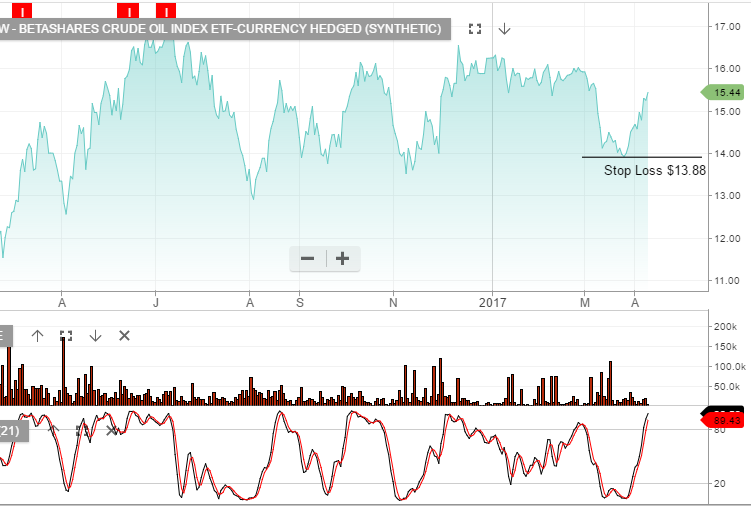

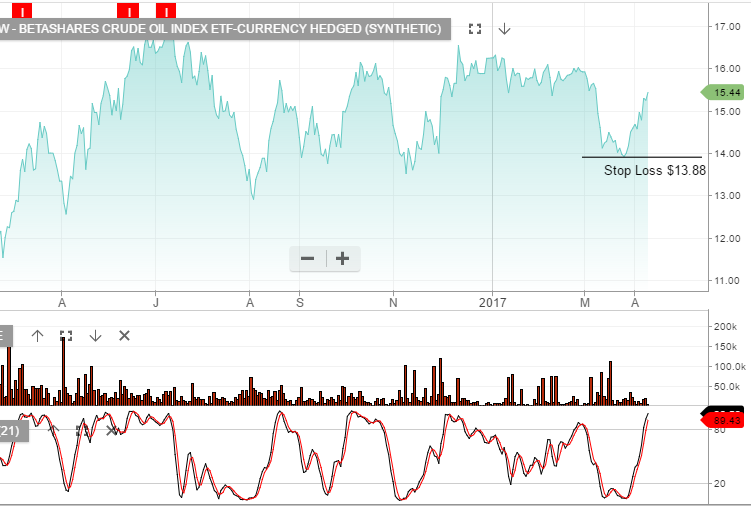

ETF Watch – Crude Oil Index

The Betashare Crude Oil Index has now rallied 10% from the recent low. At an individual stock level, our preferred energy plays remain WPL, OSH & ORG.

The Betashare Crude Oil Index has now rallied 10% from the recent low. At an individual stock level, our preferred energy plays remain WPL, OSH & ORG.

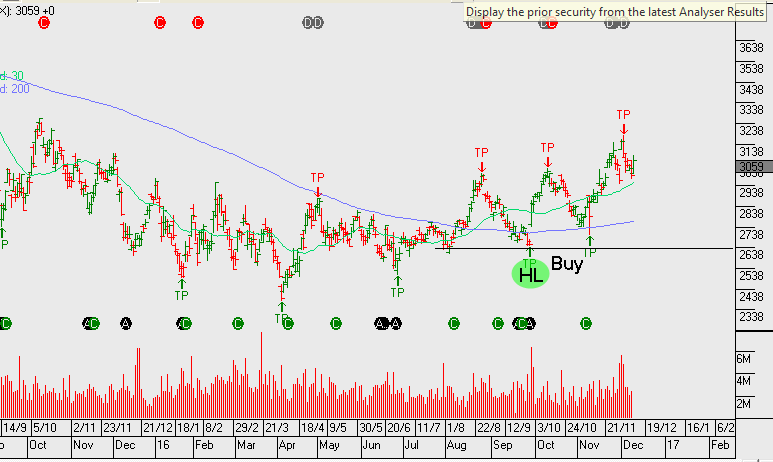

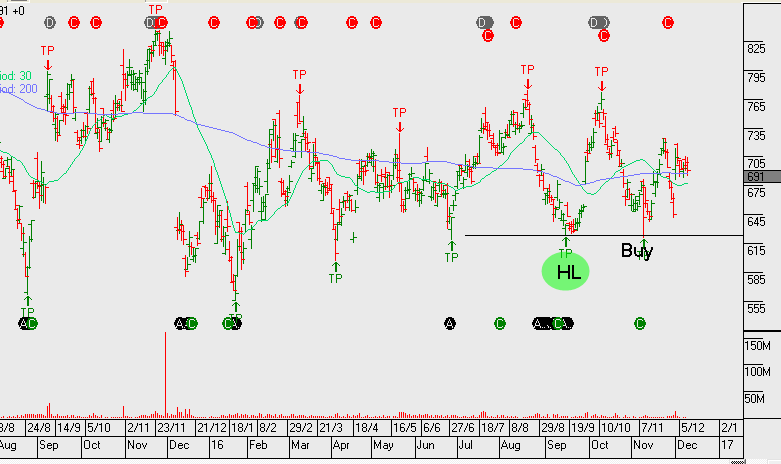

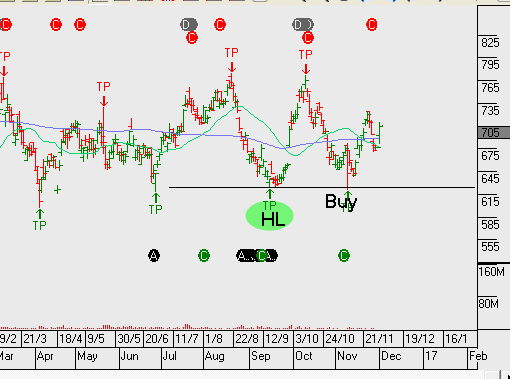

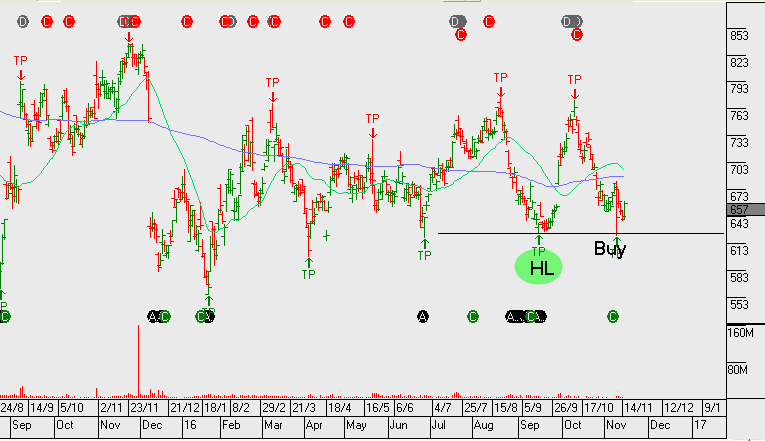

Origin has been triggered as a buy signal from our Algo Engine. We expect the stock to find buying support at or near the current price level.

Origin Energy looks like it will find buying support in the $6.25 to $6.50 range.

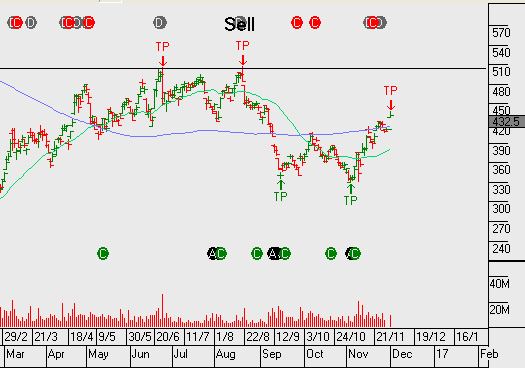

Shares of Origin Energy continue to slide after announcing yesterday that the company will take a $1.031 billion impairment charge on the APLNG gas export project in Queensland. This was the largest part of a broader $1.9 billion post-tax write-down.

Origin raised the bottom end of its forecast range for annual EBITDA by 3% to $2.45 billion, but kept the top end of the forecast at $2.62 billion.

Origin shares are down over 2% so far today at $7.10. We see initial support coming in at or near the $6.88 level.

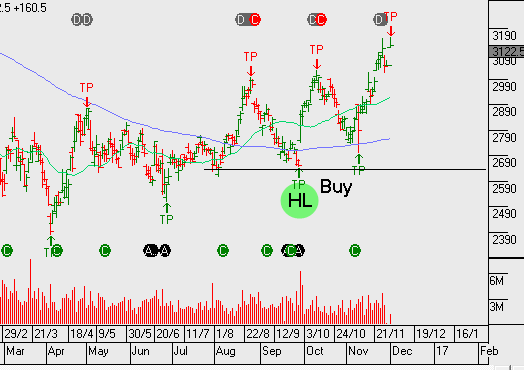

Our Algo Engine created a buy signal in September 2016 at $5.00

Our long ORG position continues to perform well with Origin being one of the standout recovery stories over the past 6 months. We think this has further to play-out as ORG restructures assets, pays down debt and grows LNG export volumes.

We suggested going long oil names ahead of the OPEC meting, our preferred buy ideas were WPL, ORG, OSH and BHP. We see further upside ahead!

On November 30th, leaders of the Organization of Petroleum Exporting Nations (OPEC) agreed to their first production cut in eight years by collectively deciding to curtail crude oil production by 1.2 million barrels per day. Since then, West Texas Intermediate (WTI) Oil futures have gained over 6% from $45.20 to $51.50 at Friday’s NYMEX close.

The OPEC agreement got a shot in the arm on Saturday as 11 Non-OPEC oil producing countries agreed to cut their output by 558,000 barrels per day. This is the first time in over 15 years that a global agreement to cut production has been struck and adds fundamental support to the current rally in Crude Oil.

Technical indicators suggest the January WTI contract can move higher this week. The recent high in the $52.70 area is the next logical target, but there’s scope for a move back above $54.00 after this weekend’s Non-OPEC agreement. Near-term support is seen in the $49.60 area.

Although investors may be rightfully sceptical about the longevity of the OPEC and Non-OPEC productions cuts, our reading of the charts suggests being patient in trying to pick a near-term top in crude oil prices.

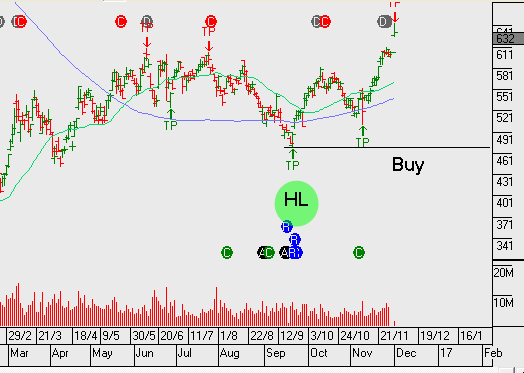

In an effort to streamline its business and reduce debt, Australia’s largest gas and power retailer Origin Energy has announced plans to divest its conventional oil and gas exploration assets through an IPO on the ASX in 2017.

Origin will group these assets into a new listed company called NewCo. These combined assets have an estimated value in the $2.5 to 2.8 billion range, based on a forecast of $50/$70 crude oil prices. At that valuation, proceeds of between $1.8 to $2.0 billion are expected to be allocated back to Origin.

Considering the uncertain outlook for global oil prices going into 2017, Origin’s strategy appears to be reasonable but isn’t a game changer in terms of its share price valuation.

With the current share price trading around the high of the year at $6.58, we consider this news to be neutral to bullish. However, with crude oil prices unlikely to trade above $60.00 in the near-term, the $7.00 level could cap gains over the medium-term.

Crude Oil prices surged as much as 10%, almost reaching the $50.00 mark, as the Organization of Petroleum Exporting Countries (OPEC) agreed to curb oil production for the first time since 2008 in an effort to reduce oversupply and support prices.

The 14 nation cartel, led by Saudi Arabia, agreed to cut production to 32.5 million barrels per day, which pencils out to a 1.2 million barrel per day reduction from current levels. Saudi Arabia agreed to take the lion’s share of the cut; lowering their daily production by 486,000 barrels per day to get the deal done.

Russia, the world’s largest Non-OPEC producer, had long resisted cutting output but has tentatively agreed to join the effort by reducing production by 300,000 barrels per day. OPEC will meet with Non-OPEC producers on December 9th.

If history is an accurate gauge, the bullish market response to this deal may be short lived. OPEC members haven’t shown a strong track record of compliance to previous production agreements. As such, the recent price action in Crude Oil could reverse over the near term as more details are released.

Oil prices surged overnight as investors speculate that OPEC members will push toward securing a deal to cut output. West Texas Intermediate Crude oil rose 5.8%.

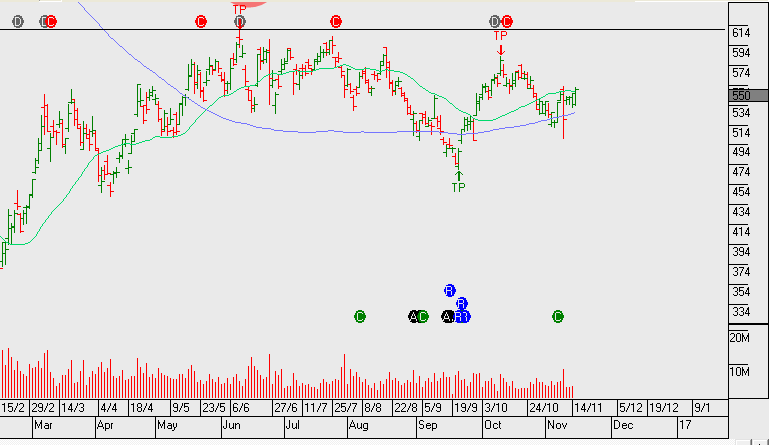

As an introduction to our ETF Watch commentary, we’re looking at the BetaShares Oil ETF listed on the ASX under the code OOO.AXW. The ETF provides investors with a “pure play” to take a view on oil prices. It aims to track the performance of an index (before fees and expenses), that provides exposure directly to crude oil futures.

In addition, as oil is priced in USD the fund hedges its USD exposure back to AUD, which reduces currency risk for Australian investors.

At a company specific level, we continue to like OSH, ORG and note the recent positive momentum in STO following China’s Hony Capital increasing its share holding.

Origin production numbers in the recent quarter displayed some encouraging progress within the LNG business unit. Production volumes increased 8% quarter on quarter and upstream revenue increased 32%.

APLNG T1 continues to operate above nameplate capacity & T2 has now started.

ORG’s balance sheet remains under pressure with $9.1b in debt, although the company is ahead of market guidance with respect to managing the reduction of debt.

ORG should continue to benefit from its diversified exposure to energy markets. FY17 outlook is for revenue of $12b, net profit of $550m with gearing at 50% and no dividend. FY18 we see a slight improvement in revenue and net profit increasing to $800m and the likely announcement of a return to paying $0.25 per share in dividends. This places the stock on an FY18 yield of 5%.

Origin has options available to unlock shareholder value. We may see a split of their retail division which will open potential acquisition options for Woodside (or others) to consider the Origin LNG assets as an example.

Or start a free thirty day trial for our full service, which includes our ASX Research.