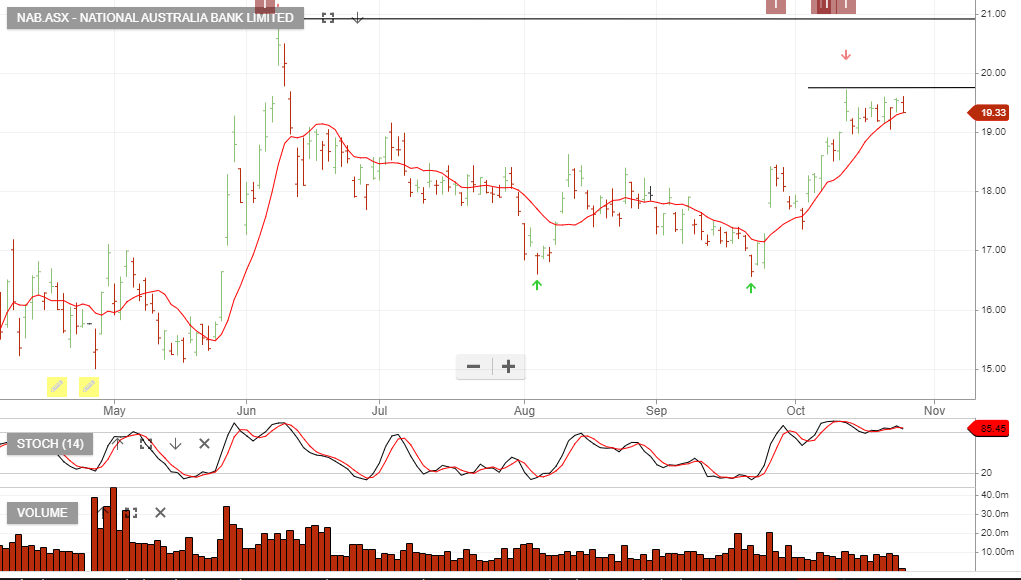

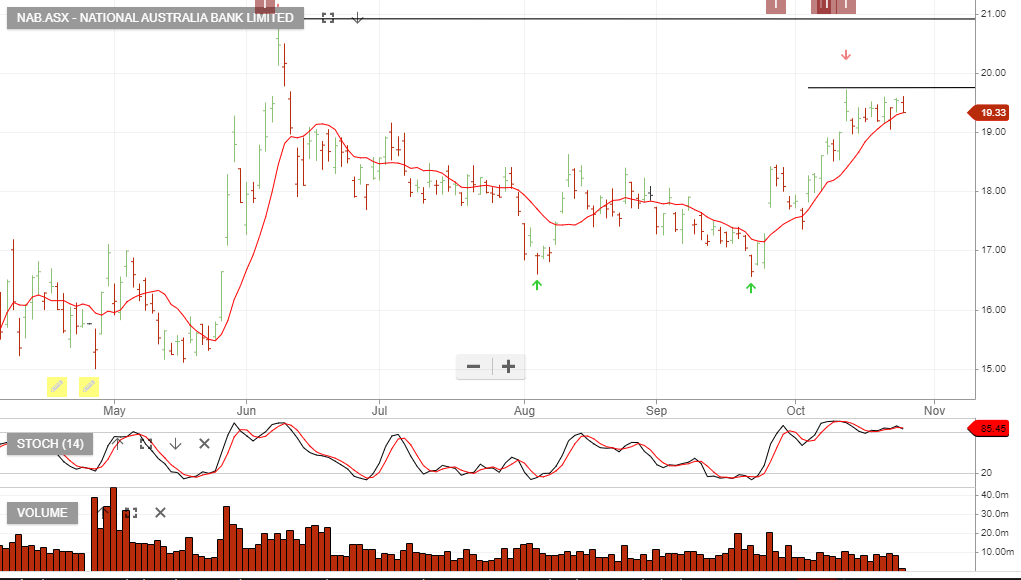

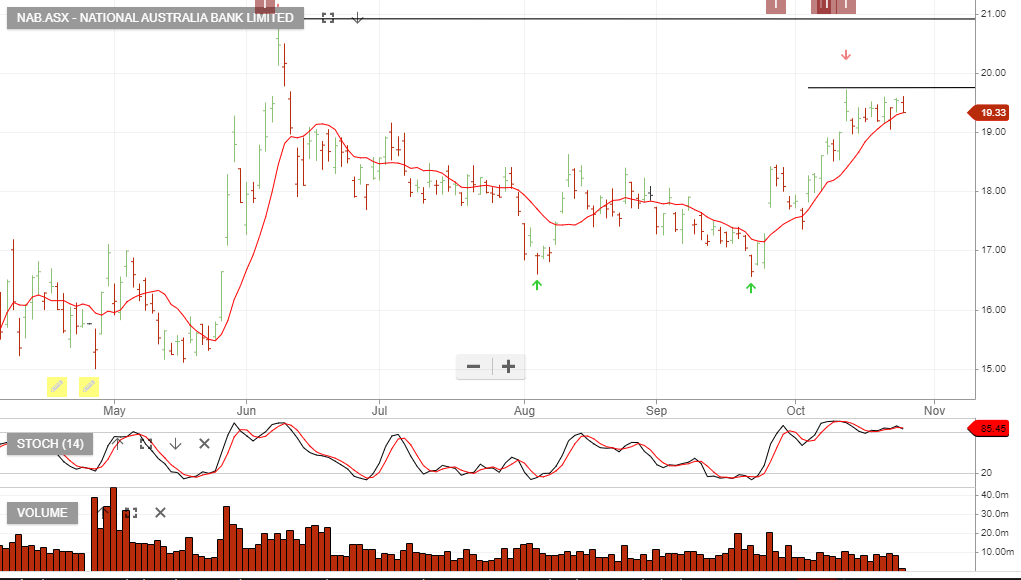

National Australia Bank is under Algo Engine sell conditions and we expect selling pressure to build at the $19.50 resistance level.

National Australia Bank is under Algo Engine sell conditions and we expect selling pressure to build at the $19.50 resistance level.

National Australia Bank is under Algo Engine sell conditions and we expect selling pressure to build at the $19.50 resistance level.

National Australia Bank 1H2020 profit falls by 51%.

The company also moved quickly to shore its balance sheet following the initial impact of COVID-19 related business provisions. NAB will raise $3.5bn via an institutional placement at $14.15 per share.

The placement will be done at a 10.5% discount.

Our bearish warnings on NAB are still yet to play out completely, as we see further raisings likely in the Sept quarter.

We expect National Australia Bank to run into selling pressure at $16.50. We favour the short side of this trade.

Today NAB announced first-half earnings will take a $1.14 billion after-tax hit – even before the impact of the coronavirus is accounted for.

NAB said investors will have to wait until it reports its half-year numbers on May 7 to see the impact of the pandemic on its “earnings and balance sheet including provisions, combined with capital and dividend implications”.

National Australia Bank is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

NAB reported FY19 cash earnings of $5.1bn and opted to operate a discounted DRP as well as partially underwrite the DRP, instead of discounted equity raising, as was the case with WBC.

ANZ, WBC, NAB and MQG all offer yield support but little in the way of near -term earnings growth.

National Australia Bank is under Algo Engine buy conditions and was added to the ASX 100 model portfolio on Friday.

We now have ANZ, NAB and MQG under buy conditions.

Or start a free thirty day trial for our full service, which includes our ASX Research.